Wrong Again: ‘Experts’ Keep Missing the Mark on Inflation

“Economists exist to make weathermen look good.”

Inflation: Why the Economists were Wrong

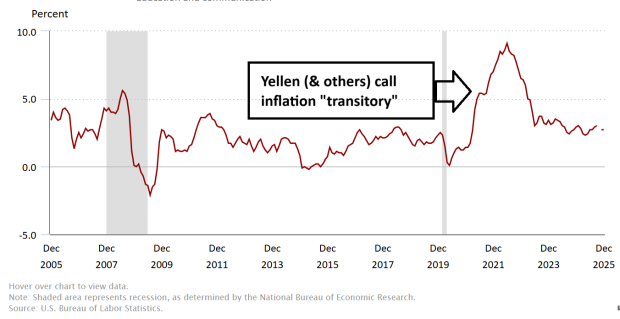

In early June 2021, then-Treasury Secretary Janet Yellen used the word ‘transitory’ to describe U.S. inflation. At the time, the consumer price index (CPI) was at an already elevated 5%. Over the next few months, Yellen would repeat her sentiment that inflation was merely transitory. However, due to massive (and unnecessary) post-COVID fiscal stimulus, global supply chain disruptions, and a dramatic shift in consumer spending habits from services to goods, inflation would soar to 9.1%, marking the highest U.S. inflation reading in over 40-years.

Image Source: BLS

Ultimately, roughly two years later, inflation would finally retreat to the more reasonable, historical normal of 3%. That said, the damage was done. Later, once the inflationary dust had finally settled, Yellen conceded that she was wrong, saying:

“I regret saying it was transitory. It has come down. But I think transitory means a few weeks or months to most people.”

How Tariff-Induced Inflation Predictions Fell Flat

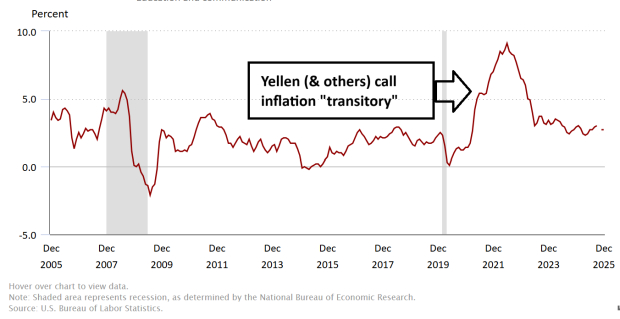

Fast-forward to early 2025, and Donald Trump had reassumed the presidency. On April, 2nd 2025, during the now infamous ‘Liberation Day’, President Trump shook Wall Street by imposing blanket reciprocal tariffs on all its trading partners, leading to trade conflicts between the U.S. and partners such as China, the EU, and Canada.

At the time, Larry Summers, a prominent American economist, former U.S. Treasury Secretary, and Harvard President, joined the popular “All-In” podcast for a debate about whether President Trump’s tariff policy would drive up inflation. In subsequent interviews, Larry Summers warned:

“If the planned tariffs were allowed to go into effect…the inflation risks could easily match or exceed those of the early 2020s. This is probably the most sensitive moment we’ve had for an escalation in inflation since the policy errors of 2021.”

Again, the “experts”, academics, and mainstream economists would be proven wrong. Today, year-over-year CPI is at just 2.7%.

Image Source: BLS

Why Inflation Will Remain Tame in 2026

While many economists remain cautious about inflation, here are three reasons they are wrong again:

1. Tariffs will not cause inflation: Although tariffs caused a price adjustment, they do not cause persistent price increases (inflation). In other words, the tariffs had a temporary, one-time impact.

2. Housing & Energy Prices are Coming Down: The housing market is beginning to weaken as rents come down. Shelter comprises ~35% of CPI. Meanwhile, energy prices are contained as the Trump Administration removes cumbersome regulations and pushes for energy independence.

3. The AI Productivity Boom: AI technology will lead to lower unit labor costs. In other words, businesses will be able to produce more goods and services without raising prices.

4. Less QE: Incoming Fed Chair Kevin Warsh has wisely warned of the adverse inflationary impacts of quantitative easing (QE). As Chair, Warsh is likely to end inflationary QE practices.

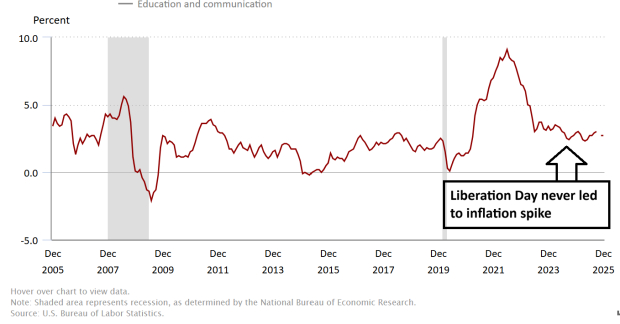

Government Inflationary Numbers Lag

Government inflation numbers like CPI use older data sets and, thus, have less value than other inflationary gauges like Truflation. Unlike government numbers, Truflation collects and analyzes millions of real-time prices to calculate a more accurate, timely, inflation number. The latest Truflation reading has CPI plunging to just 0.86%!

Image Source: Truflation

According to Ark Invest’s (ARKK) Cathie Wood, “As measured by Truflation, consumer price inflation has dropped to 0.86% on a year-over-year basis, breaking significantly below the 2-3% range in place for the past two years. In our view, inflation could be negative, contrary to BlackRock (BLK) and Pimco forecasts.” Meanwhile, traditional inflationary hedges such as the iShares Bitcoin ETF (IBIT), the SPDR Gold Shares ETF (GLD), and the iShares Silver ETF (SLV) experienced sharp declines last week.

Bottom Line

The disconnect between academic theory and market reality has never been wider. While mainstream economists warn of tariff-induced inflation and sticky prices, this does not illustrate reality.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market’s next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don’t build. It’s just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>

BlackRock (BLK) : Free Stock Analysis Report

SPDR Gold Shares (GLD): ETF Research Reports

iShares Silver Trust (SLV): ETF Research Reports

ARK Innovation ETF (ARKK): ETF Research Reports

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.