Stock markets cheer India-U.S. trade deal: Sensex, Nifty surge 2.5%

Some prominent gainers were Bajaj Finance, InterGlobe Aviation, Power Grid, Sun Pharma, Bajaj Finserv and Reliance Industries. File

| Photo Credit: PTI

After starting the trade on a buoyant note, the 30-share BSE Sensex further jumped 4,205.27 points or 5.14% to hit the day’s high of 85,871.73. It later ended at 83,739.13, up 2,072.67 points or 2.54%.

The 50-share NSE Nifty zoomed 639.15 points or 2.55% to settle at 25,727.55. During the day, it surged 1,252.8 points or 4.99% to 26,341.20.

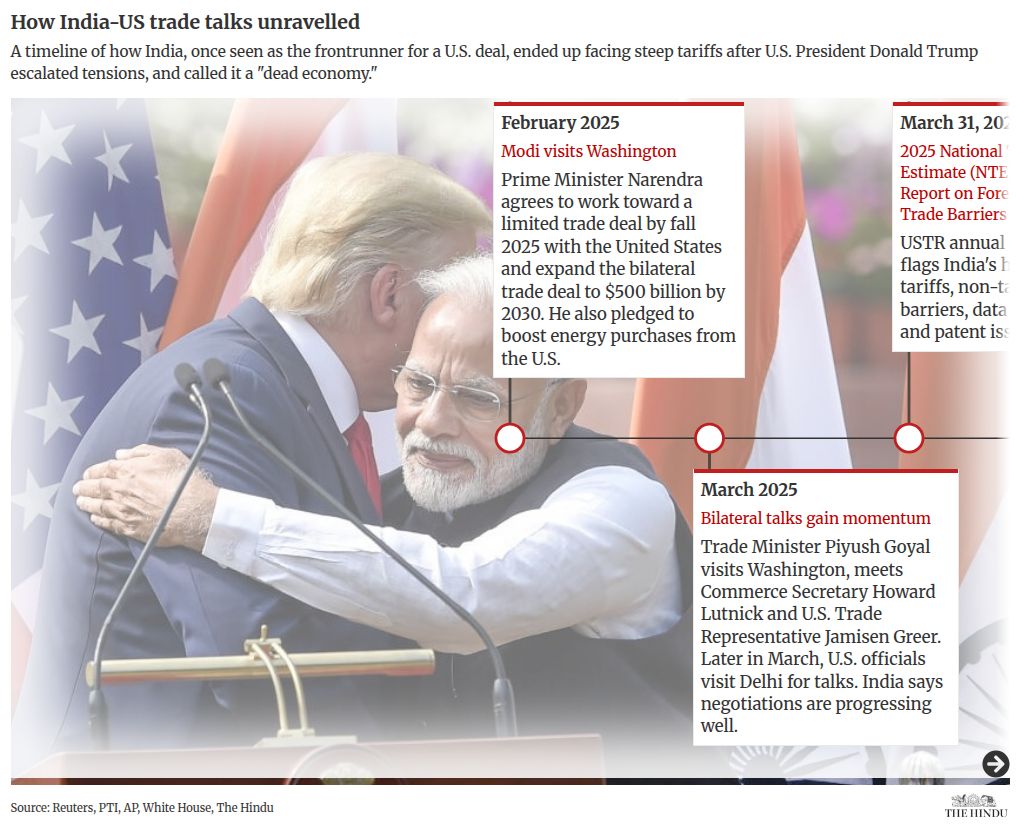

India and the U.S. have agreed to a trade deal under which Washington will bring down the reciprocal tariff on Indian goods to 18% from the current 25%, U.S. President Donald Trump said on Monday (February 2) after a phone conversation with Prime Minister Narendra Modi.

From the 30 Sensex firms, Adani Ports surged 9.12%.

The other prominent winners were Bajaj Finance, InterGlobe Aviation, Power Grid, Sun Pharma, Bajaj Finserv and Reliance Industries.

Tech Mahindra and Bharat Electronics were the only laggards.

The trade deal also propelled a sharp rally in textile, leather, gems and jewellery, seafood exports and speciality chemicals stocks.

“Indian equities experienced a significant rally today, driven by the long-anticipated India–U.S. trade deal and a strengthening rupee, which boosted expectations of renewed FII inflows.

“The reduction of U.S. tariffs on Indian goods from 50% to 18% enhances India’s competitive position among emerging markets and bolsters the outlook for export-oriented sectors with high U.S. exposure, such as textiles, aquaculture, gems and pharmaceuticals, which were supported in the 2026 Union Budget,” Vinod Nair, Head of Research, Geojit Investments Limited, said.

In Asian markets, South Korea’s Kospi rebounded sharply and jumped nearly 7%. Japan’s Nikkei 225 index, Shanghai’s SSE Composite index and Hong Kong’s Hang Seng index also ended higher.

European markets were trading in positive territory.

U.S. markets ended higher on Monday (February 2).

Foreign institutional investors offloaded equities worth ₹1,832.46 crore on Monday (February 2), while Domestic Institutional Investors (DIIs) bought stocks worth ₹2,446.33 crore, according to exchange data.

Brent crude, the global oil benchmark, dropped 0.65% to $65.87 per barrel.

On Monday (February 2), the Sensex jumped 943.52 points or 1.17% to settle at 81,666.46. The Nifty climbed 262.95 points or 1.06% to end at 25,088.40.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.