Walmart Vs Target: Which Retail Stock is the Best Investment as Q4 Results Approach?

Coming off a record holiday shopping season, investors are largely anticipating Q4 results from Walmart WMT and Target TGT.

Walmart will take the stage first, with its Q4 report due this week on Thursday, February 19, while Target will report at the beginning of next month on Tuesday, March 3.

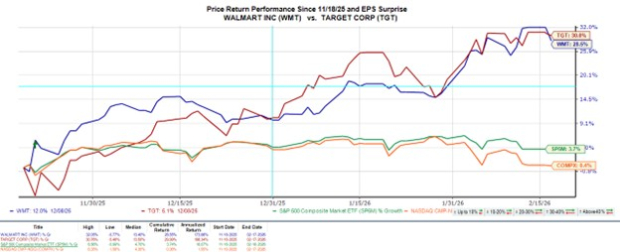

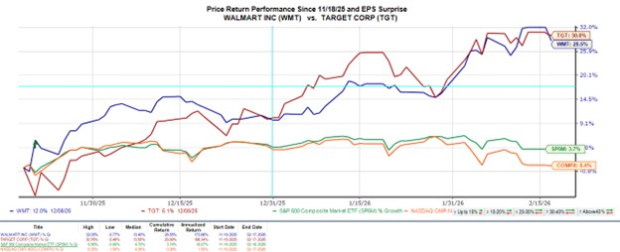

With both stocks spiking about 30% in the past three months, Walmart vs. Target has become a compelling investment debate.

Image Source: Zacks Investment Research

WMT & TGT Performance Overview

Notably, Walmart has continued to fire on all cylinders, attracting more shoppers, especially value-focused consumers, thanks to its lower sourcing costs and a massive omnichannel ecosystem with strong e-commerce growth.

That said, Target stock is starting to stage a sharp rebound after struggling with sales declines, brand challenges, and weaker customer traffic. To rectify its struggles, Target is implementing a mix of cost-cutting initiatives, store-level improvements, and large-scale reinvestment that also includes enhancing merchandise selection, and digital capabilities to better compete with Walmart and Amazon AMZN.

Trading near an all-time high of $134 a share, Walmart stock is up over 160% in the last three years to impressively outperform the broader indexes, with Target shares down more than 30% during this period and 12% from a 52-week high of $131.

Image Source: Zacks Investment Research

Walmart & Target’s Q4 Expectations

Walmart’s Q4 sales are thought to have increased 5% year over year to $189.99 billion, with quarterly earnings expected at $0.73 per share, a 10% increase from EPS of $0.66 in the comparative quarter.

Rounding out its fiscal 2026, Walmart’s annual sales are slated to increase 4% to $711.46 billion, with full-year EPS projected to be up 5% to $2.64.

Image Source: Zacks Investment Research

As for Target, Q4 sales and EPS are expected to be down 1% and 10%, respectively, at $30.54 billion and $2.17 per share.

Target’s annual sales are expected to dip 1% in its FY26 to $104.87 billion, with full-year EPS projected to drop 17% to $7.30 compared to $8.86 per share in FY25.

Image Source: Zacks Investment Research

Target Still has the Valuation Edge

Despite Walmart’s steady expansion, Target’s stock continues to make the case for being enticingly undervalued.

To that point, TGT trades at 14X forward earnings, a distinct discount to the benchmark S&P 500’s 22X and the Zacks Retail Wholesale sector’s 24X. WMT, on the other hand, trades at a noticeable forward P/E premium of 45X.

Image Source: Zacks Investment Research

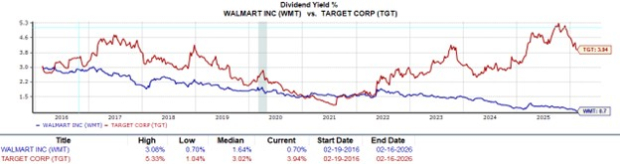

Target is the Higher-Yielding Dividend King

Making Target’s enticing P/E valuation more attractive is that it’s 3.94% annual dividend yield towers over the S&P 500’s 1.09% average and the retail wholesale sector’s 0.73%, which is roughly on par with Walmart.

Target is also the longer-standing “Dividend King”, increasing its dividend for 54 consecutive years versus Walmart’s 52 years (50+ years required).

Image Source: Zacks Investment Research

Bottom Line

Target stock currently sports a Zacks Rank #2 (Buy) as TGT appears to have more room to rally leading up to its Q4 report in early March, when considering its arguably cheap P/E valuation.

Walmart stock still offers long-term value to shareholders, but stronger-than-expected Q4 results may be needed this week to justify a somewhat lofty P/E valuation with WMT landing a Zacks Rank #3 (Hold) at the moment.

Beyond Nvidia: AI’s Second Wave Is Here

The AI revolution has already minted millionaires. But the stocks everyone knows about aren’t likely to keep delivering the biggest profits. Little-known AI firms tackling the world’s biggest problems may be more lucrative in the coming months and years.

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.