Dara Khosrowshahi Just Delivered Incredible News for Uber Stock Investors

Key Points

- Uber operates the world’s largest ride-hailing network, with over 200 million monthly active users.

- The company is betting big on autonomous vehicles, which could reduce the enormous cost of its human drivers.

-

Uber CEO Dara Khosrowshahi thinks the transition to autonomous ride-hailing could be a multitrillion-dollar opportunity.

- 10 stocks we like better than Uber Technologies ›

Uber Technologies (NYSE: UBER) operates the world’s largest ride-hailing platform, in addition to booming food delivery and commercial freight networks. But the company relies on 9.7 million drivers to facilitate rides and deliveries for its 202 million monthly active users, and they are its largest cost by a country mile.

Uber is now actively partnering with developers of self-driving cars to automate as many trips as possible, which will dramatically improve the economics of every ride. In fact, CEO Dara Khosrowshahi says this shift presents the company with a multitrillion-dollar opportunity, and it could drive significant upside in Uber stock over the long term.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Here’s why Uber could be the ultimate investment for the looming autonomous revolution.

Image source: Getty Images.

A multitrillion-dollar opportunity

Uber reported $193.4 billion in gross bookings during 2025, representing the dollar value of every ride, food order, and commercial delivery its platform facilitated. Drivers took home $85.4 billion throughout the year, which was the single largest portion of those gross bookings.

After also deducting other costs, like the money paid to restaurants for food orders, Uber’s 2025 revenue came in at $52 billion. If we zoom in even further and account for operating expenses, the company’s adjusted non-GAAP (generally accepted accounting principles) profit was $5.2 billion for the year. As you can see, only a very small portion of Uber’s enormous gross bookings actually flow through to its top and bottom lines.

However, if the company shrinks (or eliminates) the whopping $85.4 billion cost of its human drivers, a huge chunk of that money would quickly become revenue and profit. That’s where autonomy comes in, and Uber is investing heavily to become the best platform in this emerging space.

Uber knows building a capable self-driving car is only a small part of competing in the autonomous boom. Without a network that can efficiently manage utilization, an autonomous service simply won’t succeed. For example, deploying too many cars in one city could lead to an underutilized fleet that bleeds profits, whereas not deploying enough cars will leave users waiting an unacceptable amount of time for a ride. Uber has over 15 years of experience managing these challenges.

Plus, achieving scale is an incredibly expensive endeavor. Uber already has the users and the infrastructure in place, which is why over 20 companies developing autonomous vehicles are plugging into its network. One of them is Alphabet‘s Waymo, which is now completing over 450,000 paid autonomous trips every single week across five U.S. cities, using a combination of its own and Uber’s network.

Autonomous vehicles are currently used in just 0.1% of all ride-sharing trips worldwide, so this transition won’t happen overnight. However, Uber plans to offer autonomous trips in 15 cities globally by the end of 2026, and it intends to be the largest player in this space by 2029. As mentioned, Khosrowshahi expects this to create a multitrillion-dollar opportunity for his company.

Uber stock could be a great long-term buy

Uber acknowledges that autonomous ride-sharing won’t be a winner-take-all industry, because the opportunity is simply so large. Tesla (NASDAQ: TSLA), for example, could become a serious competitor because it plans to build its own ride-hailing network to go along with its Cybercab autonomous robotaxi, and unlike most of the start-ups in this space, it has enough financial resources to pull it off.

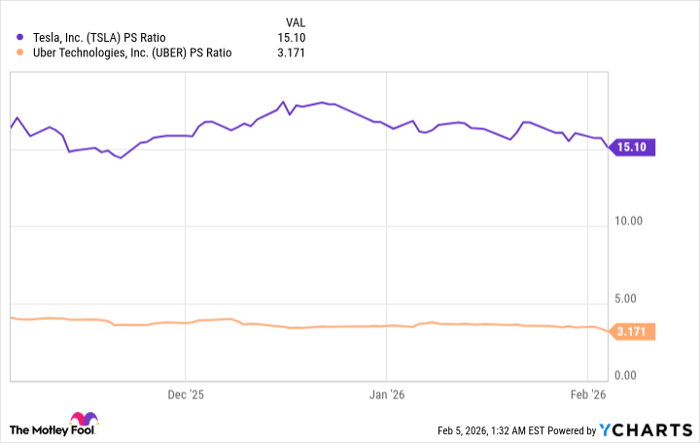

However, I think Uber might be the best investment in the entire industry, not only because of its strategy but also because of its attractive valuation. Its stock is trading at a price-to-sales (P/S) ratio of just 3.1, making it substantially cheaper than Tesla:

Data by YCharts.

Plus, based on Uber’s adjusted 2025 earnings of $2.45 per share, its stock is trading at a price-to-earnings (P/E) ratio of just 30.1, which is a discount to the 32.8 P/E ratio of the Nasdaq-100 index.

In other words, Uber might be undervalued relative to many of its peers in the tech sector. Tesla stock is trading at a sky-high P/E of 377, which almost makes it uninvestable at the current level in my opinion, even if you factor in a successful foray into the autonomous ride-hailing industry.

In summary, long-term investors who want to expose their portfolios to the autonomous driving revolution might want to consider buying Uber stock.

Should you buy stock in Uber Technologies right now?

Before you buy stock in Uber Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Uber Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Tesla, and Uber Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.