Prediction: 2 Stocks That Will Be Worth More Than Amazon 3 Years From Now

Key Points

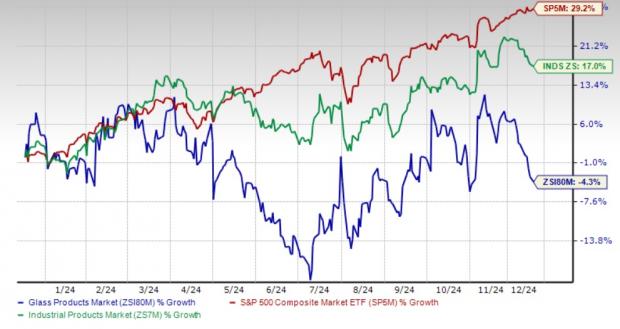

Amazon (NASDAQ: AMZN) is a well-known tech behemoth. Plenty of people use its commerce platform, and its name has become synonmous wth online shopping. Amazon is also competing in the artificial intelligence (AI) space, with its Amazon Web Services (AWS) cloud computing division. Despite operating in those lucrative areas, Amazon’s growth rate has slowed a bit, and its stock price is underperforming. This opens it up to be passed by others who are operating at a high level.

Two stocks that are crushing it now and could easily be worth more than Amazon in three years are Taiwan Semiconductor Manufacturing (NYSE: TSM) and Broadcom (NASDAQ: AVGO). Each of these companies is highly exposed to the AI build-out, which is likely to be years-long, so there is plenty of time for these two stocks to surpass Amazon in market cap.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

TSMC is close to passing Amazon now

Currently, Amazon has a $2.13 trillion market cap. TSMC and Broadcom aren’t all that far behind at $1.57 trillion and $1.54 trillion, respectively. Both TSMC and Broadcom expect huge growth over the next few years, primarily fueled by the massive AI spending going on.

Last year, Amazon delivered EPS of $7.78. This year? Analysts expect $7.74, and next year that number rises to $9.41. The slight drop over the next year is related to all the expenses associated with Amazon building out its AI-related AWS operations. Amazon expects to spend $200 billion in capital expenditures (capex) this year, which is a huge acceleration from last year. While capex doesn’t affect EPS directly, it can have other effects that appear later down the road.

Some of that spending by Amazon will be fueling the monster growth that Broadcom and TSMC are expecting over the next year as Amazon and multiple other companies purchase their AI-related products and services. This will easily allow both companies to grow past Amazon over the next few years.

This makes them no-brainer stocks to buy now. These two will continue to climb up the valuation leaderboard over the next few years and could even challenge other companies currently more valuable than Amazon.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 16, 2026.

Keithen Drury has positions in Amazon, Broadcom, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Amazon and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.