How Are Mag 7 Earnings Shaping Up?

The market loved Meta Platforms’ META quarterly results but wasn’t impressed with Microsoft’s MSFT and Tesla’s TSLA December-quarter numbers.

The market’s disappointment with the Microsoft report notwithstanding, the company delivered +28.1% earnings growth on +16.7% top-line gains for the period, also handily beating estimates. The sticking point for investors was Azure and other cloud services revenue growth of +38% (in constant currency terms) and underwhelming guidance for the current period.

Worries about decelerating Azure growth have been weighing on Microsoft’s shares, as has the company’s relationship with OpenAI. Azure revenues were up +39% each in constant currency terms in each of the preceding two quarters, and the mid-point of guidance for the March quarter represents a +37.5% growth pace. Management has flagged capacity constraints as the primary reason for the growth deceleration, but market participants do not seem fully on board with that explanation.

Meta’s Q4 growth numbers are a lot less impressive, with earnings and revenues up +9.3% and +23.8%, respectively, flagging the social-media bellwether’s margin pressures. But what impressed investors is the company’s ability to use AI more effectively in its advertising business. The notable AI-centric improvement in the business was the +3.5% increase in click rates on its ads, resulting in a +1% increase in conversion rates.

As with Microsoft, Meta claims to be capacity-constrained and unable to execute on all the ideas it has to streamline their ad business with the help of AI. It is this argument that allowed the company to get away with a further increase to its capex budget. They are currently targeting to spend $135 billion in capex this year, up from $72 billion in 2025 and $39 billion in 2024.

We will see how the market reacts to reports from Amazon AMZN and Alphabet GOOGL this week, with the former reporting after the market’s close on Thursday, February 5th, and the latter on Wednesday, February 4th. The expectation is that Amazon’s earnings would be up +5.7% on +12.7% higher revenues, while Alphabet’s quarterly earnings and revenues are expected to be up +17.5% and +16%, respectively.

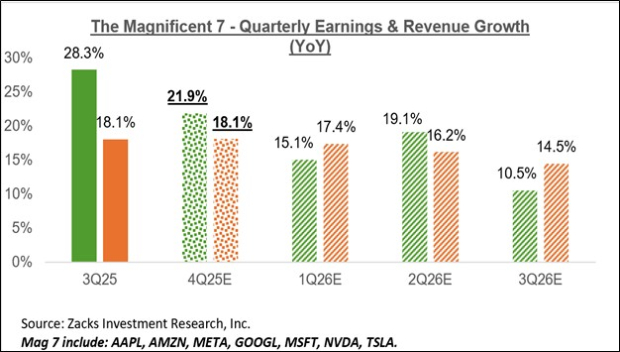

The aggregate growth numbers for the Mag 7 group are impressive, with Q4 earnings on track to be up +21.9% from the same period last year on +18.1% higher revenues, following the group’s +28.3% earnings growth on +18.1% revenue growth in 2025 Q3. Not all members of the elite group are equally contributing to the growth pace, ranging from Tesla’s -53.4% earnings decline in Q4 and Nvidia’s estimated +67.4% jump.

The chart below shows the group’s blended Q4 earnings and revenue growth relative to what was achieved in the preceding period and what is expected in the coming three periods.

Image Source: Zacks Investment Research

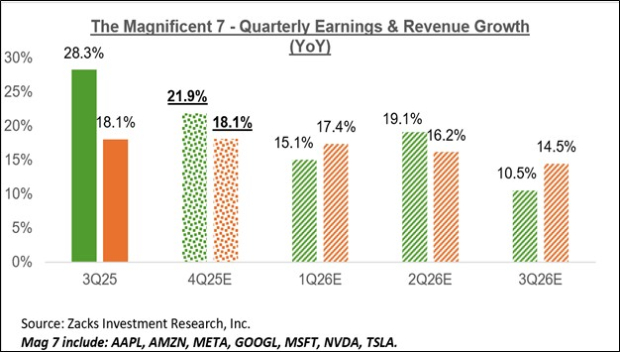

The chart below shows the one-year performance of the Mag 7 group, with Alphabet and Nvidia outperforming the market, while the rest underperform.

Image Source: Zacks Investment Research

The chart below shows the Mag 7 group’s earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

Please note that the Mag 7 group is on track to account for 25.2% of all S&P 500 earnings in 2025, up from 23.2% in 2024 and 18.3% in 2023. Regarding market capitalization, the Mag 7 group currently carries a 34.2% weight in the index.

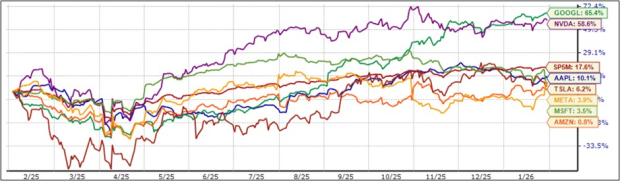

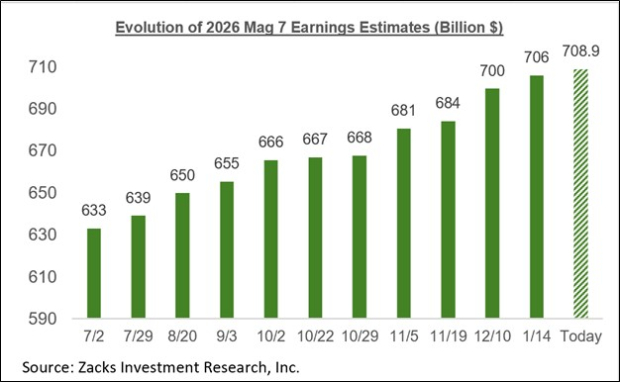

The Mag 7 group has been enjoying a steadily improving earnings outlook, with analysts raising their estimates. We saw that trend in play ahead of the start of the Q3 earnings season, and something similar is in place for 2025 Q4 as well.

The chart below shows how aggregate earnings estimates for the Mag 7 group have evolved since July 2025.

Image Source: Zacks Investment Research

Q4 Earnings Season Scorecard

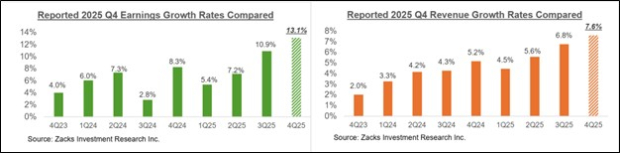

Through Friday, January 30th, we have seen Q4 results from 167 S&P 500 members or 33.4% of the index’s total membership. Total earnings for these companies are up +13.1% from the same period last year on +7.6% higher revenues, with 77.8% beating EPS estimates and 64.7% beating revenue estimates.

We have more than 450 companies on deck to report results this week, including 127 index members. The week’s lineup includes, besides the aforementioned Amazon and Alphabet reports, a representative cross-section of bellwether operators, including Disney, Palantir, Pfizer, Eli Lilly, AMD, Chipotle, Uber, Qualcomm, Ralph Lauren, and others.

The comparison charts below put the growth rates for these 167 index members in comparison with what we had seen from this same group of companies in other recent periods.

Image Source: Zacks Investment Research

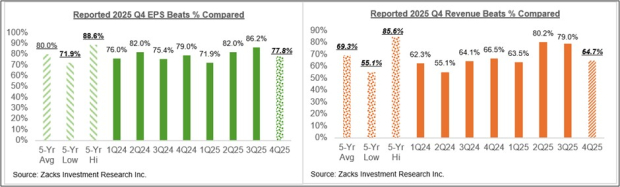

The comparison charts below show the Q4 EPS and revenue beats percentages for this group of companies relative to what we had seen from them in other recent periods.

Image Source: Zacks Investment Research

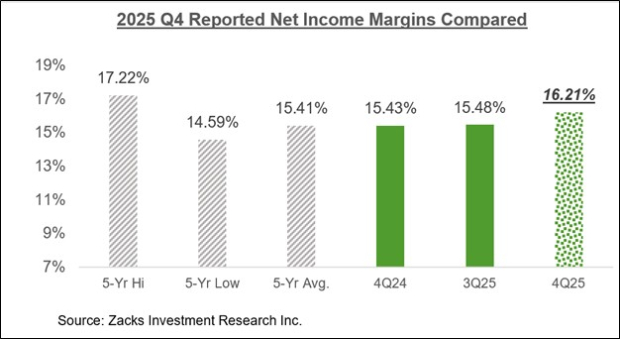

The comparison chart below puts the Q4 net margins for the 167 companies that have reported in a historical context.

Image Source: Zacks Investment Research

As you can see above, earnings and revenue growth rates remain strong and accelerating, but the EPS and revenue beats percentages are on the weak side.

The Earnings Big Picture

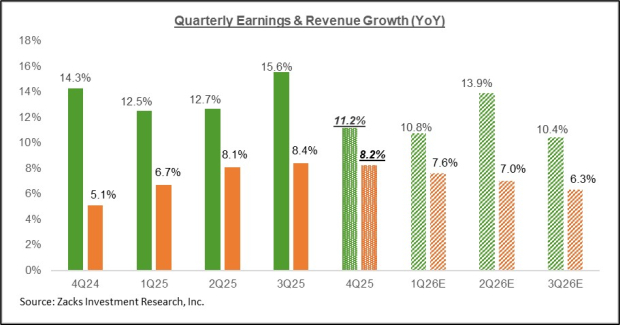

The chart below shows the Q4 earnings and revenue growth expectations in the context of where growth has been in the preceding four quarters and what is expected in the coming three quarters.

Image Source: Zacks Investment Research

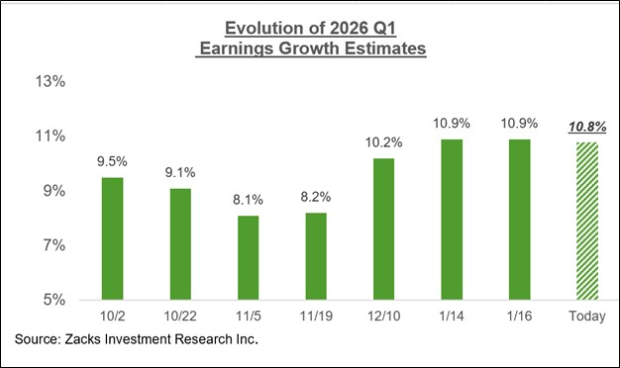

Estimates for the current period (2026 Q1) have come under some pressure in recent days, as the chart below shows.

Image Source: Zacks Investment Research

The above downtrend notwithstanding, estimates have actually modestly increased for 10 of the 16 Zacks sectors since the start of January, including Tech, Basic Materials, Autos, Industrials, Transportation, and others. On the negative side, estimates have come down for 6 of the 16 Zacks sectors, including Energy, Medical, Consumer Discretionary, and others.

The chart below shows the overall earnings picture on a calendar-year basis, with double-digit earnings growth expected in 2025 and 2026.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>>Taking Stock of the Q4 Earnings Season

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

See Our Newest 5 Stocks Set to Double Picks >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.