Investing in This Unstoppable Vanguard ETF in 2026 Could Turn $100 per Month Into $949,000

Key Points

The right investment can transform your finances, and investing in exchange-traded funds (ETFs) is one of the simplest ways to build life-changing wealth. Each fund contains dozens or hundreds of stocks, helping diversify your portfolio with minimal research or effort on your part.

While there are numerous ETFs to choose from, this Vanguard fund offers a distinct approach and has a proven track record of outperforming the market. With enough time and consistency, it could even help turn $100 per month into nearly $1 million. Here’s how.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

A supercharged ETF to grow your savings

Growth ETFs can be incredibly powerful investments, and one popular choice is the Vanguard Mega Cap Growth ETF (NYSEMKT: MGK).

Mega-cap stocks are generally defined as those with a market cap of at least $200 billion, and this ETF contains 66 of the largest U.S. stocks that still have growth potential. With a median market cap of $2.5 trillion, this fund is chock-full of industry-leading juggernauts from a variety of market sectors.

One of the advantages of this particular fund is its mix of stability and growth. Because mega-cap stocks are so large, they stand a better chance of surviving periods of market volatility. They may still experience short-term turbulence, but they’re more likely to recover over time compared to smaller companies.

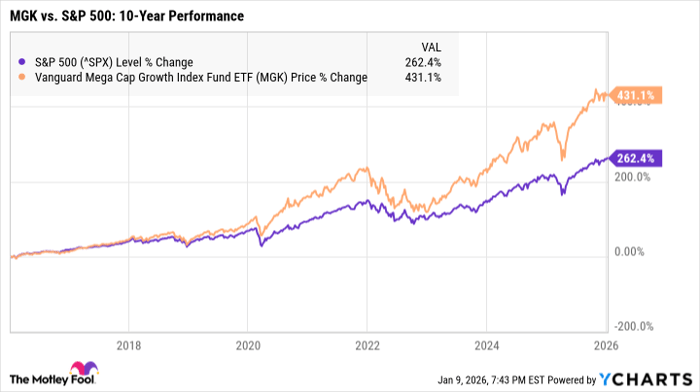

Despite their relative stability, the mega-cap stocks within this ETF are also more likely to earn above-average returns. Over the last 10 years, the Vanguard Mega-Cap Growth ETF has earned total returns of more than 431%, compared to 262% for the S&P 500.

In other words, if you’d invested $5,000 a decade ago, you’d have around $26,000 with the Vanguard Mega Cap Growth ETF compared to just $18,000 with an S&P 500 ETF.

Just keep in mind that with most growth ETFs, you’re likely to see steeper downturns during periods of volatility compared to broad market funds. If you choose to invest in any growth fund, be prepared to hold your investment for at least five years or so to help limit the impact of short-term market turbulence.

Turning $100 per month into $949,000

There’s no way to know exactly how this ETF — or any investment — will perform in 2026 and beyond. However, examining this fund’s past performance can give you a rough idea of its earning potential.

Over the last 10 years, the Vanguard Mega Cap Growth ETF has earned an average rate of return of just over 18% per year. For comparison, the market as a whole has historically earned an average return of around 10% per year.

If you were to invest $100 per month, here’s approximately how that would add up over time depending on whether you’re earning average returns of 18% or 10% per year:

| Number of Years | Total Portfolio Value: 18% Avg. Annual Return | Total Portfolio Value: 10% Avg. Annual Return |

|---|---|---|

| 15 | $73,000 | $38,000 |

| 20 | $176,000 | $69,000 |

| 25 | $411,000 | $118,000 |

| 30 | $949,000 | $197,000 |

Data source: Author’s calculations via investor.gov.

With enough time, $100 per month invested in this ETF could potentially grow to nearly $1 million. But even if this ETF underperforms or you can’t stay in the market for that long, it’s still possible to accumulate hundreds of thousands of dollars.

ETFs can be lucrative wealth-building opportunities, but time and consistency are key. By investing regularly and keeping a long-term outlook, the Vanguard Mega Cap Growth ETF could help you earn more than you might think.

Should you buy stock in Vanguard World Fund – Vanguard Mega Cap Growth ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Mega Cap Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Mega Cap Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $482,451!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,133,229!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 197% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 12, 2026.

Katie Brockman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.