Q1 Macroeconomic Update: AI and Tax Cuts Key to 2026 Economic Growth

By Phil Mackintosh, Senior Vice President, Chief Economist at Nasdaq, and Michael Normyle, Senior Director, Economic Research at Nasdaq

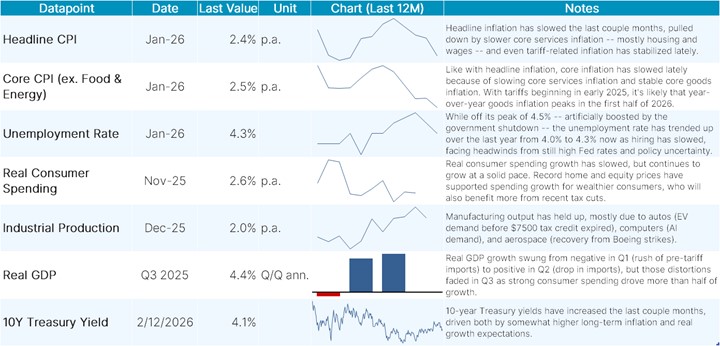

Economy at a Glance

Figure 1: Key Indicators and Trends

The Fed: Inflation, Employment, and Rates

The labor market has cooled over the last few years, which was a goal of the Fed’s 2022-2024 rate hike cycle. As a result, the number of job openings per unemployed person has more than halved and is now well-balanced (Figure 2, purple line).

As labor demand slowed, wage growth also slowed. It looks set to cool further (green line), which should help to keep inflation falling and companies improving margins.

Hiring and firing rates are both slow, with the layoff rate near its lowest since 2000 (red line). This seems to be keeping consumers spending, which helps grow retail sales.

Figure 2: U.S. Labor Market

Sources: FactSet, Nasdaq Economic Research

After adding 1.5 million jobs in 2024, the economy added less than 200,000 in 2025 but started off 2026 strong with a gain of 130,000 jobs. Last year’s job gains were concentrated in the Education & Health Services and Leisure & Hospitality sectors and both were still playing catch-up post-Covid (Figure 3). Most of the other sectors either saw small net gains or small net losses. However, the Federal Government sector saw the largest drop, by design, due to 289,000 DOGE job cuts.

This slowdown has helped the Fed continue with rate cuts. The most recent data indicates hiring has stabilized at low levels, which the Fed has recognized and is one reason markets don’t expect another rate cut until mid-2026.

Figure 3: 2025-2026 Job Gains and Losses

Sources: BLS, Nasdaq Economic Research

What’s Driving the Economy?

Three things are driving the economy:

- Rate cuts and slower inflation are helping businesses.

- Consumer spending remains resilient overall. However, a clear “K-shaped” pattern has emerged: the top 10% of income-earning households now account for nearly half of all spending—near historical highs—while lower income consumers are increasingly strained.

- Artificial intelligence (AI) spending is now boosting the economy—not just the stock market.

In addition, the One Big Beautiful Bill Act (OBBBA) will be a tailwind in 2026. The Congressional Budget Office (CBO) estimates that it will boost GDP growth by +0.9%. Accelerated depreciation and R&D expensing are expected to increase business spending, especially on capex. The OBBBA also includes tax cuts for consumers. Tax refunds are expected to be $100 billion larger this year, while lower withholding throughout the year will add another $100 billion in tax savings.

For the average consumer, this translates into a more than 2% gain in after-tax income (Figure 4). This may sustain the “K-shaped” dynamic, since the tax benefits grow as you move up the income ladder. Lower income households see little to no impact, partly because few in the bottom 20% pay income taxes.

Figure 4: 2026 % Change in After-Tax Income from OBBA (by Income Quintile)

Sources: CBO, Nasdaq Economic Research

What’s Driving Markets?

We’re nearly through Q4 2025 earnings season and it’s shaping up to be a strong quarter.

The Nasdaq-100® is on track for +16% p.a. earnings growth, which is its 11th straight quarter of at least +15% p.a. earnings growth (Figure 5, blue bars). Analysts project this trend to continue for the next year. The S&P 600 Small Caps aren’t far behind, on pace for +15% YoY earnings growth in Q4 2025 (green bars). This is only their third straight quarter of positive earnings growth.

Lower interest rates are a key factor as smaller companies tend to rely more heavily on floating-rate debt and the Fed’s rate cuts are finally translating into lower interest expenses, especially for small cap companies. Analysts’ forecasts show earnings growth is expected to stay positive throughout 2026 for small cap companies as well.

Figure 5: Earnings Growth (%, YoY)

Sources: FactSet, Nasdaq Economic Research

One reason large cap companies’ earnings growth has been stronger is that their margins have increased to record levels. However, as research from Torsten Slok of Apollo shows, this expansion in recent years is entirely driven by Tech stocks (Figure 6, orange bars), which have benefited from AI investment in high margin goods like chips and services like cloud computing.

Figure 6: S&P 500 Profit Margin Expansion Coming from Tech Companies

Source: Apollo

AI Spending Supporting Economic Growth

The five major AI hyperscalers (AMZN, GOOG, META, MSFT, and ORCL) spent nearly $450 billion on capex last year.

Research from Bridgewater suggests that over 70% of AI capex passes through to GDP—even accounting for the fact that many chips and other hardware are imported. As a result, nearly half of the 2025 U.S. GDP growth came from tech investments (Figure 7, red bar), with the other half coming from consumer spending.

Economic growth in 2026 may look similar to 2025. AI hyperscalers are projected to boost capex nearly 50% to $660 billion, with AI spending estimated to add +1.4 percentage points to 2026 growth and the OBBBA tax cuts to support consumer spending.

Figure 7: YTD Average Contribution to 2025 U.S. GDP Growth

*Including information processing equipment, software, and R&D; Source: Alpine Macro

5 Questions Board Members Should Ask Now

- How are you measuring AI productivity gains and what are those gains thus far?

- Are your competitors using AI in their products?

- With the Fed cutting rates, how does that impact your debt restructuring plans?

- Is the business facing a skilled labor shortage and are you prepared to manage it?

- How are tariffs impacting your supply chain, margins, and competitive positioning?

To receive an exclusive video with further insights from Nasdaq’s Chief Economist and Senior Director of Economic Research, join the Nasdaq Center for Board Excellence. Forthe latest market insights, explore the Nasdaq Center for Board Excellence Resource Library and subscribe to Market Makers.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.