GM Stock Up 42% in 6 Months: Worth Holding Onto for More Gains?

U.S. legacy automaker General Motors GM is going strong, thanks to robust vehicle offerings, a growing software and services business and restructuring in China. The company has also reworked its electric vehicle (EV) strategy to align with the slower-than-expected adoption. Balance sheet strength and solid commitment to increasing shareholder value add to the optimism.

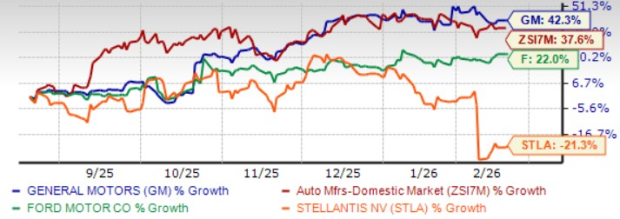

Over the past six months, shares of General Motors have gained roughly 42%, outperforming the industry as well as close peers, including Ford F and Stellantis STLA. While Ford rose 22% over the same timeframe, Stellantis declined 21%.

6-Month Price Performance Comparison

Image Source: Zacks Investment Research

Nonetheless, near-term headwinds, including tariffs and EV reset charges, are likely to dent GM’s profits. But even then, is the longer-term growth story intact? Or is it better to dump General Motors now? Let’s delve deeper.

Strong Fundamentals Back Long-Term Growth

General Motors has built strong momentum, with several factors working clearly in its favor. In 2025, the company emerged as the top-selling automaker in the United States, achieving its highest full-year market share in a decade at around 17%. Notably, 2025 marked GM’s fourth consecutive year of market share growth.

GM has also responded decisively to slower-than-expected EV demand. The company sold its stake in the Ultium Cells Lansing plant and pivoted some assembly capacity from EVs back to internal combustion engine (ICE) vehicles. While GM took $7.6 billion in charges in the second half of the year to reduce EV capacity, these actions are expected to lower fixed costs. Importantly, warranty expenses are trending in the right direction, and EV-related losses are set to decline, improving overall profitability.

GM expects its North America EBIT margins in the 8-10% range this year, up from 6.8% in 2025. This recovery is projected to be driven by lower costs, a better product mix, and the elimination of one-time headwinds that weighed on 2025 results.

Beyond vehicles, GM’s software and services business is becoming an increasingly important profit driver. Advanced offerings such as OnStar and Super Cruise delivered record subscriptions in 2025. OnStar reached 12 million subscribers, including more than 120,000 Super Cruise subscribers, representing nearly 80% year-over-year growth. Deferred revenues from software and services are expected to rise to about $7.5 billion by the end of this year, nearly 40% higher than 2025 levels. This growing recurring revenue base strengthens long-term earnings visibility.

GM is also investing heavily to support future growth. Over the past two years, it has invested more than $20 billion in capital projects. For 2026 and 2027, GM expects to spend $10-12 billion annually, including roughly $5 billion to boost U.S. manufacturing capacity for high-demand vehicles and reduce tariff exposure.

At the same time, GM continues to reward shareholders. In 2025 alone, it repurchased $6 billion worth of shares and paid over $500 million in dividends. Since late 2023, General Motors has returned $23 billion to shareholders, cutting its share count by nearly 35%. The board recently approved a new $6 billion buyback and raised the dividend by 20%, underscoring confidence in future cash flow generation.

Upbeat 2026 Outlook

For 2026, GM expects net income attributable to stockholders in the range of $10.3-$11.7 billion compared with $2.7 billion reported in 2025. It expects adjusted EBIT in the range of $13-$15 billion compared with $12.7 billion reported in 2025. Automotive operating cash flow is expected to be between $19 billion and $23 billion compared with $18.7 billion reported in 2025. Adjusted EPS is estimated in the range of $11-$13 compared with $10.60 reported in 2025.

The Zacks Consensus Estimate for GM’s 2026 EPS implies a 16% year-over-year uptick. The consensus mark for 2026 EPS has moved up by 58 cents in the past 30 days.

Valuation Check

GM stock is trading at 6.48X forward earnings, way lower than the industry. Its closest peer, Ford, has a P/E ratio of 9.06. Meanwhile, Stellantis is trading at a forward earnings multiple of 4.32, reflecting operational and financial challenges. General Motors has a Value Score of A.

GM Looks Undervalued

Image Source: Zacks Investment Research

Our Take: GM is Worth Retaining

In 2025, General Motors incurred $3.1 billion in gross tariff costs. Tariffs will remain a headwind in 2026, with GM expecting gross costs in the $3-$4 billion range. The first-quarter impact is projected at $750 million to $1 billion, and costs may remain somewhat uneven due to supply-chain timing. That said, GM continues to actively mitigate these pressures. Pricing discipline, manufacturing adjustments and efficiency initiatives should offset a meaningful portion of the tariff burden.

Importantly, tariffs do not undermine the broader investment case. GM’s improving margins, strong market share momentum, disciplined capital allocation and growing software revenue base provide solid long-term support. We believe the stock remains worth holding for investors with a long-term horizon.

The consensus price target for GM stock is $92.24, implying an upside of more than 13% from current levels.

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in the coming year. While not all picks can be winners, previous recommendations have soared +112%, +171%, +209% and +232%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Stellantis N.V. (STLA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.