Prediction: This Will Be the Next Artificial Intelligence (AI) Chip Stock to Join Nvidia, Taiwan Semiconductor, and Broadcom in the Trillion-Dollar Club (Hint: It’s Not AMD)

Key Points

- Demand for AI chips has been off the charts during the last three years.

- While GPUs and custom silicon remain prominent in capex budgets, hyperscalers are now scrambling to procure memory chips.

-

Micron Technology is a leader in the high-bandwidth memory chip market.

- 10 stocks we like better than Micron Technology ›

Although artificial intelligence (AI) has made its mark across various pockets of the technology realm, perhaps no industry has transformed more than semiconductors. Before the AI revolution, Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing (NYSE: TSM), and Broadcom (NASDAQ: AVGO) were each viewed as cyclical chip businesses with unpredictable growth prospects.

Today, these three companies are trillion-dollar enterprises fueling the future of generative AI development. GPUs, accelerators, and custom application-specific integrated circuits (ASICs) have become the hardware backbone supporting how data workloads are processed and transferred.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Smart investors have started to look beyond the obvious winners of the AI semiconductor market and are beginning to look at which companies could emerge as the next member of the trillion-dollar club.

By year-end 2026, I predict that Micron Technology (NASDAQ: MU) will be the chip stock on everyone’s radar. Let’s dig into Micron’s importance in the chip value chain and understand why the company is positioned for explosive growth in the AI infrastructure era.

Image source: Micron Technology.

What is Micron’s role in the AI chip industry?

Perhaps the biggest impact on generative AI so far has been the introduction of large language models (LLMs) such as ChatGPT. Although LLMs have proven to be incredibly useful, training these text-based models is really only just beginning to scratch the surface of what AI can do.

Hyperscalers like Microsoft, Alphabet, Amazon, and Meta Platforms have ambitions well beyond building chatbots. These companies have their eyes on next-generation services featuring agentic AI, autonomous systems, and robotics.

These more sophisticated applications require enormous investments in inference — the ability for a trained model to make decisions. This means that AI workloads are expanding at an unprecedented pace.

Against this backdrop, developers need to ensure that they are complementing their GPU clusters with the resources needed to allow smooth data transfer. Micron’s broad suite of high-bandwidth memory (HBM), dynamic random access memory (DRAM), and NAND chips helps mitigate data bottlenecks and ensure efficient memory and storage capabilities.

Why 2026 could Micron’s “Nvidia” moment

Surging demand from hyperscalers coupled with a tightening supply base of chips has fueled rising prices in the memory and storage market. According to research compiled by TrendForce, prices for DRAM and NAND chips could rise by as much as 60% and 38%, respectively, during the first quarter.

For the company’s first quarter of fiscal 2026 (ended Nov. 27), Micron reported revenue of $13.6 billion, a 57% increase year over year. What’s impressive is Micron’s top line accelerated across each of its core segments: cloud memory, core data, mobile, and automotive and embedded devices. In addition, the company generated gross margins of at least 40% and operating margins of at least 30% in each business line.

These trends are important to understand because they underscore that not only are Micron’s products in high demand, but the company is able to produce lucrative unit economics across its entire operation. Considering the total addressable market for HBM is expected to reach $100 billion by 2028 — nearly triple its current size — Micron’s trajectory looks absolutely explosive.

As more infrastructure capital flows downstream from GPUs to HBM, Micron could be on the verge of having its breakout moment akin to what Nvidia experienced at the dawn of the AI revolution.

Micron stock looks poised for a breakout

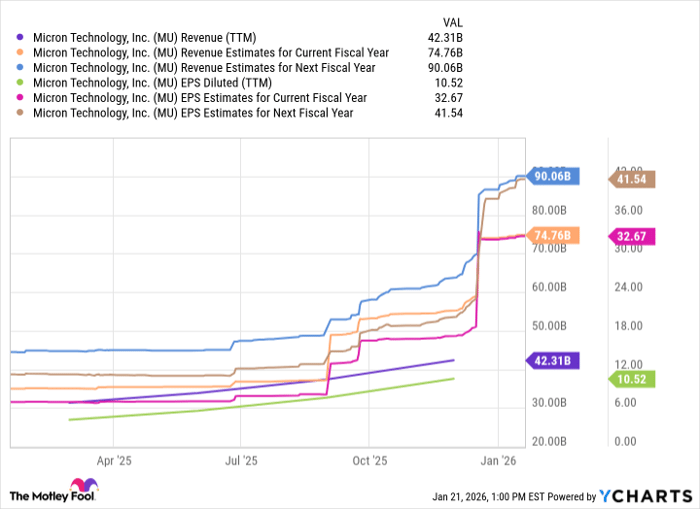

During the past 12 months, Micron has generated $42 billion in revenue and about $10 in earnings per share (EPS). Thanks to the current memory chip supercycle, Wall Street is calling for monster growth during the next two years. By fiscal 2027, analysts are projecting that Micron’s revenue will more than double while EPS could surge nearly fourfold.

MU Revenue (TTM) data by YCharts

Despite the secular tailwinds fueling Micron’s growth, the company trades at a modest forward price-to-earnings (P/E) multiple of just 12.3. This is a meaningful discount to other chip leaders in their respective verticals. For example, Nvidia, TSMC, and Broadcom have commanded forward P/Es in the range of 30 to almost 60 throughout the AI revolution.

Although Micron is not a direct competitor to these businesses, this benchmark shows how adjacent suppliers along the chip market have earned meaningful premiums given their importance to the AI narrative.

Because Micron’s revenue and earnings profiles are poised for significant acceleration during the next couple of years, I think the company is positioned for substantial valuation expansion.

At a forward P/E of 23 — which could still be seen as discounted — Micron would have an implied market cap of roughly $850 billion. As more investors become aware of Micron’s indispensable role due to intensified demand for memory chips, I think a forward earnings multiple of 30 is completely reasonable. At that point, Micron would reach a $1 trillion valuation.

Considering AI infrastructure is a multiyear, multitrillion-dollar opportunity that’s only just beginning, I see Micron stock as a compelling long-term stock to buy and hold in 2026 — all at a no-brainer value.

Should you buy stock in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $464,439!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,150,455!*

Now, it’s worth noting Stock Advisor’s total average return is 949% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 25, 2026.

Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Micron Technology, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.