Only 2 “Magnificent Seven” Stocks Outperformed the S&P 500 in 2025. Are They Both Buys for 2026?

Key Points

- Nvidia held a near-monopoly on high-end AI training hardware.

- Nvidia will inevitably lose market share in the AI chip industry as more companies develop their own.

-

Alphabet has shown that AI tools haven’t had a noticeable negative effect on its Google Search business.

- 10 stocks we like better than Nvidia ›

The “Magnificent Seven” stocks got their name by being seven of the best-performing and dominant tech companies in the world. Unfortunately, most of the companies had a less-than-magnificent 2025.

Five of the companies underperformed the S&P 500‘s 16.4% returns, with the two exceptions being Nvidia (NASDAQ: NVDA) and Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL). They finished 2025 up 38.9% and 65.4%, respectively.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Considering their impressive recent gains, are they buys for this year? For long-term investors, there’s a clear answer.

Image source: Getty Images.

Making the case for Nvidia

Nvidia is the world’s most valuable public company with a market of more than $4.5 trillion (as of Jan. 23). Its historic growth can all be traced back to the current artificial intelligence (AI) gold rush.

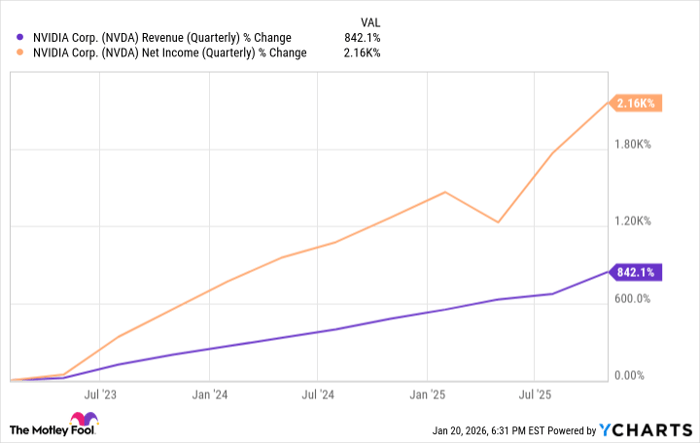

Nvidia’s graphics processing units (GPUs) have become a critical part of the AI pipeline because they can handle the processing needed to train and run AI models. The company essentially had a monopoly on high-end AI training hardware for a while, and both its stock price and earnings have shot up because of it.

NVDA Revenue (Quarterly) data by YCharts

Nvidia has solidified itself as the leader of the hardware side of AI. If companies keep their plans to continue building out their AI infrastructure, Nvidia will remain one of the biggest beneficiaries. It will inevitably lose some dominance as companies like Amazon and Alphabet begin designing their own chips, but it’s not easy for customers to change providers.

Trading at 38 times its projected earnings over the next year (second-highest in the Magnificent Seven behind Tesla), Nvidia isn’t cheap. But if you’re a long-term investor, consistently building a stake in Nvidia is a smart move. Just expect the inevitable volatility along the way.

Making the case for Alphabet

There were concerns that generative AI tools like ChatGPT could cut into Alphabet’s business as people relied more on those tools for answers versus searching on Google. So far, though, Alphabet is proving that it’s not an issue.

Instead of losing search dominance, Alphabet has been effective at integrating AI into its Search business and enhancing (in most cases) the experience. People’s search habits could evolve, but so far, that’s an encouraging sign.

Alphabet’s Google advertising business is self-explanatory and continues to be its bread and butter (more than 72% of total revenue in the third quarter). However, its cloud business continues to look promising. It has been Alphabet’s fastest-growing business in recent quarters.

Google Cloud will likely remain behind Amazon Web Services and Microsoft Azure in market share for the foreseeable future, but it’s in a good spot to capture a decent amount of the growing demand for cloud services. Add in the fact that Alphabet has its own data centers and is developing its own chips, and the company has a good path to a fully functional in-house AI stack.

Alphabet is a buy this year and going forward.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $461,527!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,155,666!*

Now, it’s worth noting Stock Advisor’s total average return is 950% — a market-crushing outperformance compared to 197% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 28, 2026.

Stefon Walters has positions in Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.