Top Auto Stocks to Buy as Q4 Results Approach: ALSN, F

Among the Zacks Rank #1 (Strong Buy) list, Allison Transmission Holdings ALSN and Ford Motor F are two top auto stocks that investors will want to consider as their Q4 results approach after-market hours on Tuesday, February 10.

Magnifying their strong buy ratings, Allison and Ford stock are both checking the box in terms of valuation with an “A” Zacks Style Scores grade for Value.

That said, here is some insight as to why these highly ranked auto stocks could serve as valuable options to consider in the portfolio.

Allison’s Strategic Expansion

As a key supplier of transmissions for commercial and defense vehicles, Allison’s core business has been doing well, producing healthy margins for a manufacturer on top of recent strategic moves that have reinforced investor confidence.

Last month, Allison completed the acquisition of Dana Incorporated’s Off-Highway Drive & Motion Systems business, forming a global multi-billion-dollar revenue enterprise across 29 countries.

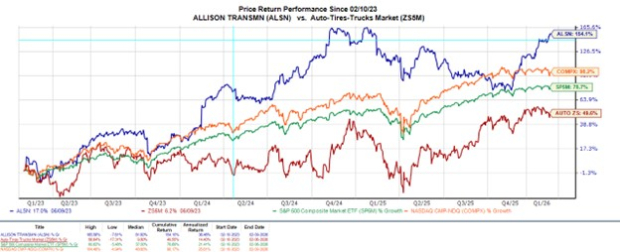

Investors typically reward strategic acquisitions that broaden market reach and strengthen competitive positioning. Sustained multi-year outperformance also signals durable business strength, which keeps a stock in demand, and ALSN has soared over +150% in the last three years to impressively outpace the broader indexes and the Zacks Auto, Tires and Trucks sectors +49%.

Image Source: Zacks Investment Research

There is anticipation that Allison will see an expansive rebound toward new financial peaks in fiscal 2026 after a contraction from a record FY24. Plus, ALSN has a generous annual dividend yield that is near 1%.

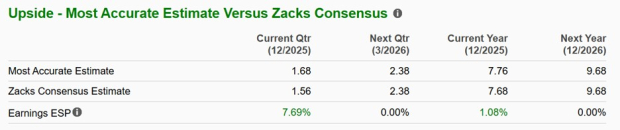

Although Q4 EPS projections call for Allison’s bottom line to fall 22% year over year to $1.56, the Zacks ESP (Expected Surprise Prediction) indicates the auto equipment leader could beat earnings expectations. To that point, the Most Accurate and recent estimate among Wall Street has Q4 EPS pegged at $1.68 and 7.69% above the underlying Zacks Consensus (Current Qtr below).

Such an earnings beat could certainly keep the momentum going in ALSN, which is trading near a 52-week high of $116 a share but is still at an attractive 11X forward earnings multiple.

Allison’s annual sales and EPS are now thought to have dipped over 7% in FY25, but are projected to rebound by high double digits this year to what would be new peaks of $5.67 billion and $9.68 per share, respectively.

Image Source: Zacks Investment Research

Marketing Campaigns Boost Ford’s Stock

Remaining one of the most intriguing value stocks, the Zacks ESP also suggests that Ford should be able to surpass its Q4 2025 EPS expectations of $0.17, with the Most Accurate and recent estimate at $0.19. This compares to Q4 EPS of $0.39 a year ago as tariffs have impacted Ford’s margins along with sizeable losses in its electric-vehicle division.

However, Ford has remained in the third spot regarding domestic EV sales behind Tesla TSLA and General Motors GM, and its total vehicle sales increased 6% in 2025 to 2.2 million, its best year since 2019.

Image Source: Zacks Investment Research

To offset tariffs, Ford launched a patriotic “From America, For America” campaign, allowing the public to buy vehicles at employee discount prices while also cutting costs on 2024 and 2025 vehicle models to “sidestep” the tariff impact.

Echoing higher sentiment, Ford stock has rebounded mightily in the last year, rising nearly +50% at around $13 a share, and has now posted positive gains of +7% in the last three years.

Notably, Ford’s senior marketing leadership has stated that 2026 messaging is centered on what Ford vehicles can do in regard to performance and capability rather than discounts or patriotic pricing themes.

What has kept investors engaged is that Ford stock trades at less than 10X forward earnings and is expected to post a promising rebound in FY26 EPS to $1.53. Most intriguing is that this should help Ford sustain its enticing 4.35% annual dividend yield, as it will keep its payout ratio under 50%.

Image Source: Zacks Investment Research

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don’t build. It’s uniquely positioned to take advantage of the next growth stage of this market. And it’s just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>

Ford Motor Company (F) : Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.