Stocks Settle Higher on Strength in Tech

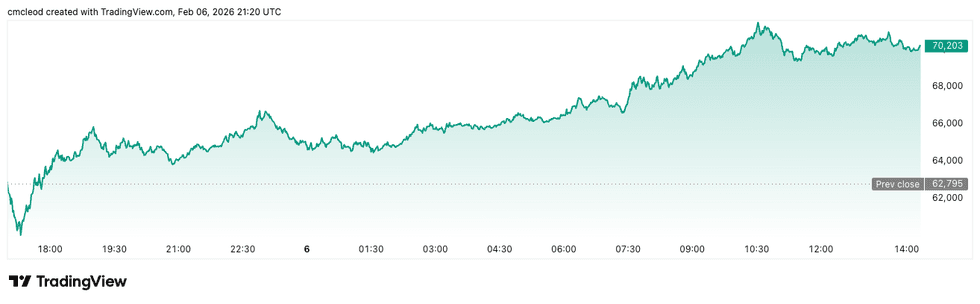

Stock indexes recovered from early losses on Monday and settled higher, with the Dow Jones Industrials posting a new all-time high. Stock indexes rallied on Monday after chipmakers and AI-infrastructure stocks rebounded from early losses. Also, mining stocks rose on Monday after gold prices jumped 2% and silver prices surged more than 6%.

Join 200K+ Subscribers:

Find out why the midday Barchart Brief newsletter is a must-read for thousands daily.

Stocks initially moved lower on Monday due to early weakness in technology stocks. Also, US bond yields initially rose on Monday, pressuring stocks, after Chinese regulators told banks to scale back their holdings of US debt, reviving worries about the haven status of US assets.

However, T-note yields fell back from early highs on Monday and moved lower, helping stocks recover on dovish comments from National Economic Council Director Hassett, who said we should expect slightly lower US job numbers, citing slower population growth and higher productivity.

The markets this week will focus on corporate earnings results and economic news. On Tuesday, the Q4 employment cost index is expected to rise by 0.8%. Also, Dec retail sales are expected to climb by +0.4% m/m and +0.4% m/m ex-autos. On Wednesday, Jan nonfarm payrolls are expected to climb +69,000, and the Jan unemployment rate is expected to remain unchanged at 4.4%. Also, Jan average hourly earnings are expected to rise by +0.3% m/m and +3.7% y/y. On Thursday, initial weekly unemployment claims are expected to fall by -7,000 to 224,000. Also, Jan existing home sales are expected to decline by -3.5% m/m to 4.20 million. On Friday, Jan CPI is expected to be up +2.5% y/y, and Jan core CPI is expected to be up +2.5% y/y.

Q4 earnings season is in full swing, as more than half of the S&P 500 companies have reported earnings results. Earnings have been a positive factor for stocks, with 79% of the 297 S&P 500 companies that have reported beating expectations. According to Bloomberg Intelligence, S&P earnings growth is expected to climb by +8.4% in Q4, marking the tenth consecutive quarter of year-over-year growth. Excluding the Magnificent Seven megacap technology stocks, Q4 earnings are expected to increase by +4.6%.

The markets are discounting a 19% chance for a -25 bp rate cut at the next policy meeting on March 17-18.

Overseas stock markets settled higher on Monday. The Euro Stoxx 50 closed up by +1.01%. China’s Shanghai Composite rose to a 1-week high and closed up +1.41%. Japan’s Nikkei Stock 225 rallied to a new all-time high and closed up sharply by +3.89%.

Interest Rates

March 10-year T-notes (ZNH6) on Monday closed up by +2.5 ticks. The 10-year T-note yield fell -1.2 bp to 4.194%. T-note prices recovered from early losses on Monday and moved higher after National Economic Council Director Hassett said we should expect slightly lower US job numbers, citing slower population growth and higher productivity.

T-notes initially moved lower on Monday after Chinese regulators told banks to scale back their holdings of US debt, reviving worries over the haven status of US assets. Also, supply pressures are weighing on T-note prices as the Treasury will auction $125 billion of T-notes and T-bonds in this week’s quarterly refunding, beginning Tuesday’s $58 billion auction of 3-year T-notes.

European government bond yields were mixed on Monday. The 10-year German bund yield fell -0.2 bp to 2.840%. The 10-year UK gilt yield rose +1.3 bp to 4.527%.

The Eurozone Feb Sentix investor confidence index rose by +6.0 to a 7-month high of 4.2, stronger than expectations of 0.0.

ECB Governing Council member Peter Kazimir said the ECB should only alter interest rates “if there is a major departure from our baseline scenario” for growth and inflation.

Swaps are discounting a 2% chance of a -25 bp rate cut by the ECB at its next policy meeting on March 19.

US Stock Movers

Chip makers and AI-infrastructure stocks recovered from early losses on Monday and moved higher, boosting the broader market. Advanced Micro Devices (AMD) and Broadcom (AVGO) closed up more than +3%. Also, Nvidia (NVDA), Applied Materials (AMAT), NXP Semiconductors NV (NXPI), and Marvell Technology (MRVL) closed up more than +2%. In addition, Western Digital (WDC), ASML Holding NV (ASML), and Qualcomm (QCOM) closed up more than +1%.

Mining stocks rallied on Monday after the price of gold rose +2% and silver jumped by more than +6%. Coeur Mining (CDE) closed up more than +7%, and Hecla Mining (HL) closed up more than +5%. Also, Freeport McMoRan (FCX) and Newmont Mining (NEM) closed up more than +4%, and Barrick Mining (B) closed up more than +3%.

AppLovin (APP) closed up more than +13% to lead gainers in the S&P 500 and Nasdaq 100 after Citigroup said the company’s clients through the week of February 6 are up +3% from the prior week.

Oracle (ORCL) closed up more than +9% after D.A. Davidson upgraded the stock to buy from neutral with a price target of $180.

TEGNA Inc (TGNA) closed up more than +8% after President Trump backed Nexstar Media Group’s proposed acquisition of the company.

Viatris (VTRS) closed up more than +6% after UBS upgraded the stock to buy from neutral with a price target of $18.

Dynatrace (DT) closed up more than +6% after reporting Q3 revenue of $515.5 million, better than the consensus of $506.6 million, and raising its full-year revenue forecast to $2.01 billion from $1.99 billion to $2.00 billion, above the consensus of $1.99 billion.

Ciena Corp (CIEN) closed up more than +6%, adding to last Fridays’ +7% jump, after the stock rejoined the S&P 500 Index on Monday for the first time in 16 years.

Robinhood Markets (HOOD) closed up more than +5% after Wolfe Research upgraded the stock to outperform from peer perform with a price target of $125.

SoFi Technologies (SOFI) closed up more than +2% after Citizens Jmp Securities LLC upgraded the stock to market outperform from market perform with a price target of $30.

Kyndryl Holdings (KD) closed down more than -55% after reporting Q3 revenue of $3.86 billion, below the consensus of $3.89 billion, and cutting its full-year adjusted pretax profit estimate to $575 million-$600 million from a previous estimate of at least $725 million.

Monday.com (MNDY) closed down more than -21% after forecasting Q4 revenue of $328 million to $330 million, below the consensus of $333.7 million.

Cleveland-Cliffs (CLF) closed down more than -16% after reporting Q4 revenue of $4.31 billion, well below the consensus of $4.58 billion.

Hims & Hers Health (HIMS) closed down by more than 16% after it said it would stop selling its recently launched copycat version of the new Wegovy weight-loss pill.

Waters (WAT) closed down more than -13% to lead losers in the S&P 500 after forecasting Q1 adjusted EPS of $2.25 to $2.35, weaker than the consensus of $2.52.

Workday (WDAY) closed down more than -5% to lead losers in the Nasdaq 100 after CEO Eschenbach is leaving immediately and will serve as an advisor.

Beckton Dickinson (BDX) closed down more than -1% after reporting Q1 life sciences revenue of $766 million, well below the consensus of $1.3 billion.

Earnings Reports(2/10/2026)

American International Group Inc (AIG), Assurant Inc (AIZ), Coca-Cola Co/The (KO), CVS Health Corp (CVS), Datadog Inc (DDOG), Duke Energy Corp (DUK), DuPont de Nemours Inc (DD), Ecolab Inc (ECL), Edwards Lifesciences Corp (EW), Fiserv Inc (FISV), Ford Motor Co (F), Gilead Sciences Inc (GILD), Hasbro Inc (HAS), Incyte Corp (INCY), Marriott International Inc/MD (MAR), Masco Corp (MAS), Quest Diagnostics Inc (DGX), Robinhood Markets Inc (HOOD), S&P Global Inc (SPGI), Trimble Inc (TRMB), Welltower Inc (WELL), Williams Cos Inc/The (WMB), Xylem Inc/NY (XYL), Zimmer Biomet Holdings Inc (ZBH).

On the date of publication,

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.