Economic Survey calls for fiscal flexibility for the Centre, cautions States against worsening finances

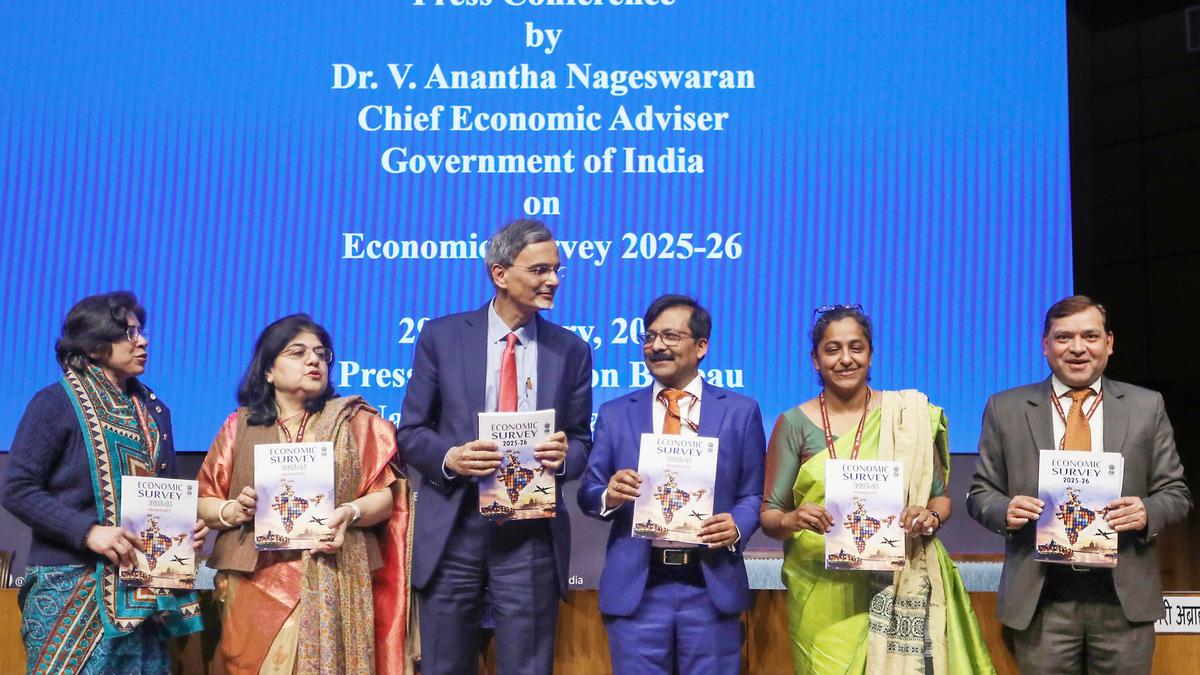

The Survey, authored by Chief Economic Advisor V. Anantha Nageswaran, tabled in Parliament by Finance Minister Nirmala Sitharaman, noted that the Centre had stuck to its commitments to reduce its fiscal deficit but also cautioned States about worsening finances brought on by lower revenues and higher expenditure, including on cash transfers.

Economic Survey 2025-26: Follow LIVE updates, highlights on January 29, 2026

Centre’s fine fiscal performance

The Survey said that, after spiking to 9.2% of GDP during the pandemic year of 2020-21, the Centre’s fiscal deficit was on target to be 4.4% at the end of the current financial year, in line with Finance Minister Nirmala Sitharaman’s commitment to halve the FY21 fiscal deficit in five years.

“It is noteworthy that the government was determined to and succeeded in bringing down the fiscal deficit ratio as promised, despite it not being a legislative target, even while improving the quality of fiscal expenditure with a concurrent emphasis on capital expenditure,” the Survey said.

Also Read | Economic Survey 2025-26 shows India in bright light in an increasingly darker world

Need for fiscal flexibility

The FRBM Act’s fiscal deficit target of 3% of GDP by March 2020 has been repeatedly deferred by the government, and the Survey acknowledged that there is a “perception” that this target and framework must be reinstated. However, it also went on to argue that this might not be the best approach.

“While it appears prima facie appropriate, in the highly uncertain current global environment, it is important to retain greater policy freedom and commit to targets that the government can deliver on,” the Survey said. “Since the FRBM Act was first enacted in 2003, the 3% target has been achieved only once.”

This, it said, eroded India’s fiscal credibility. Since then, it has taken five years of “sustained commitment to fiscal prudence” following the COVID-19 pandemic for this trust to be restored among financial markets and credit-rating agencies.

“It is important to retain that trust,” the Survey emphasised.

Also Read | Economic Survey backs scrapping MGNREGS, cites structural flaws, strong rural economy

New framework should remain for now

In her last Budget, Ms. Sitharaman had specified a new fiscal framework, under which the Centre would target bringing down its debt-to-GDP ratio to 50% with a 1% leeway above and below by March 31, 2031. This, the Survey has argued, is the appropriate strategy for now, and can be revisited after this time period is over.

“It is a concrete commitment with a specific date,” the Survey noted. “Yet it affords the government flexibility to fine-tune fiscal policy in response to emerging needs in the intervening period, in a volatile and unpredictable geopolitical and geoeconomic environment.”

It said that, once this target is met, and the fiscal deficit declines gradually, then a new FRBM target could be considered.

“A return to a rule-based regime will likely be credible and durable if ushered in after a period of lower global macro uncertainty and after debt and/or deficit ratios come meaningfully closer to 50% or 3% of GDP, respectively,” the Survey said.

Also Read | Economic Survey 2025-26: Key takeaways in charts

State finances deteriorating

While praising the Centre for its fiscal prudence, the Survey however cautioned State governments against worsening finances.

It noted that, between 2018-19 and 2024-25, 18 States saw a deterioration in their revenue balances, out of which 10 slipped into revenue deficits from revenue surplus, five saw worsening revenue deficits and three saw falling revenue surpluses.

The number of States in revenue surplus reduced from 19 in 2018-19 to 11 in 2024-25, leading to an overall increase in the collective revenue deficit of States to 0.7% from 0.1% of GDP over this time period.

It added that, between 2023-24 and 2024-25, the revenue deficit increased by 40 basis points across all States.

“A key driver of this renewed fiscal stress has been lagging revenue growth relative to nominal GDP growth, compounded by the incurring of expenditures such as discretionary unconditional cash transfers,” the Survey noted.

Published – January 29, 2026 10:39 pm IST

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.