Time to Buy Stock in These Top Asset Managers

Stocks of asset managers tend to be attractive because of their fee-based recurring revenue, scalable business models with high margins, strong cash flow, and shareholder-friendly returns, including generous dividends.

Keeping this in mind, several asset managers are standing out among the coveted Zacks Rank #1 (Strong Buy) list.

With now appearing to be an ideal time to buy based on what has been a pleasant trend of positive earnings estimate revisions, these highly ranked finance stocks also have enticing dividends that are above 3%.

Brookfield Asset Management – BAM

Stock Price: $50

We’ll start with Brookfield Asset Management BAM, an alternative asset manager with assets under management (AUM) across real estate, infrastructure, renewable power, private equity, and credit.

Brookfield has been delivering record fundraising and deployment, which directly boosts fee-related earnings, the lifeblood of an asset manager.

Reinforcing confidence in its cash flow durability, Brookfield has raised its quarterly dividend by 13% to $0.50 per share from $0.44. Offering a healthy 3.5% annual dividend yield, Brookfield is expected to post double-digit sales and EPS growth in FY26 and FY27.

Expanding through acquisitions and new strategies, Brookfield announced this month that it plans to acquire Peakstone Realty Trust PKST in a $1.2 billion all-cash deal.

Notably, Peakstone owns 76 industrial properties with 60 assets in industrial outdoor storage (IOS) and the rest in traditional warehouses. Analysts noted that the deal is part of a broader revival in M&A activity as interest-rate volatility eases, with Brookfield gaining exposure to a high-demand, supply-constrained segment of commercial real estate.

Janus Henderson Group – JHG

Stock Price: $50

Providing investment advisors for securities, fixed income, property, and private equity sectors, Janus Henderson Group JHG has spent the past few years appeasing investors by restructuring, cutting costs, and improving margins.

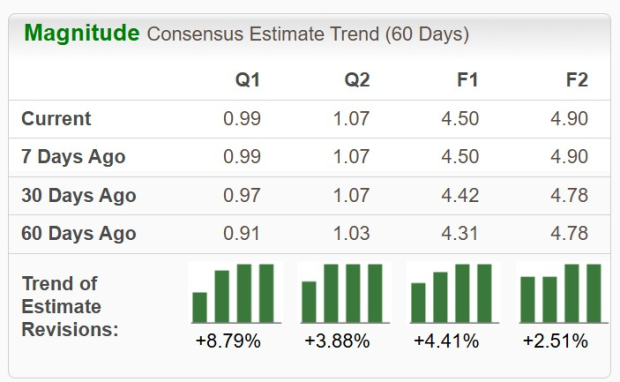

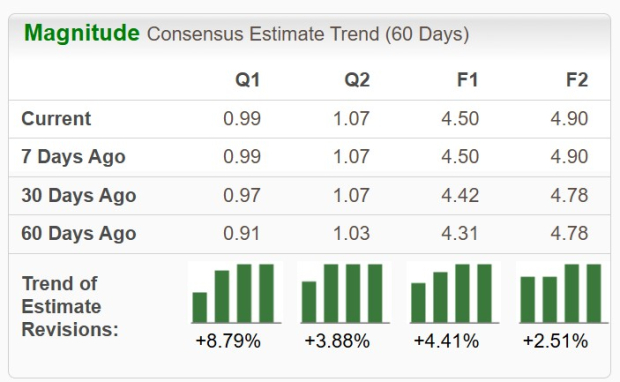

After posting record EPS in FY25, Janus Henderson’s bottom line is expected to contract 6% this year but is projected to rebound 8% in FY27 to what would be new peaks of $4.90 per share. Plus, FY26 and FY27 EPS estimates are up 4% and 2% in the last 60 days, respectively.

Image Source: Zacks Investment Research

What’s striking for income-focused investors is that even after a 70% surge over the past three years to fresh all-time highs, JHG still trades at a relatively inexpensive 10X forward earnings multiple.

Image Source: Zacks Investment Research

2 Additional Affordable Standouts

Two more affordable asset managers that are standing out among the Zacks Rank #1 (Strong Buy) list are Alerus Financial ALRS and Patria Investments Limited PAX. Making their strengthening EPS outlook and affordable stock prices more attractive is that both trade around 10X forward earnings.

Alerus stock trades at $25 a share and provides banking, mortgage, retirement, wealth management, and benefit services. Meanwhile, Patria shares trade under $15 as a provider of asset management services to investors focusing on private equity funds, infrastructure development funds, co-investment funds, constructivist equity funds, and real estate and credit funds.

Like Brookfield and Janus Henderson, they also have dividends above 3%, with Patria’s 4.29% being the highest.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market’s next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don’t build. It’s just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>

Brookfield Asset Management Ltd. (BAM) : Free Stock Analysis Report

Janus Henderson Group plc (JHG) : Free Stock Analysis Report

Alerus Financial (ALRS) : Free Stock Analysis Report

Patria Investments Limited (PAX) : Free Stock Analysis Report

Peakstone Realty Trust (PKST) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.