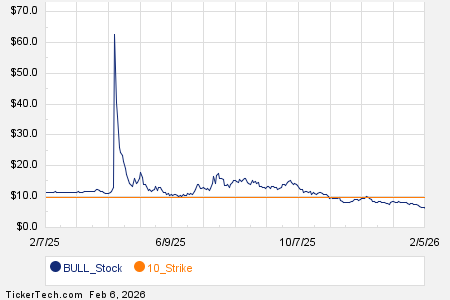

D-Wave Quantum Shares Crashed in January. Is it Time to Buy?

Key Points

- D-Wave Quantum made a defining acquisition last month.

- The company now plans to lead in quantum annealing as well as gate-model systems.

-

The valuation is high, and only risk-tolerant investors should own the stock at this stage.

- 10 stocks we like better than D-Wave Quantum ›

D-Wave Quantum (NYSE: QBTS) wants to lead the development of quantum computing with a unique, dual-platform approach. The month of January included several steps to accomplish that goal.

Yet rather than sending shares higher, D-Wave stock lost 18.9% last month, according to data provided by S&P Global Market Intelligence. That makes it a good time to take another look at the investing thesis.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

Game-changing potential

Quantum computing could be a powerful game changer in many areas. It possesses enormous, transformative potential across industries such as pharmaceuticals, materials science, finance, and cybersecurity by tackling problems that classical computers cannot solve. 2025 was a somewhat breakthrough year as quantum sensing technology advanced beyond foundational research. The emphasis has shifted to production and deployment with quantum computing processing.

Companies are taking varied approaches, leaving investors to decide which, if any, quantum computing stocks to include in their portfolios. D-Wave was primarily known for its leading quantum annealing system, which is already commercially available. It’s an energy-efficient system designed to help enterprises speed up decision-making, optimize operations, and respond to disruptions.

Last month, however, the company completed what could be a somewhat transformational acquisition. D-Wave brought Quantum Circuits Inc. (QCI) into its fold. That company creates full-stack superconducting gate-model quantum computing systems engineered for commercial scalability. The combination gives D-Wave a balance between its commercial annealing quantum systems and a path to develop gate-model quantum computers at scale for general-purpose, fault-tolerant computing.

Still, there’s no guarantee the company will achieve enough success to justify its valuation of over $7 billion, let alone grow from there. Only highly risk-tolerant investors should own the stock at this early stage. Shares are going to be volatile, as evidenced by the 19% drop in January.

It’s possible, if not likely, that investors will revalue the company if sales of D-Wave’s quantum annealing system don’t grow quickly enough, or if development of its gate-model system doesn’t advance meaningfully this year. Investors should just be aware of those possibilities if wanting to speculate in the quantum annealing space.

Should you buy stock in D-Wave Quantum right now?

Before you buy stock in D-Wave Quantum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and D-Wave Quantum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

Howard Smith has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.