Why the government has increased capital spending for the defence sector

The capital outlay

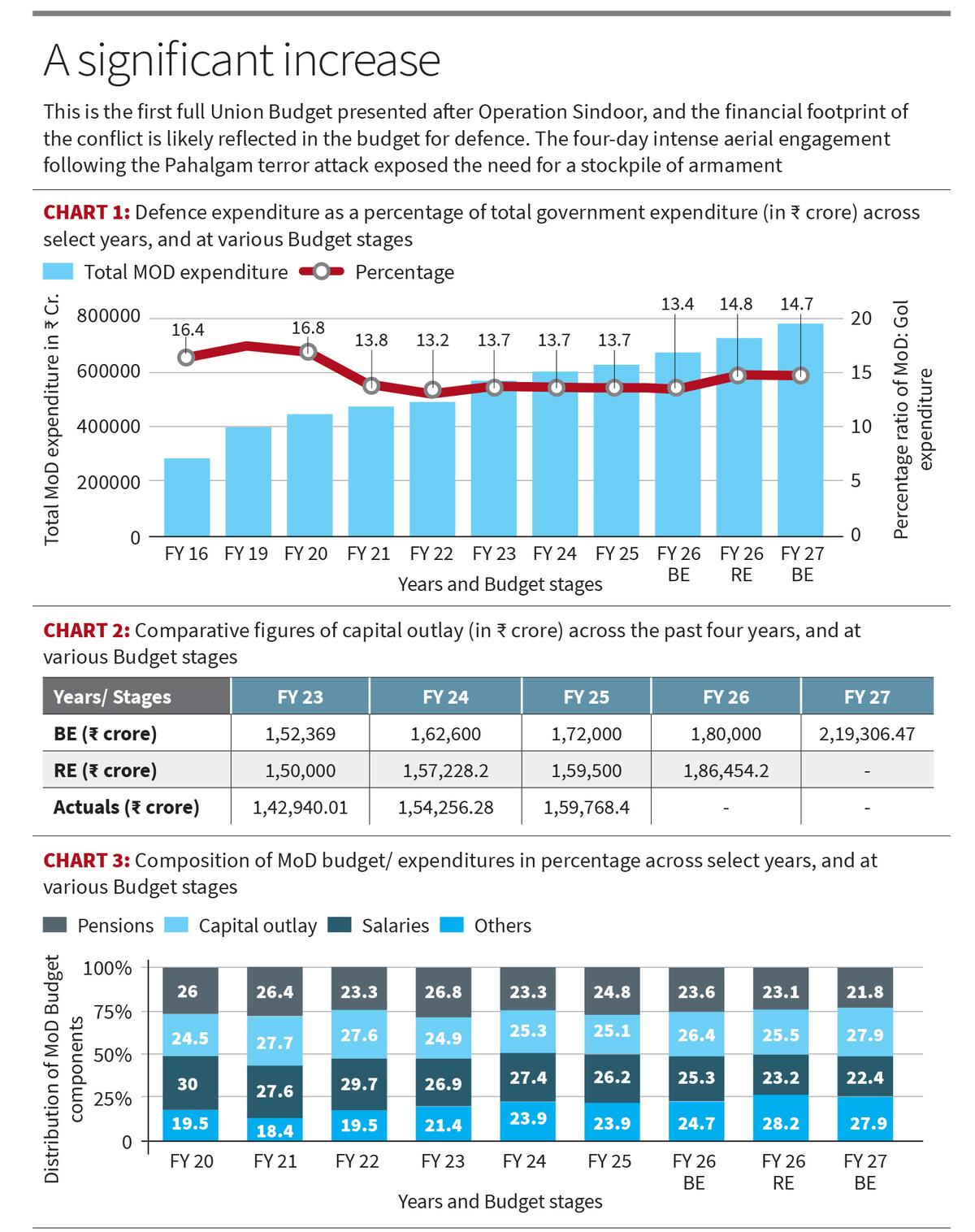

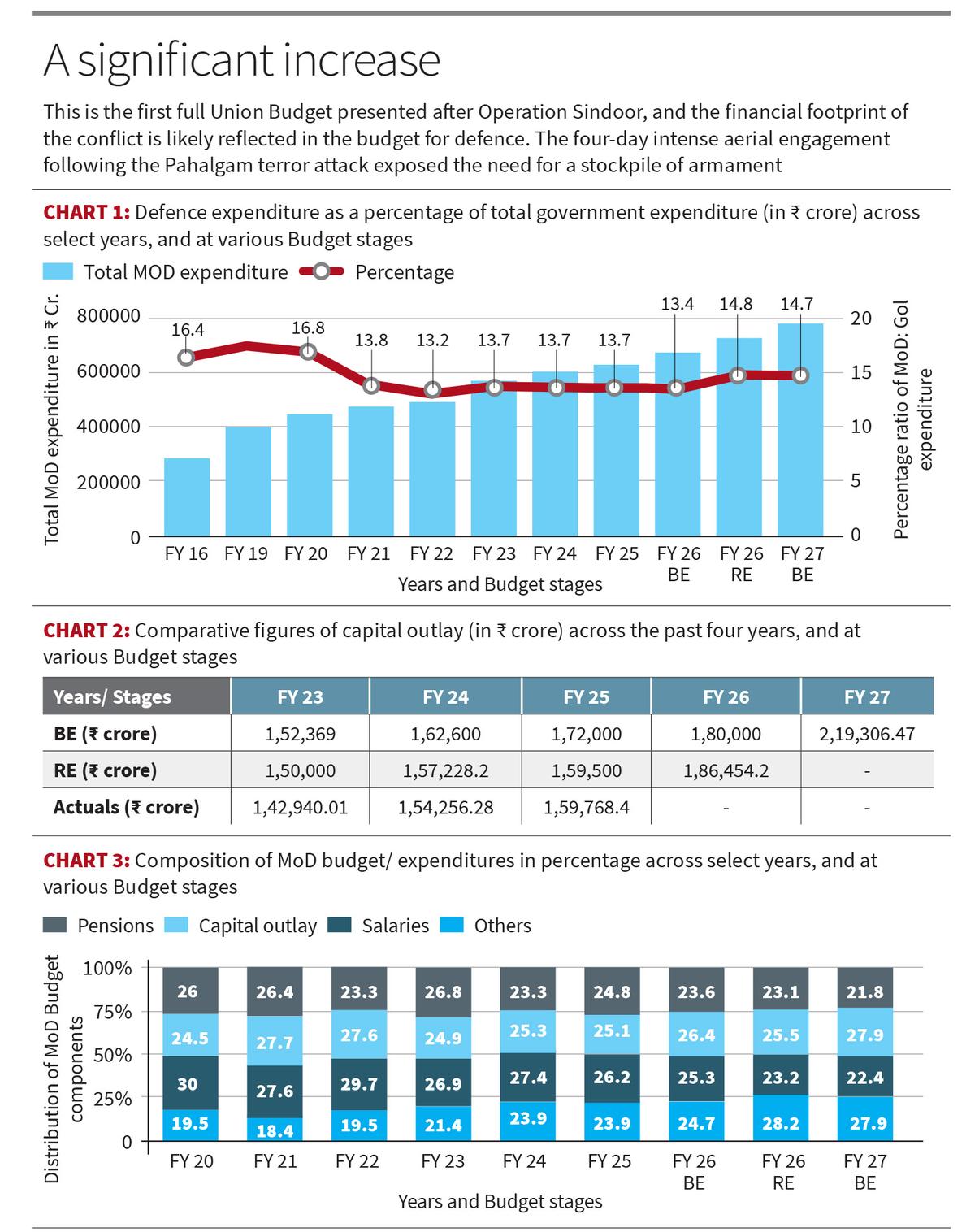

The absolute figures are robust. The total Ministry of Defence (MoD) expenditure has touched a historic high, nearing ₹7,84,678 crore for FY27 (Budget Estimate). This allocation accounts for 14.7% of the Government’s total expenditure at the BE stage for FY27. While this percentage is a slight dip from the Revised Estimates (RE) of 14.8% in FY26, it marks a significant stabilisation compared to the lean years of FY21 and FY22, when the defence share had shrunk to nearly 13.2%. If New Delhi can continue to floor defence spending at 14-15% of the central spending pie, it would gradually insulate national security imperatives from the vagaries of fiscal consolidation

The spectre of ballooning revenue expenditure, specifically salaries and pensions, has haunted defence planners for decades. Because capital outlay is the fund that goes into modernisation and the purchases of big-ticket items such as armour, ships or aircraft, it is expected that revenue and capex components of a defence budget are at parity.

Utilising and diversifying

In the FY27 BE, the share of capital outlay has risen to 27.9% of the total defence budget. This is a remarkable jump from the 24.9% figure for FY23 (Actuals) and the 24.5% figure for FY20 (Actuals). In absolute terms, the capital outlay for FY27 BE stands at a staggering ₹2,19,306 crore. To put this in perspective, just a year prior, the BE for FY26 had allocated ₹1,80,000 crore for capital expenses. A year-on-year leap of nearly ₹40,000 crore in the capital head is hence significant. Not to mention, at the RE stage in FY26, more capex has been demanded, which is a departure from previously observed trends wherein the BE is always higher than the RE, and the RE is nearly always higher than the Actuals (see Chart 2).

However, to understand fully the urgency in these figures, one must acknowledge three main aspects of capex utilisation and the geopolitical realities of the past few years.

Firstly, this is the first full Union Budget presented after Operation Sindoor, and the financial footprint of that conflict is likely reflected in the demands for grants. The four-day intense aerial engagement following the Pahalgam terror attack exposed the need for a stockpile of armament such as precision-guided munitions (PGMs) and loitering munitions, especially if the Indian armed forces are to prepare for a two-front challenge involving both China and Pakistan. In that regard, it is possible that the 21.8% jump in capital outlay is not just for future-proofing, but also for the replenishment of the war wastage reserves depleted in May 2025.

Secondly, the expenditure trends may also signal that Emergency Procurement (EP) — once an adhoc measure after the Galwan incident — has now been effectively institutionalised. The rapid spike in capital spending suggests that the fast-track mechanism used to induct anti-drone systems and long-range vectors during Operation Sindoor could now be the standard operating procedure for critical technologies.

Thirdly, a critical nuance often missed in headline numbers is the concept of committed liabilities. These are payments due in the upcoming FY for contracts signed in previous years. Historically, a major chunk of capex has been absorbed by past obligations, which could include, say, installments for S-400s, Rafales, or Akash missiles signed years ago, leaving less untied cash for new signings. The hope is that the capex hike breaks this cycle, given that for the Government to be able to sign contracts for the procurement of say, Advanced Medium Light Aircraft, or Project 75I diesel-electric submarines, funds worth at least 10-15% of the total contract amount must be free for the agreement to go through in FY27.

Composition statistics

Finally, an assessment of the composition of the total MoD expenditure shows that the share of pensions in the total defence budget has contracted to 21.8% in FY27, down from 26% in FY20. Similarly, the salary component has moderated to 22.4%, a sharp decline from the 30% high seen in FY20.

While the absolute pension bill remains high, its share of the pie is shrinking, likely a preliminary result of the Agnipath scheme and a deliberate policy to cap revenue expenditure. With ₹2.19 lakh crore in the kitty for capital expenditure, the pressure now shifts to the domestic industry. The government has reserved nearly 75% of the capital acquisition budget for the domestic industry under the Aatmanirbhar Bharat initiative.

The challenge, however, remains absorption capacity. Can defence public sector undertakings and private sector players deliver on time? The “Buy Indian-IDDM” (Indigenously Designed, Developed, and Manufactured) route of the Defence Acquisition Procedure is valuable, but recent operational urgencies dictate that delivery timelines cannot be flexible.

The heavy allocation suggests that the government is confident in the maturity of the Indian defence industrial base, and so, business performance, too, should reflect commitment to the act.

Anushka Saxena is a Staff Research Analyst at the Takshashila Institution.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.