After prolonged cloudy spell, sun set to shine on FMCG companies; benign inflation, lower GST rates expected to lift nos

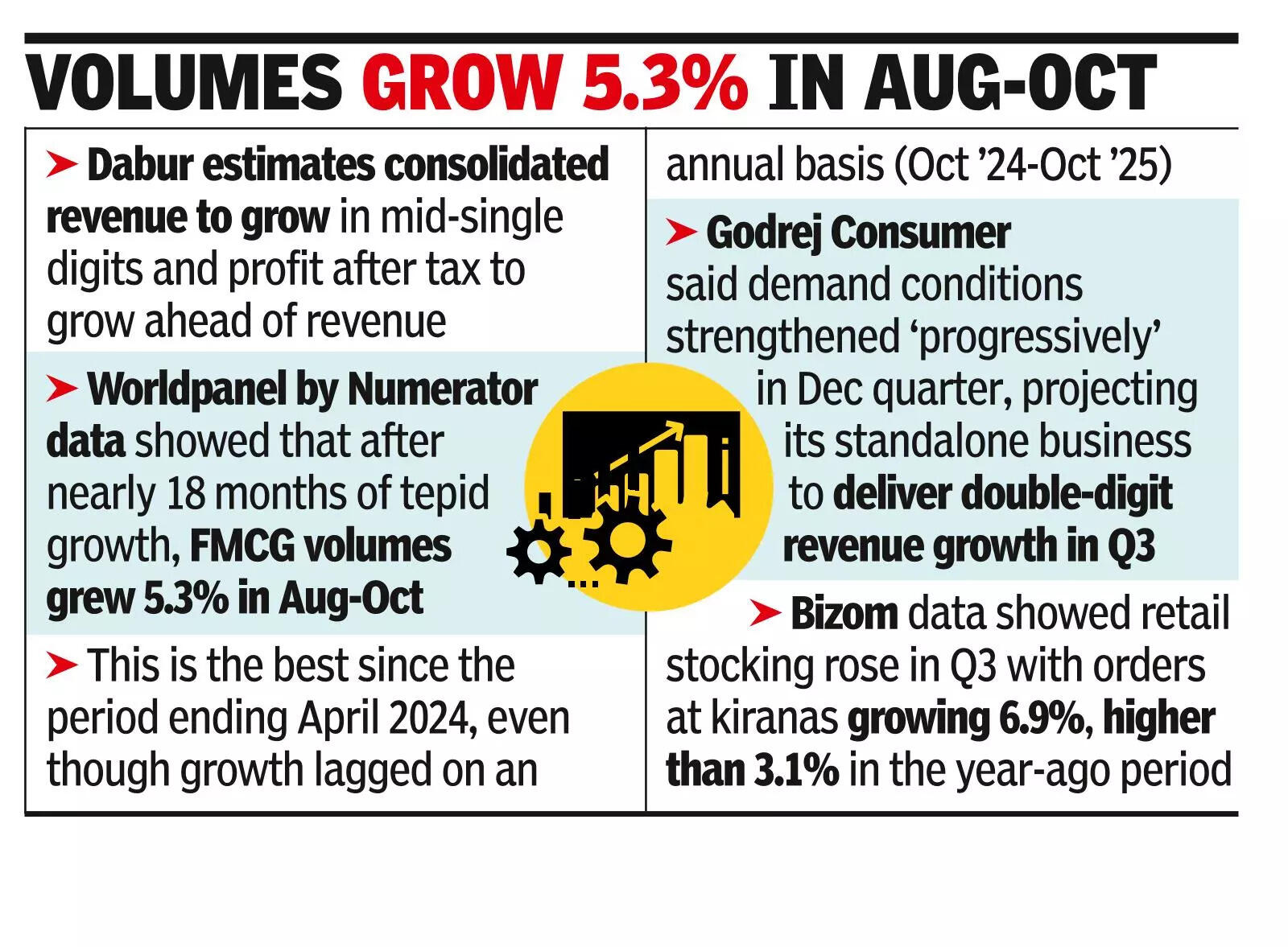

MUMBAI: After months of sluggishness, demand recovery is in sight for consumer goods companies, partly helped by GST cuts which drove down prices of a host of household essentials and left more money in the hands of shoppers. There have been some initial signs of revival on the ground already, firms said in their recent quarterly updates, betting on a mix of low inflation and GST reductions to aid consumption of soaps, shampoos and packaged food in the coming quarters.“In the month of Oct 2025, distributors and retailers focused on liquidating existing higher-priced inventory in the channel. Post trade stabilisation, consumer sentiment improved in urban and rural areas,” Dabur said in its Q3 forecast released earlier this week. The maker of Real juices and Hajmola estimates consolidated revenue to grow in mid-single digits and profit after tax to grow ahead of revenue.The new GST regime kicked in from Sept 22 last year, coinciding with the onset of the festive season during which consumer spends typically go up. Data released by Worldpanel by Numerator (formerly Kantar Worldpanel) on Tuesday showed that after nearly 18 months of tepid growth, FMCG volumes grew 5.3% in the Aug-Oct period, its best since the period ending April 2024, even though growth lagged on an annual basis (Oct 2024-Oct 2025).

Worldpanel by Numerator published the study based on the most recent data available at the time of compiling it, which in this case, was Oct. Hence, the quarters captured in the data are not in the typical FY calendar format. K Ramakrishnan, MD, South Asia at Worldpanel by Numerator said that the momentum continued well into Nov and should hold in the months ahead. While festivities and GST cuts buoyed consumer sentiment, the broader impact of the tax rejig should get reflected better from Jan onwards, said Ramakrishnan.Analysts at the firm said that a 5% volume growth is “possible” within the first few months of 2026. “With the gap between branded and unbranded reducing post GST, we should also start seeing the branded equal or beat the pace at which unbranded is growing. With macro tailwinds aligning and consumer confidence rebounding, India’s FMCG sector is not just poised for recovery-it is gearing up for a decisive leap into sustained, value-driven growth,” they said.Godrej Consumer Products said demand conditions in India strengthened ‘progressively’ in the Dec quarter, projecting its standalone business to deliver double-digit revenue growth in Q3.

Benign Inflation, Lower GST Rates Expected To Lift Nos

Benign Inflation, Lower GST Rates Expected To Lift Nos