Nasdaq Survey: What Top Business Leaders Think of AI

Businesses are broadly still in the early stages of exploring how artificial intelligence can help their organizations – but that is not stopping them from making significant investments in the technology. Those findings come from a new 2026 Outlook Survey from Nasdaq, which asked CEOs, board chairs, C-suite executives, and leaders for their thoughts on AI and the economy. The survey found that, despite significant institutional investments in AI, just 5% of leaders believe their organizations are AI-native. The vast majority, 71%, categorized themselves as either “newbies” or “explorers” when it comes to AI readiness.

The top three areas where leaders are seeing the greatest progress toward AI adoption are product development, anti-fraud and anti-money laundering, and compliance and risk management.

As for the obstacles to increased AI adoption, business leaders pointed to several leading internal barriers: an unclear return on investment, the need to address technology debt and legacy technology, and concerns about governance or compliance. On the external front, survey respondents said tool maturity, regulatory complexity, and cost concerns were the top three barriers to greater adoption.

Here are some key findings from the survey; access the full survey by filling in the form at the end of this article:

Investing in AI

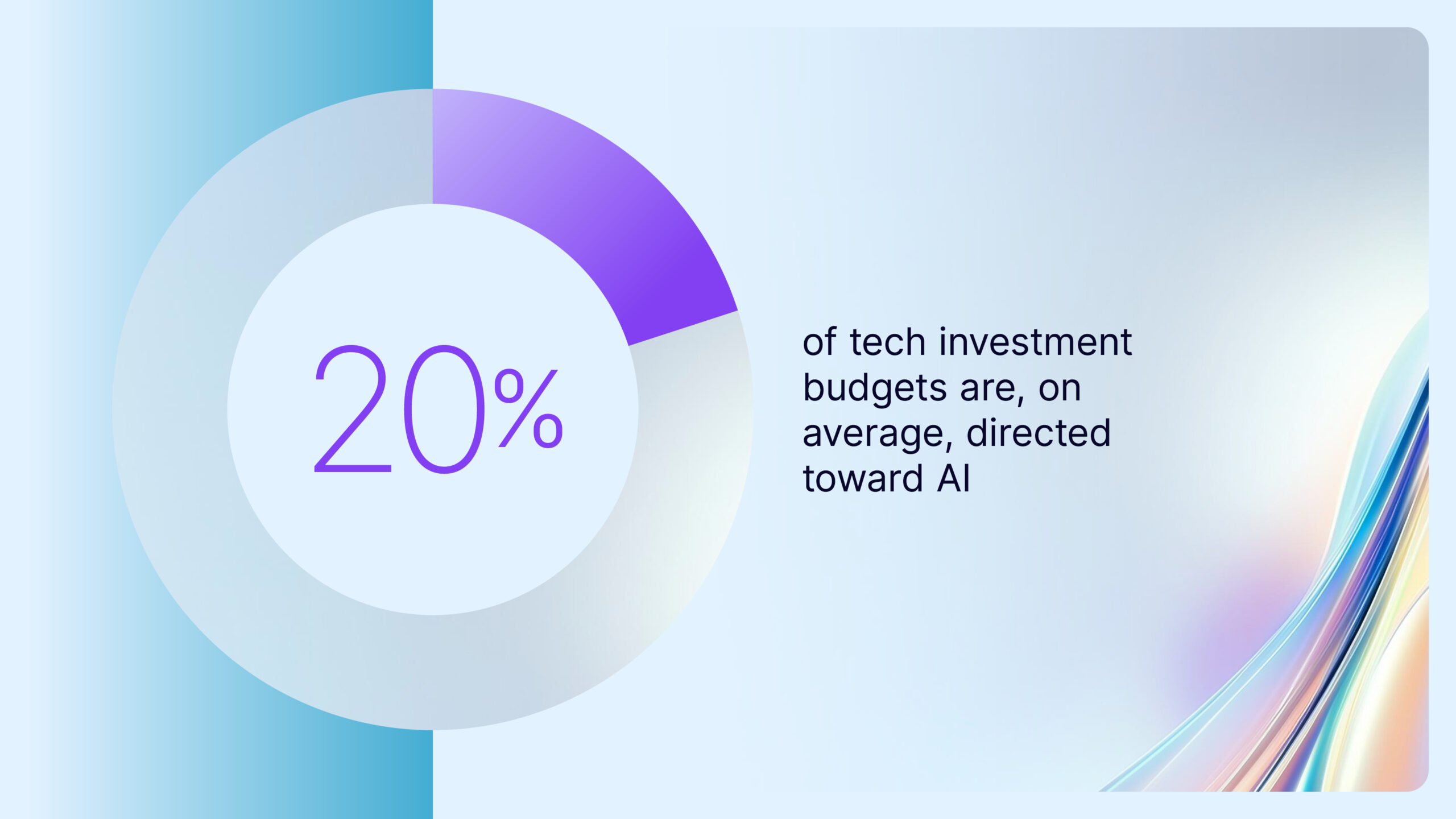

On average, leaders reported dedicating one-fifth of their technology budget to AI initiatives. However, there was significant variation across organizations, with 31% saying that less than 10% of their tech budget is focused on AI, while 12% of respondents said at least half of their budget was going toward this technology.

Not all business functions are seeing equal AI adoption, the survey found. Financial institutions are seeing the greatest AI adoption around product development, fraud detection, and compliance teams. Meanwhile, the use of AI in trading showed an interesting split, with one-in-four institutions already scaling and deploying AI solutions within the function, while a full half are still standing at the starting line.

In terms of how businesses are thinking about using the technology, the survey found that addressing innovation and compliance challenges stood out as primary components of AI strategy.

Early days of AI adoption

Despite these significant investments, 71% of respondents said their workforce was still in the early stage of AI readiness. The survey grouped organizations into four categories:

- 22% are Newbies: Learning about AI’s capabilities, benefits and risks but have not yet adopted AI in their organization

- 49% are Explorers: In the early adoption phase, starting to incorporate AI capabilities across some products or business areas

- 25% are Adopters: Fairly fluent in AI capabilities, with varying levels of adoption and implementation

- 5% are Leaders: Fully AI-native

The impact of AI

When asked what they expected AI’s long-term impact to be on the economy, 63% of respondents said they thought it would be “evolutionary,” meaning that it would have a meaningful impact, but not as transformative as some expect.

30% of leaders said they did, in fact, anticipate AI transforming every aspect of our economy, while only 6% said the impact would be negligible.

What comes after an AI bubble

Whatever the ultimate impact of AI technology may be, 87% of survey respondents said they believed there is currently an AI industry bubble. Still, only 11% of leaders said they expected this to result in a major pullback in the short-to-medium term.

Following a bubble burst, the most likely outcome would be “significant” consolidation in the AI industry, according to 70% of respondents.

Expectations for 2026

Turning to the broader macro-outlook, a large majority of institutional leaders were bullish on both global growth (68%) and their own firms’ prospects (79%) in 2026, with most expecting “moderate” growth in both categories.

In fact, only 3% of leaders characterized the year ahead as “high risk,” while 69% described their assessment as “neutral,” “cautious optimism,” or “strong optimism.”

When asked what will have the greatest impact on economic performance this year, the top three answers were:

- 38%: Improved geopolitical relations and trade stability

- 25%: Inflation control and price stability

- 14%: Improved consumer confidence

Check out the full results of Nasdaq’s 2026 Outlook Survey here by filling in the form below.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.