Magna International Q4 Earnings Surpass Expectations, Dividend Raised

Magna International MGA reported fourth-quarter 2025 adjusted earnings of $2.18 per share, which rose from the year-ago quarter’s $1.69. The figure beat the Zacks Consensus Estimate of $1.81.

Net sales increased 2% year over year to $10.85 billion, which outpaced the Zacks Consensus Estimate of $10.48 billion.

Magna International Inc. Price, Consensus and EPS Surprise

Magna International Inc. price-consensus-eps-surprise-chart | Magna International Inc. Quote

Magna International Inc. price-consensus-eps-surprise-chart | Magna International Inc. Quote

MGA’s Segmental Performance

The Body Exteriors & Structures segment’s revenues totaled $4.25 billion, up 4.6% year over year. This was due to higher production on certain ongoing programs, the launch of new programs, and the overall appreciation of foreign currencies compared to the U.S. dollar. The figure also topped the Zacks Consensus Estimate of $4.1 billion.

The segment reported an adjusted EBIT of $465 million, up from $371 million recorded in the year-ago period. The metric also topped the Zacks Consensus Estimate of $365.22 million on enhanced productivity and efficiency and supply-chain premiums in 2024.

The Power & Vision segment’s revenues increased 1.5% year over year to $3.84 billion due to higher production on certain programs, the launch of new programs and the overall appreciation of foreign currencies compared to the U.S. dollar. The metric surpassed the Zacks Consensus Estimate of $3.8 billion.

Segmental adjusted EBIT fell from $235 million to $166 million due to unfavorable product mix and higher net warranty costs and input production costs. The metric missed the Zacks Consensus Estimate of $269.2 million.

Revenues from the Seating Systems segment rose 8.1% year over year to $1.63 billion due to the launch of programs and the net strengthening of foreign currencies against the U.S. dollar. The metric also topped the Zacks Consensus Estimate of $1.48 billion.

Segmental adjusted EBIT rose to $136 million from $67 million in the year-ago period due to productivity and efficiency improvements, lower net warranty costs and customer recoveries for tariffs. The metric also topped the Zacks Consensus Estimate of $89 million.

The Complete Vehicles segment’s revenues decreased 10.1% year over year to $1.26 billion due to lower engineering revenues and the end of production of the Jaguar I-Pace and Jaguar E-Pace. The metric outpaced the Zacks Consensus Estimate of $1.24 billion.

The segment reported adjusted EBIT of $50 million, down from $56 million in the year-ago period due to lower income resulting from reduced engineering sales and unfavorable net commercial items. The metric outpaced the Zacks Consensus Estimate of $39.62 million.

Magna’s Financials

Magna had $1.61 billion in cash and cash equivalents as of Dec. 31, 2025, up from $1.25 billion as of Dec. 31, 2024. As of Dec. 31, 2025, long-term debt was $4.69 billion, up from $4.13 billion as of Dec. 31, 2024.

In the reported quarter, cash provided from operating activities totaled $1.98 billion, up from the year-ago figure of $1.91 billion.

The company raised its quarterly dividend by 2% to 49.50 cents per common share, which will be paid on March 13, 2026, to shareholders of record as of Feb. 27, 2026.

MGA’s 2026 Guidance

Magna expects 2026 revenues to be in the band of $41.9-$43.5 billion compared with 42.01 billion reported in 2025. Adjusted EBIT margin is expected to be in the band of 6-6.6%. Adjusted diluted EPS is anticipated to be in the band of $6.25-$7.25 compared with $5.73 reported in 2025. Capex is guided in the band of $1.5-$1.6 billion.

Magna Zacks Rank & Key Picks

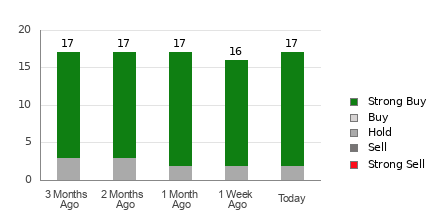

MGA carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the auto space are Ford Motor F, Modine Manufacturing MOD and Strattec Security STRT, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for F’s 2026 earnings implies year-over-year growth of 39.5%. The EPS estimate for 2026 and 2027 has improved 7 cents and 8 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for MOD’s fiscal 2026 sales and earnings implies year-over-year growth of 21.2% and 18.8%, respectively. The EPS estimate for fiscal 2026 and 2027 has improved 5 cents and 7 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for STRT’s fiscal 2026 sales and earnings implies year-over-year growth of 2.1% and 16.2%, respectively. The EPS estimate for 2026 and 2027 has improved 85 cents and 48 cents, respectively, in the past sev

Quantum Computing Stocks Set To Soar

Artificial intelligence has already reshaped the investment landscape, and its convergence with quantum computing could lead to the most significant wealth-building opportunities of our time.

Today, you have a chance to position your portfolio at the forefront of this technological revolution. In our urgent special report, Beyond AI: The Quantum Leap in Computing Power, you’ll discover the little-known stocks we believe will win the quantum computing race and deliver massive gains to early investors.

Ford Motor Company (F) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

Strattec Security Corporation (STRT) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.