Credit card debt tops $1.28 trillion

Credit card balances hit a fresh high in the fourth quarter, rising by $44 billion to $1.28 trillion, according to a new report on household debt by the Federal Reserve Bank of New York released Tuesday. That’s a 5.5% jump from a year earlier.

The central bank’s monthly Survey of Consumer Expectations, released Monday, also found that fewer consumers expect their households’ financial situations to be better off a year from now — and a larger share expect to be worse off.

‘Evidence consistent with a K-shaped economy’

Near the end of the year, credit card debt often ticks higher as consumers increase their spending during the peak holiday shopping season. “Given what we are seeing in the labor market, spending is holding up quite well,” the New York Fed researchers said on a press call Tuesday.

Even as the job market shows signs of strain, consumer spending has largely stayed strong. However, that has been attributed to robust buying by higher-end consumers, other research shows.

“You see evidence consistent with a ‘K-shaped’ economy,” the New York Fed researchers said. “Some groups are really struggling.”

That’s not just apparent in the number of auto loan, credit card and home equity lines of credit delinquencies, the New York Fed researchers said. “You also see that in rising mortgage delinquency rates,” the researchers said, referring to the growing number of homeowners who are falling behind on their mortgage payments.

Across the board, “elevated delinquency rates are more pronounced in the lowest-income areas,” the Fed researchers also found.

Affordability puts pressure on credit card debt

Meanwhile, with an average credit card rate of around 20%, credit cards are one of the most expensive ways to borrow money. Currently, about 175 million people in the U.S. have credit cards, and while some pay their bills in full each month, roughly 60% of credit card users carry a balance from one month to the next, according to the New York Fed.

President Donald Trump’s call for a temporary 10% cap on credit cards, could mean significantly lower interest rate charges for those with revolving debt. Yet, banks and industry executives have said they would fight credit card price controls, just as they successfully fought the Consumer Financial Protection Bureau’s efforts to cap card late fees last year.

More than half, 55%, of consumers carry credit card balances to cover essential expenses, according to a separate report by debt management company Achieve released Monday.

Among those falling behind, many have had to choose between keeping up with debt payments and covering everyday necessities, the survey of 2,000 consumers found.

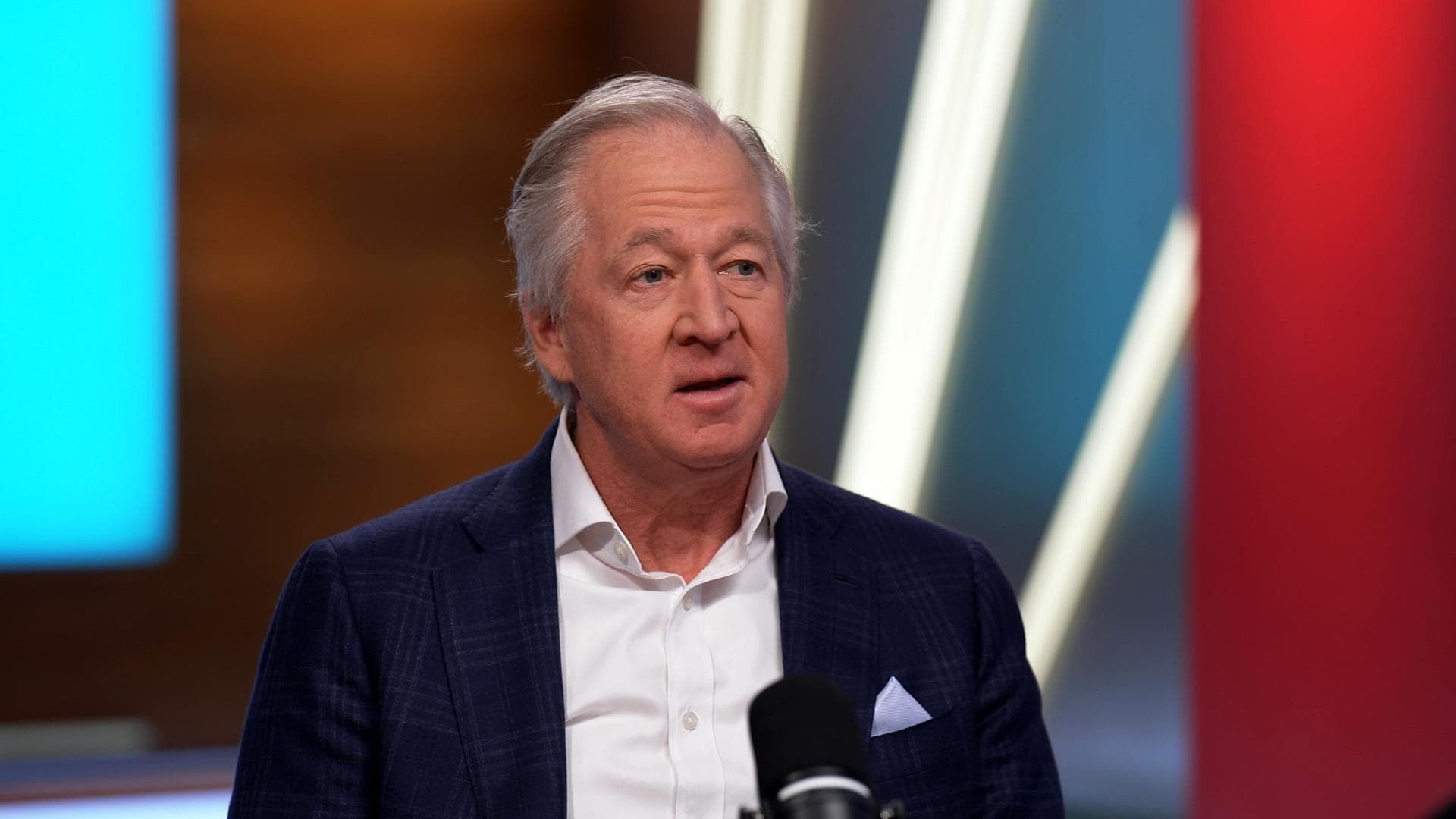

“This is what the K-shaped economy looks like in the real world. There’s an affluent half of the population whose financial lives aren’t disrupted by momentary inconveniences. But for everyone else, financial triage and tradeoffs are a way of life,” Andrew Housser, Achieve’s co-founder and co-CEO, said in a statement.

“The longer this persists, the more the gap widens,” he added.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.