February Flinch: Why the Bull Market is Due for a Breather

Even the strongest bull markets require pullbacks. While U.S. equity markets enjoyed a strong start to 2026, some short-term warning signs are building.

So Go the Leaders, So Goes the Market

Yesterday, despite beating Wall Street estimates, AI leader Microsoft (MSFT) saw its worst single session drop since March 2020 during the COVID-19 pandemic – before recovering late in the session. Investors are punishing the stock primarily due to a staggering rise in CAPEX spending. MSFT announced that it spent $37.5 billion last quarter to build AI data centers – a 66% year-over-year increase. Other concerns include a slight slowdown in MSFT’s cloud business and an overreliance on ChatGPT-parent and partner OpenAI for revenue. Markets tend to follow the leaders, which are currently AI stocks. The adverse reaction to Microsoft earnings is likely to put a damper on AI stocks, and thus the market, over the coming weeks.

Silver Blow-Off Top Spells Danger for Market

After a historical run where silver has tripled in a handful of months, silver’s bull market is coming to a close in classic form – a blow-off top. Recently, the precious metal showed several warning signs, including, record trading volume, a distance above the 200-day moving average of more than 100%, and several exhaustion gaps. For those who have studied market history, such moves have occurred in the past – most notably, when the Hunt Brothers tried to corner the market in the 1980s and when the great commodity bull of the 2000s ended in 2011. Investors need to be watching this move because previous instances have had broader implications, resulting in 10% drops in the S&P 500 over the coming weeks.

February Seasonality

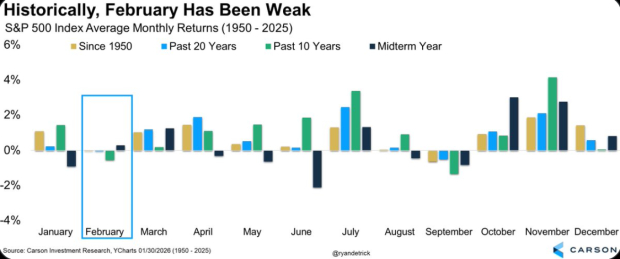

While there are several bullish tailwinds for 2026, including, record tax returns, a dovish Federal Reserve, and the massive AI buildout, corrections in the first half of a mid-term election year are common. According to Carson Research’s Ryan Detrick, “February is one of two months (September being the other) that is negative on average since 1950, the past 10 years, and the past 20 years.”

Image Source: Carson Research

Sentiment is Skewed Overwhelmingly Bullish

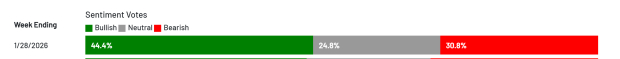

The AAII Sentiment survey offers insight into the opinions of individual investors. Currently, AAII respondents lean overwhelmingly bullish – a bearish contrarian indication.

Image Source: Zacks Investment Research

Bottom Line

While the long-term outlook for 2026 remains supported by a dovish Fed and the AI revolution, the current convergence of parabolic commodity moves and poor seasonality cannot be ignored. Markets rarely move in a straight line, and the present “exhaustion” signal suggest that a period of consolidation is possible.

Related tickers: Silver ETF (SLV), ProShares 2x Silver ETF (AGQ), Gold ETF (GLD), Direxion Gold Miners 2x Bear (DUST)

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

Microsoft Corporation (MSFT) : Free Stock Analysis Report

SPDR Gold Shares (GLD): ETF Research Reports

iShares Silver Trust (SLV): ETF Research Reports

ProShares Ultra Silver (AGQ): ETF Research Reports

Direxion Daily Gold Miners Index Bear 2X Shares (DUST): ETF Research Reports

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.