Notable Friday Option Activity: RPD, HCA, KTOS

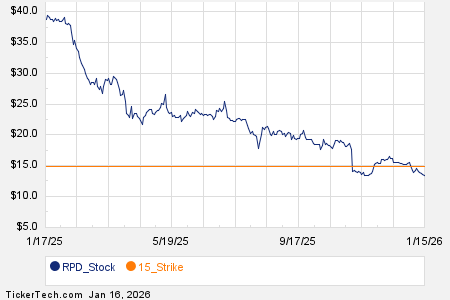

Among the underlying components of the Russell 3000 index, we saw noteworthy options trading volume today in Rapid7 Inc (Symbol: RPD), where a total of 4,346 contracts have traded so far, representing approximately 434,600 underlying shares. That amounts to about 41.6% of RPD’s average daily trading volume over the past month of 1.0 million shares. Particularly high volume was seen for the $15 strike call option expiring February 20, 2026, with 3,238 contracts trading so far today, representing approximately 323,800 underlying shares of RPD. Below is a chart showing RPD’s trailing twelve month trading history, with the $15 strike highlighted in orange:

HCA Healthcare Inc (Symbol: HCA) saw options trading volume of 4,344 contracts, representing approximately 434,400 underlying shares or approximately 41.5% of HCA’s average daily trading volume over the past month, of 1.0 million shares.

Particularly high volume was seen for the $430 strike put option expiring February 20, 2026, with 2,405 contracts trading so far today, representing approximately 240,500 underlying shares of HCA. Below is a chart showing HCA’s trailing twelve month trading history, with the $430 strike highlighted in orange:

And Kratos Defense & Security Solutions, Inc. (Symbol: KTOS) options are showing a volume of 13,906 contracts thus far today. That number of contracts represents approximately 1.4 million underlying shares, working out to a sizeable 41.4% of KTOS’s average daily trading volume over the past month, of 3.4 million shares.

Especially high volume was seen for the $124 strike call option expiring January 16, 2026, with 806 contracts trading so far today, representing approximately 80,600 underlying shares of KTOS. Below is a chart showing KTOS’s trailing twelve month trading history, with the $124 strike highlighted in orange:

For the various different available expirations for RPD options, HCA options, or KTOS options, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

FSS Options Chain

JANX Historical Stock Prices

Institutional Holders of MERC

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.