Think AWS Is Losing To Azure and Google Cloud? You Need To Hear This Quote From Amazon CEO Andy Jassy

Key Points

- Amazon CEO Andy Jassy took the opportunity on theearnings callto remind investors that AWS is still significantly larger than its rivals.

- Investors were skeptical of the company’s plans to spend $200 billion in capital expenditures this year.

-

The overall business is still delivering solid growth.

- 10 stocks we like better than Amazon ›

It’s no secret that Amazon (NASDAQ: AMZN) has been losing market share in cloud infrastructure to Alphabet’s (NASDAQ: GOOG) (NASDAQ: GOOGL) Google Cloud and Microsoft (NASDAQ: MSFT) Azure for years now.

That trend continued in 2025. Amazon reported a respectable 20% growth at AWS, but that was well behind Google Cloud at 36%, and Microsoft, which operates on a different fiscal calendar, but reported 39% growth in Azure in its most recent quarter.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Amazon invented cloud computing, or infrastructure-as-a-service (IaaS), as a business more than 20 years ago, and it has been the leader ever since, but the recent gains from Alphabet and Microsoft underscore the larger narrative in AI that Amazon has fallen behind its hyperscaler peers.

However, Amazon CEO Andy Jassy seems to be tired of hearing that, as he gave a robust defense of AWS and reasserted its cloud leadership on Amazon’s recentearnings call

Jassy told investors, “As a reminder, it’s very different having 24% year-over-year growth on a $142 billion annualized run rate than to have a higher percentage growth on a meaningfully smaller which is the case with our competitors. We continue to add more incremental revenue and capacity than others, and extend our leadership position.”

He also noted that AWS clocked its fastest revenue growth in the last 13 quarters at 24%, and its chips business, led by Graviton and Trainium, which are designed for AI, have reached $10 billion in annual revenue run rate, growing triple digits.

Image source: Getty Images.

Amazon is still the cloud leader

As Jassy said, AWS added more than $21.2 billion in revenue in 2025, compared to Google Cloud, which grew by $15.5 billion.

In Microsoft’s fiscal 2025, which ended in June 2025, Azure grew by roughly $19 billion. AWS is still more than double the size of Google Cloud and significantly larger than Azure.

Amazon is also preparing to outspend its rivals in capital expenditures, targeting $200 billion this year, predominantly for AWS, inclusive of AI workloads, showing it has no intention of yielding that lead.

In addition to its revenue advantage, AWS also generates significantly more profit than its rivals do. In 2025, AWS operating income rose to $45.6 billion, compared to just $13.9 billion for Google Cloud.

Is Amazon a buy?

Amazon stock dove after its earnings report on Thursday night. The company reported results in line with estimates, but investors seemed to balk at the $200 billion capex forecast, though Microsoft and Alphabet both received similar responses.

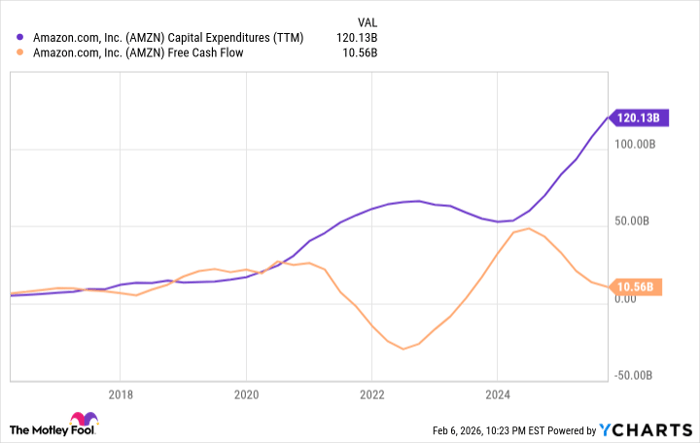

Amazon has been through this kind of cyclical capex spend before in both its cloud computing and e-commerce businesses, and it’s paid off. As you can see from the chart below, free cash flow fell sharply after its warehouse ramp during the pandemic, and it’s pulling back again as it accelerates the AWS buildout.

AMZN Capital Expenditures (TTM) data by YCharts

The company generated $139.5 billion in operating cash flow in 2025, meaning the $200 billion target will almost certainly lead to negative free cash flow in 2026.

However, that shouldn’t distract from Amazon’s solid execution. While its results might have only matched expectations, they were still strong. Revenue in the quarter rose 14% to $213.4 billion, and operating income was up 18% to $25 billion.

The stock now trades at a price-to-earnings ratio of less than 30, though that is based on generally accepted accounting principles (GAAP) earnings that include $15 billion in other income, likely from gains in its equity holdings.

Adjusting for that, Amazon looks fairly valued, and the sentiment around the spending boom seems likely to limit the stock’s upside.

That’s not a reason to sell, but Amazon’s upside potential looks limited until it can show its spending boom is paying off.

Should you buy stock in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 7, 2026.

Jeremy Bowman has positions in Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.