These Industry Leaders Stand Out After Q4 Earnings: MAR, MCD, TMUS

While the hype train for AI-related tech stocks has worn thin this earnings season, the market has rewarded traditional industry leaders across a variety of sectors following their favorable Q4 reports this week.

The reasonable valuations and respectable dividends of these industry-leading stocks have kept investors engaged with their continued dominance, being echoed by steady expansion.

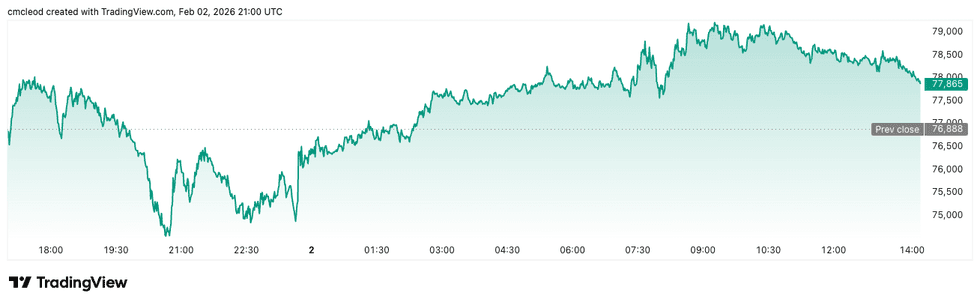

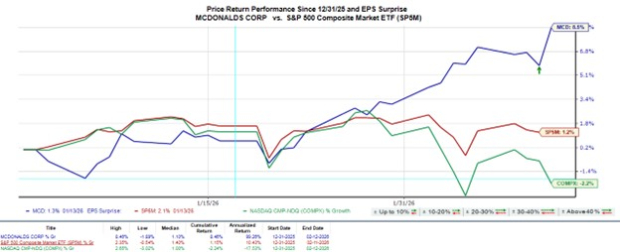

McDonald’s – MCD

Annual Dividend Yield: 2.3%

We’ll start with McDonald’s MCD, as the global fast-food powerhouse saw its stock hit fresh 52-week highs of $333 a share in today’s trading session after exceeding Q4 expectations on Wednesday.

Loyalty and digital engagement continue to expand for McDonald’s, which leadership credited to value pricing and customer-focused adjustments for improving traffic and strengthening affordability perceptions.

Global comparable sales rose 6% year over year in Q4, and U.S. comparable sales jumped 7%, showing robust demand across markets. Notably, systemwide sales to loyalty members increased 20% YoY, with active users up 19%, a sign of recurring demand.

MCD trades slightly beneath the benchmark S&P 500’s 25X forward earnings multiple and is on the verge of being a Dividend King, increasing its dividend for 49 consecutive years and being a year away from achieving this illustrious status.

Image Source: Zacks Investment Research

TMobile US – TMUS

Annual Dividend Yield: 1.95%

Spiking 9% since surpassing Q4 expectations yesterday, T-Mobile US TMUS shares were up another 2% on Thursday. Historically, T-Mobile has drawn investor interest as a disruptive wireless carrier, earning its position as a telecom leader by branding itself as the “customer first” alternative, eliminating hidden fees, long-term contracts, and other pain points that frustrate consumers.

T-Mobile’s Q4 results relayed this long-standing narrative, posting industry-leading net customer additions of 2.4 million when including broadband subscribers, with its 962,000 postpaid phone net adds being an industry best as well.

TMUS has the most enticing forward P/E valuation on the list at 18X. Offering a pleasant discount to the benchmark, this is not an overly stretched premium to its Zacks Wireless National Industry average of 13X, despite still being a disrupter and a clear leader in the space.

Image Source: Zacks Investment Research

Marriott International – MAR

Annual Dividend Yield: 0.75%

Last but not least is hospitality trailblazer Marriott International MAR, dominating the hotel industry by blending tradition with innovation. Marriott posted mixed Q4 results on Tuesday, but has seen its stock spike 7% since reporting.

Despite a slight Q4 EPS miss, a revenue beat, strong forward guidance, and robust global demand have fueled the rally.

To that point, Marriott’s Worldwide RevPAR (revenue per available room) increased 2% during Q4, driven by 6% growth in international markets. Furthermore, Marriott’s 2026 RevPAR growth outlook was guided at 1.5%-2.5%, which is considered constructive given macro uncertainty.

The company also highlighted continued development strength, including a growing luxury pipeline and strong currency conversion activity, signaling future revenue growth and reassuring investors about long-term expansion.

At 30X forward earnings, MAR trades at a slight P/E premium to the broader market, but this is notably near its decade-long median of 24X.

It’s also noteworthy that along with being one of the stock market’s better performers in the last five years, Marriott has raised its dividend by 25.67% during this period and still has a low payout ratio, leaving room for plenty of dividend hikes in the future.

Image Source: Zacks Investment Research

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

See Our Newest 5 Stocks Set to Double Picks >>

Marriott International, Inc. (MAR) : Free Stock Analysis Report

McDonald’s Corporation (MCD) : Free Stock Analysis Report

T-Mobile US, Inc. (TMUS) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.