Crypto Market Update: Coinbase Announces Nationwide Expansion of its Prediction Market

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrencymarket news

Bitcoin and Ether price update

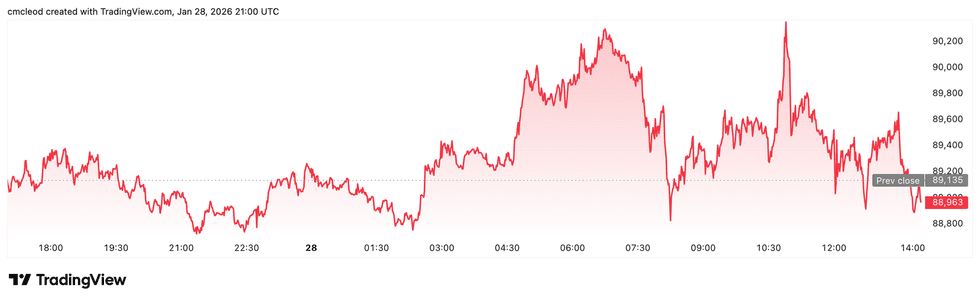

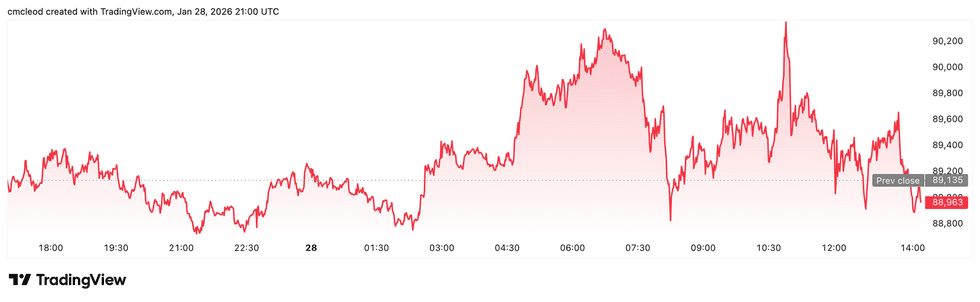

Bitcoin (BTC) was priced at US$89,089.42, down by 0.3 percent over 24 hours.

Chart via TradingView.

Chart via TradingView.

Bitcoin price performance, January 28, 2025.

In an email to the Investing News Network, MEXC Research’s Shawn Young offered commentary on the crypto bear market, forecasting a potential mild recovery for BTC and ETH in February, a historically strong month for the assets.

Despite current Fear sentiment and a possible shift in the 4-year market cycle, strong institutional investment and developer efforts to address quantum threats are long-term catalysts expected to drive future price growth.

“Once clarity emerges in this regard,” he said, “this will serve as a major catalyst boost across the board.”

Ether (ETH) was priced at US$3,011.69, down by 0.2 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.92, down by 0.1 percent over 24 hours.

- Solana (SOL) was trading at US$125.50, down by 1.2 percent over 24 hours.

Today’s crypto news to know

Fidelity to launch FIDD stablecoin in February

Fidelity Investments is planning to launch the Fidelity Digital Dollar (FIDD) stablecoin in February, making it one of the first mainstream asset managers to start its own stablecoin.

Mike O’Reilly, president at Fidelity Digital Assets, made the announcement in an interview with Bloomberg today, touting the potential of stablecoins as both foundational payment and settlement instruments due to their real-time settlement benefits and 24/7/365 availability.

Eligible customers will be able to buy or redeem FIDD for US$1 on the Fidelity Digital Assets, Fidelity Crypto and Fidelity Crypto for Wealth Managers platforms. It will also be available on major crypto exchanges.

Coinbase announces rollout of prediction market in all 50 states

Coinbase (NASDAQ:COIN) announced the nationwide rollout of its prediction markets in partnership with Kalshi today. While no official press release was issued, the news broke via a Coinbase post on X, who stated that trades are now available on “any real-world outcomes across sports, politics, culture and more.”

The expansion completes a rollout that was previously limited due to cease-and-desist orders and other legal actions in a handful of states. Various actions were taken by state gaming regulators to prevent Kalshi from operating, arguing that its offerings were a form of gambling subject to state law. The new Coinbase partnership offers a more integrated and potentially definitive solution to these legal challenges.

Tether amasses massive gold reserve in Switzerland

Tether has quietly built what its CEO describes as the world’s largest non-sovereign gold hoard, holding roughly 140 tons of bullion worth about US$23 billion in a high-security Swiss bunker.

In an interview with Bloomberg, CEO Paolo Ardoino said the company has been buying more than a ton of physical gold per week, a pace that places it among the most active buyers in the global bullion market.

Executives say the strategy is designed to harden Tether’s balance sheet and hedge against fiat currency risk, particularly for its flagship stablecoin USDT and its gold-backed token XAUT.

Bullion traders note that sustained, price-insensitive buying of this scale can tighten supply and affect liquidity, especially when central banks and ETFs are also accumulating.

Critics, however, warn that concentrating so much physical gold in a single private entity adds a new layer of systemic and transparency risk.

South Dakota revives Bitcoin push

A South Dakota lawmaker has reintroduced legislation that would allow the state to allocate up to 10 percent of certain public funds to Bitcoin, reviving a proposal that stalled last year.

Filed by Republican Representative Logan Manhart, the bill would permit exposure through direct holdings, regulated custodians, or approved exchange-traded products. It also sets out strict custody and security standards, including exclusive control of private keys, encrypted hardware storage, and regular audits.

The measure has cleared its first procedural hurdle and is now with the state’s Committee on Commerce and Energy.

Similar initiatives have gained traction elsewhere, with several US states exploring or adopting crypto reserve strategies.

Paypal survey: large enterprises lead crypto payments adoption

Crypto payments are moving closer to routine checkout, driven largely by big businesses, according to a new survey from PayPal (NASDAQ:PYPL) and the National Cryptocurrency Association.

The survey found that about 40 percent of U.S. merchants now accept cryptocurrency, rising to 50% among companies with more than US$500 million in annual revenue.

Merchants cited growing customer demand as the main driver, with most saying shoppers have asked about paying with crypto and expect to use it regularly.

Ease of use remains the key barrier: respondents said adoption would accelerate if crypto payments felt as simple as card transactions.

PayPal said this demand is shaping product design, as firms look to integrate crypto without disrupting existing checkout flows.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.