Is Alibaba’s “All Others” Revenues Becoming a Drag on Growth?

Alibaba BABA is facing a growing headwind to revenue growth from its shrinking “All Others” segment despite continued strength in its core businesses. In the second quarter of fiscal 2026, revenues from the “All Others” segment dropped 25% year over year, marking another consecutive quarterly decline and making it the only business unit to contract, while China e-commerce, international commerce and cloud operations delivered solid growth.

The downturn was caused mainly by the disposal of Sun Art and Intime, which automatically reduced reported revenues, along with weaker performance at Cainiao, Alibaba’s logistics arm. Although Freshippo, Alibaba Health and Amap recorded growth, their gains could not make up for the broader slowdown in the segment. As a result, the segment has become a drag rather than a support for consolidated growth.

The impact extends beyond the top line. Losses in the segment widened as Alibaba increased investments in technology and AI-driven initiatives, adding pressure on group profitability. Given that most revenues in this segment come from direct sales and logistics services recorded on a gross basis, margins tend to be thinner and revenue more volatile, amplifying its influence on overall financial results.

The company views these units as long-term innovation platforms tied to AI infrastructure and digital services, yet near-term performance shows they are holding back reported growth. Until Cainiao stabilizes and divestment-related pressures fade, this segment is likely to continue hurting overall revenue growth. This concern is also seen in the Zacks Consensus Estimate, which forecasts only modest revenue growth of 6.2% for fiscal 2026.

Alibaba’s Logistics Business Faces Rising Competition

Alibaba’s logistics arm is facing intensifying competition as JD.com’s JD subsidiary JD Logistics and Amazon’s AMZN Amazon Logistics expand their fulfillment, warehousing and last-mile capabilities, pressuring pricing and delivery speed across key markets.

JD Logistics intensifies competition with Alibaba’s logistics business by leveraging JD.com’s self-owned, end-to-end infrastructure, which prioritizes speed, reliability and service quality over asset-light models. JD.com’s logistics segment’s revenues grew more than 24% year over year in the third quarter of 2025, supported by expanding warehousing, air cargo routes and technology investment. This vertically integrated approach gives JD.com superior control over delivery times, costs and customer experience versus Alibaba’s partner-driven network.

Amazon Logistics has emerged as a formidable competitor to Alibaba’s logistics business by leveraging Amazon’s massive fulfillment network, regionalized warehouses and fastest-ever Prime delivery speeds, including same-day and next-day service at scale. Amazon continues to invest heavily in automation, inventory placement and last-mile infrastructure, improving cost efficiency and reliability. This end-to-end control gives Amazon a clear operational edge over platform-based rivals like Alibaba.

BABA’s Share Price Performance, Valuation & Estimates

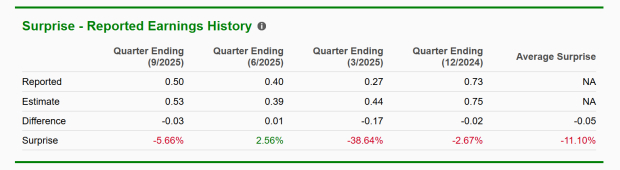

BABA shares have gained 40.3% in the past six-month period, outperforming the Zacks Internet – Commerce industry and the Zacks Retail-Wholesale sector’s growth of 2.2% and 5%, respectively.

BABA’s Six-Month Price Performance

Image Source: Zacks Investment Research

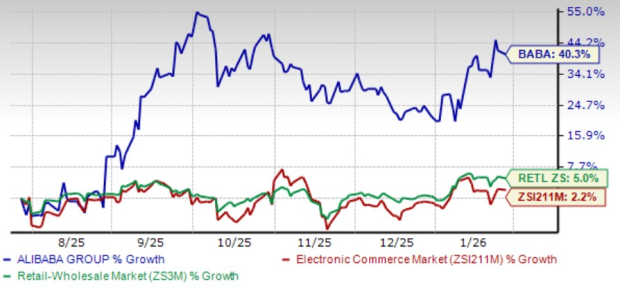

From a valuation standpoint, BABA stock is currently trading at a forward 12-month Price/Earnings ratio of 20.66X compared with the industry’s 25.02X. BABA has a Value Score of F.

BABA’s Valuation

Image Source: Zacks Investment Research

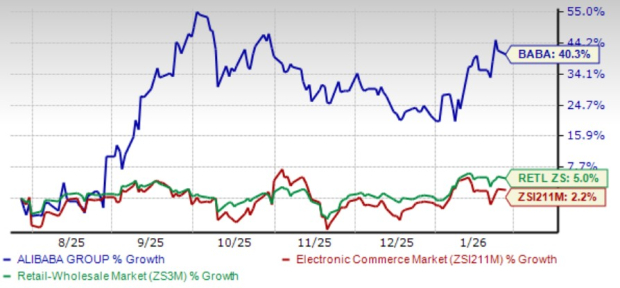

The Zacks Consensus Estimate for fiscal 2026 earnings is pegged at $6.05 per share, down by 5.2% over the past 30 days and indicating a 32.85% year-over-year decline.

Image Source: Zacks Investment Research

Alibaba currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks Top 10 Stocks for 2026

Hurry – you can still get in early on our 10 top tickers for 2026. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful.

From inception in 2012 through November, 2025, the Zacks Top 10 Stocks gained +2,530.8%, more than QUADRUPLING the S&P 500’s +570.3%.

Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2026. You can still be among the first to see these just-released stocks with enormous potential.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.