Crypto Market Update: Ledger Lines Up US$4 Billion New York IPO

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrencymarket news

Bitcoin and Ether price update

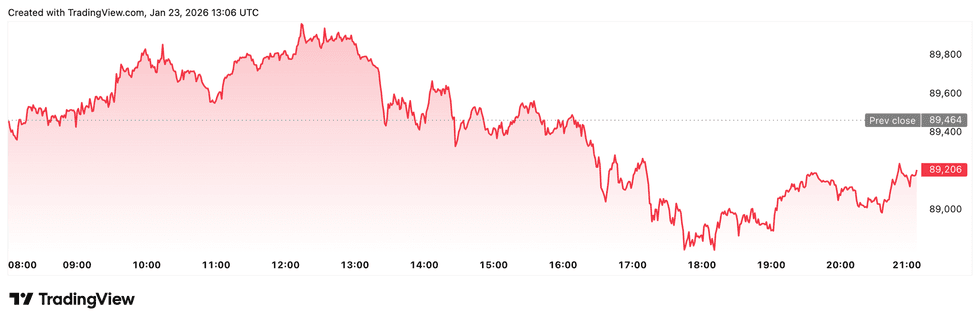

Bitcoin (BTC) was priced at US$89,128.56, down by 0.9 percent over 24 hours.

Chart via TradingView

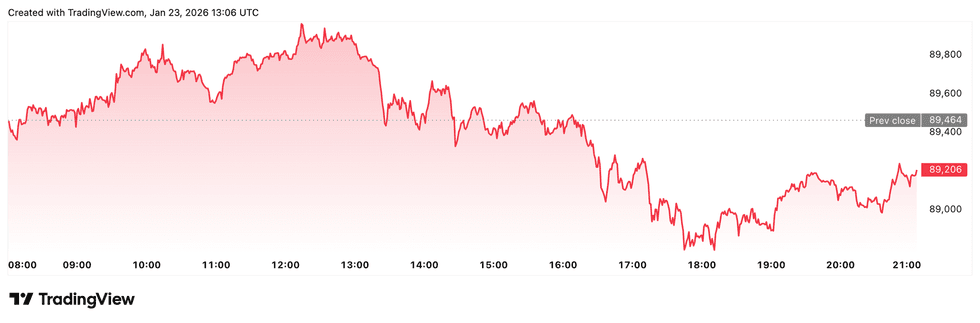

Chart via TradingView

Bitcoin price performance, January 23, 2025.

Ether (ETH) was priced at US$32,925.65, down by 1.9 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.90, down by 1.6 percent over 24 hours.

- Solana (SOL) was trading at US$127.03, down by 2.2 percent over 24 hours.

Today’s crypto news to know

Ledger lines up US$4 billion New York IPO

Ledger is preparing a New York Stock Exchange listing that could value the French hardware wallet maker at more than US$4 billion, according to a report by the Financial Times.

The company was last valued at US$1.5 billion in a 2023 funding round, underscoring how sharply sentiment has shifted toward crypto infrastructure firms.

Goldman Sachs (NYSE:GS), Jefferies Financial Group (NYSE:JEF), and Barclays (NYSE:BCS) are said to be advising on the deal, which could launch as soon as this year.

The move follows BitGo’s (NYSE:BTGO) recent NYSE debut, which helped reopen public markets for crypto-native companies. Ledger has benefited from surging demand for self-custody as high-profile crypto hacks continue to mount.

If completed, the listing would rank among the largest US IPOs by a European crypto firm.

Kansas weighs Bitcoin reserve from unclaimed digital assets

Lawmakers in Kansas are considering a bill that would create a state-run Bitcoin and digital assets reserve without buying crypto directly.

Senate Bill 352 proposes funding the reserve using unclaimed digital property already held by the state, including abandoned crypto, airdrops, staking rewards, and interest. The fund would sit within the state treasury and be administered by the Kansas treasurer.

Under the proposal, 10 percent of each deposit would flow into the general fund, while Bitcoin itself would be retained exclusively in the reserve.

UBS explores crypto trading for private banking clients

UBS Group (NYSE:UBS) is evaluating plans to offer cryptocurrency trading to select private banking clients, Bloomberg News reported, citing people familiar with the matter.

The Swiss lender is said to be choosing partners to support buying and selling of Bitcoin and Ether for clients in Switzerland. The offering could later expand to Asia-Pacific and the United States if demand holds.

While UBS has not confirmed the plans publicly, the move would align it with peers gradually opening crypto access. JPMorgan and Morgan Stanley have both signaled expanded digital asset offerings in recent months.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.