‘Panch-Jyoti’: RBI’s 5-year strategy to boost financial inclusion; key goals and action points explained

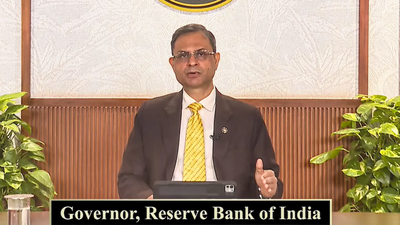

Reserve Bank of India Governor Sanjay Malhotra on Monday unveiled the National Strategy for Financial Inclusion (NSFI) 2025-30, aimed at expanding financial access and usage across India over the next five years. The strategy promotes a holistic, ecosystem-based approach to improve the quality, reach, and consistency of last-mile financial services.

Objectives focus on women, households, and micro-enterprises

At the core of the NSFI 2025-30 are five key objectives, known as ‘Panch-Jyoti’, supported by 47 action points designed to boost financial inclusion. These include a gender-sensitive approach to women-led financial initiatives and tailored strategies to strengthen the financial resilience of households, especially among underserved and vulnerable populations, according to an official RBI statement.The strategy also emphasises improving the availability and use of equitable, responsible, suitable, and affordable financial products to ensure financial safety and security for households and micro-enterprises.“The Panch-Jyoti strategy focuses on synergising livelihood, skill development, and support ecosystems and linking them with financial inclusion,” the RBI said.

Financial education and customer protection central to the plan

Governor Malhotra highlighted that the previous five-year NSFI strategy, which concluded in 2024, had successfully met its objectives. The new plan seeks to leverage financial education to promote discipline among users while strengthening customer protection and grievance redressal mechanisms for better reliability and trust in financial services.The NSFI 2025-30 has been developed under the Technical Group on Financial Inclusion and Financial Literacy (TGFIFL), following consultations nationwide with multiple stakeholders. Key participants include the Department of Economic Affairs, Department of Financial Services, Ministry of Finance, SEBI, IRDAI, PFRDA, NABARD, National Skill Development Corporation, and National Centre for Financial Education, as reported by PTI.By integrating financial literacy, livelihood support, skill development, and customer protection, the Panch-Jyoti strategy aims to create a robust, inclusive, and resilient financial ecosystem across India, strengthening access to banking and financial services for millions of households and micro-enterprises.