‘Economy not heating, room for rate cut’

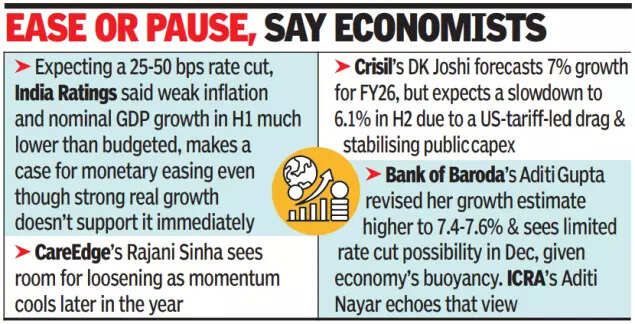

MUMBAI: The second-quarter GDP growth, at a six-quarter high of 8.2%, has shifted expectations ahead of the RBI’s Dec 5 monetary policy committee meeting. Ordinarily, such a sharp upside surprise would suggest overheating and trigger caution from the central bank. Economists say the picture is more nuanced, and rate-cut expectations remain in play.

The rise in growth doesn’t reflect a surge in the volume of goods and services, but instead the impact of lower prices, which has lifted inflation-adjusted output. This leaves space for easing even as the RBI’s task becomes more complex.Prasanna A of ICICI Securities Primary Dealership said there is “no overheating in the economy despite strong growth suggested by H1 growth numbers”. Inflation has surprised on the downside, and he pointed out that the MPC “explicitly recognised there is space for policy easing in last meeting”. He expects a 25-basis-point rate cut next week, followed by a long pause, with the RBI focusing on liquidity “after banking system liquidity conditions have tightened more than expected”. Others caution against ignoring the scale of the growth surprise. “For a forward-looking central banking… the GDP print today can’t be ignored,” said Aastha Gudwani of Barclays. She expects an unchanged policy rate for now but with a dovish tone in Dec, and flagged the possibility of open market operations (OMO) purchases. She anticipates an upward revision to the RBI’s GDP projection and a downward revision to its inflation estimate.Madhavi Arora of Emkay Global said the revision “is largely because of a statistical boost due to a soft deflator of only 0.5%”, noting nominal GDP grew just 8.7%. She has raised her FY26 real growth estimate to 7.3%, far higher than earlier projections, although she expects the pace to slow to 6.7% in H2 FY26. Very low inflation and weak nominal growth complicate fiscal and external assumptions, she said, adding that “all macro and market variables... will need to be recalibrated accordingly”. “Expectations built till a few days back of a shallow rate cut of 25 bps appear to have faded as finer readings of the strong Q2 growth print and the evolving playbook make the choice tilted in favour of pause in Dec policy. But it is important to continue with affirmative actions outside policy space and change the market perception too,” says Soumya Kanti Ghosh of SBI.DBS Bank’s Radhika Rao highlighted the policy dilemma: “The MPC faces a challenging act… with the mix of a strong growth print and record low inflation.” She expects the MPC to justify further easing through forward-looking guidance and emphasis on real rates.