The Best Trillion-Dollar Stock to Buy for 2026, According to Wall Street

Key Points

- Investor excitement around AI has pushed several stocks into the $1 trillion club over the last few years.

- Nvidia and Broadcom stand out as first-order beneficiaries from the trend, and analysts have high expectations for both in 2026.

- Growth expectations for this other trillion-dollar company are more modest, but it could easily beat them and grow even faster.

- 10 stocks we like better than Microsoft ›

At the start of the decade, there were just two companies with a market cap exceeding $1 trillion. Today, 10 publicly traded companies boast 13-figure market caps. Most of them have seen their stock prices climb due to the excitement surrounding generative artificial intelligence (AI), benefiting directly or showing substantial growth prospects as a result.

Nvidia (NASDAQ: NVDA) has been the poster child for AI stocks, becoming the most valuable company in the world in 2024 and briefly touching a $5 trillion market cap in 2025. Fellow chipmaker Broadcom (NASDAQ: AVGO) has gained momentum more recently, as its networking chips and custom AI accelerators offer key technology for AI data centers as well. The hyperscale public cloud platforms owned by Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), and Amazon (NASDAQ: AMZN) have seen demand outstrip supply quarter after quarter despite spending hundreds of billions to stand up and operate new data centers.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Wall Street views all of the above stocks favorably, but one stands above the rest with more upside than any based on analysts’ median price target. As of this writing, analysts expect shares of Microsoft to climb more than those of any other trillion-dollar company in 2026.

Image source: Getty Images.

A standout stock pick among megacaps

Microsoft currently sports a median price target of $630 per share among Wall Street analysts. That presents 33% upside from its stock price as of this writing, just edging out the upside implied for both Nvidia and Broadcom. Analysts expect Nvidia to climb to $250 on average, and the median price target for Broadcom is $460, implying an upside of approximately 32% for each.

But Microsoft is arguably a better investment than either chipmaker based on its valuation and risk profile. Analysts have high expectations for both Nvidia and Broadcom in terms of revenue and earnings growth. They see Nvidia’s revenue climbing 50% this year and earnings per share increasing 60%. They see similar results for Broadcom as it gains momentum with its AI accelerators.

What’s more, Microsoft has a lot less risk built into achieving those numbers, so it’s less likely to fall short or face an event that causes a huge earnings miss. Meanwhile, Nvidia and Broadcom are heavily reliant on just a few big customers, who could pull back on or shift spending plans at any moment. While Microsoft also has some customer concentration, with OpenAI contributing a significant amount of revenue to Azure, it’s much more diversified overall, especially when its enterprise software business is included.

Moreover, Microsoft appears poised to surpass those analysts’ expectations in 2026, potentially leading to even more upside.

The multiheaded AI growth machine

Azure is by far the biggest focus of AI investors when it comes to Microsoft. The cloud business is growing faster than its two biggest rivals, Google Cloud and Amazon Web Services. It topped $75 billion in revenue in fiscal 2025, which ended in June, and it grew 39% in the first quarter of fiscal 2026. That’s driven by significant spending from OpenAI, but also by demand from the industry at large.

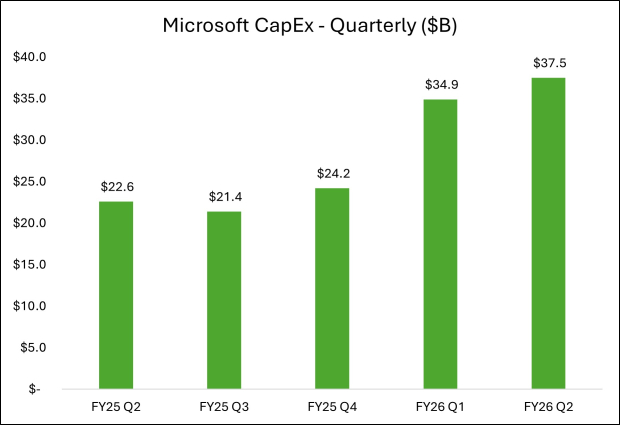

That said, Microsoft is investing heavily to meet demand. It spent $35 billion on capital expenditures last quarter, and management told investors to expect an even larger number when it reports its second-quarter results. That’s more spending than Alphabet and roughly in line with Amazon’s, but Microsoft has the backlog to support it.

Microsoft ended the quarter with $398 billion in remaining performance obligations (across both Azure and its software business) with a weighted average duration of just two years. Microsoft expects to recognize 40% of that within 12 months. In that sense, it absolutely dwarfs Alphabet and Amazon, which have been growing quickly in their own rights.

Not only is Azure growing rapidly, but Microsoft is also experiencing strong growth from its productivity and business segment, which includes commercial and consumer Microsoft 365 subscriptions, as well as Dynamics 365 (a cloud-based suite of AI-powered business applications). Both are seeing strong growth fueled by increases in revenue per user. That stems from the growing number of AI-powered features Microsoft is packing into its software with its Copilot platform.

As more businesses adopt its Copilot features across its software suite, Microsoft should be able to produce strong revenue retention rates. Total users continue to climb, too. Commercial seats for Microsoft 365 climbed 6% last quarter, consumer subscriptions climbed 7%, and management said Dynamics took market share. Total revenue growth for the company’s largest segment came in at 17%, above the average analysts’ expectation for the full year.

Combined with the momentum from Azure and its diverse backlog of customers, Microsoft is showing potential upside to analysts’ expectations for the full year. At the same time, shares are trading for just 29 times forward earnings expectations, below the 34x earnings multiple for Broadcom and 40x multiple for Nvidia. So not only are analysts the most bullish on Microsoft, they may even be underestimating it.

Should you buy stock in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $488,222!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,134,333!*

Now, it’s worth noting Stock Advisor’s total average return is 969% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 10, 2026.

Adam Levy has positions in Alphabet, Amazon, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.