Vertiv Holdings: Powering the AI Boom with Critical Infrastructure Solutions

It’s a big week for the AI trade.

After losing steam in January, tech stocks bounced sharply over the past few days as AI spending fears eased. The reality is that the evolution of data center and infrastructure stocks has been taking place for many years, with several companies emerging as true beneficiaries of the structural trend.

One such company is Vertiv Holdings, a leader in critical digital infrastructure including power management, thermal solutions, and integrated rack systems. The stock has experienced a remarkable rise in recent years. From trading under $10 per share at the trough of the 2022 bear market, shares have surged over 2,000% cumulatively, with particularly strong momentum last year and into early 2026.

Just yesterday, Vertiv hit fresh all-time highs over $200/share, reflecting a roughly 25% gain this year alone amid broadening recognition of its role in the AI ecosystem.

Image Source: StockCharts

Why Vertiv Has Been Outperforming

Vertiv’s ascent has been anything but accidental. Its growth story gained traction during the initial cloud computing wave but accelerated dramatically with the AI surge. The explosion in generative AI and large language models has driven unprecedented demand for data center capacity, where power and cooling constraints have become bottlenecks.

Vertiv’s liquid cooling technologies—essential for high-density AI servers generating immense heat—have positioned it at the forefront. Partnerships with chip giants like Nvidia, whose Blackwell GPUs require advanced thermal management, have provided validation and order visibility. Last year, Vertiv reported consistent double-digit organic growth, with data center-related revenue becoming the dominant driver.

The past year’s performance stemmed from several converging factors. Supply chain normalization allowed Vertiv to capitalize on backlog conversion, while pricing power in constrained categories like liquid cooling boosted margins. In the third quarter of last year, organic net sales improved 29% and adjusted operating profit expanded significantly. Management’s commentary on multi-year hyperscaler commitments reinforced a durable runway, as AI training and inference workloads scale globally.

As we make our way further into the new year, the stock’s outperformance over the past month—pushing to new highs—coincides with renewed sector enthusiasm. Analyst upgrades, including from KeyBanc citing sold-out capacity, have highlighted Vertiv’s share gains in thermal solutions. Amid broader market volatility, Vertiv has demonstrated relative strength, underscoring its perceived indispensability in the AI buildout.

What the Zacks Model Reveals

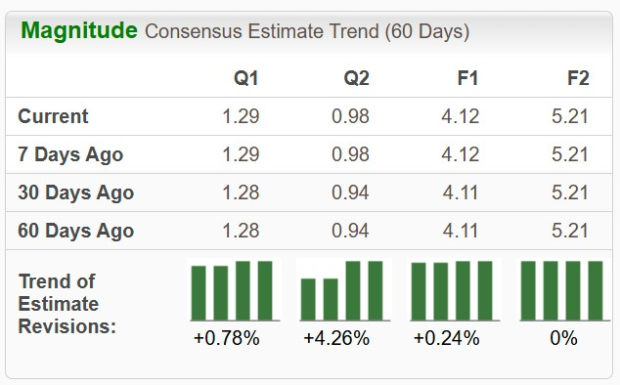

Upcoming earnings add to the intrigue. Vertiv is scheduled to report fourth-quarter results tomorrow before the opening bell. Consensus estimates call for EPS around $1.29 (up 30% year-over-year) on revenues of $2.88 billion.

Image Source: Zacks Investment Research

Attention will center on 2026 guidance, with analysts modeling continued 20%+ organic growth. Vertiv VRT currently holds a Zacks Rank #2 (Buy), reflecting positive estimate revisions and a track record of beats.

The Zacks Earnings ESP (Expected Surprise Prediction) indicator seeks to find companies that have recently seen positive earnings estimate revision activity. This more recent information has proven to be very useful in finding positive earnings surprises, giving investors a leg up during earnings season. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time according to our 10-year backtest.

VRT boasts a +2.23% Earnings ESP. Another beat may be in the cards when the company reports its Q4 results tomorrow morning.

Bottom Line

Risks like execution in new product ramps or cyclical slowdowns exist, but Vertiv’s backlog and diversified exposure provide buffers.

In reflecting on this space, Vertiv stands out for its mission-critical role—quietly enabling the AI revolution. For thoughtful investors, it represents sincere participation in a transformative trend.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.