Corn Slips Lower to Close Out January

Commitment of Traders data from CFTC showed managed money speculators in corn futures and options trimming 9,274 contracts from their net short in the week ending on January 27. That mainly came via new longs, as the net short was at 72,050 contracts. Commercials saw some long reduction, with the net short rising 17,381 contracts to 187,342 contracts.

Don’t Miss a Day:

From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

Export Sales data now has corn commitments at 57.694 MMT, which is 33% above the same period last year. That is also 71% of the USDA export projection, ahead of the 67% average sales pace.

The Buenos Aires Grains Exchange estimates the Argentina corn crop at 46% good/excellent, lagging the 52% from last week but still better than the 31% rating last year.

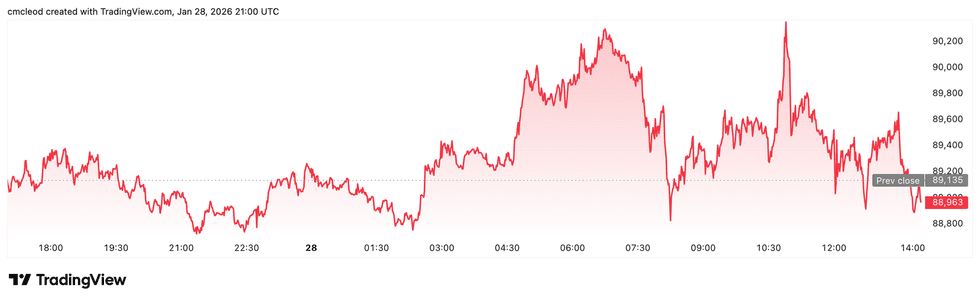

Mar 26 Corn closed at $4.28 1/4, down 2 1/2 cents,

Nearby Cash was $3.93 1/4, down 2 cents,

May 26 Corn closed at $4.35 3/4, down 3 1/4 cents,

Jul 26 Corn closed at $4.42, down 3 3/4 cents,

On the date of publication,

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

For more information please view the Barchart Disclosure Policy

here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.