3 Cheap “Magnificent Seven” Stocks to Buy Hand Over Fist

Key Points

The “Magnificent Seven” group of stocks is a well-known cohort that makes up the world’s largest companies. It includes:

- Nvidia (NASDAQ: NVDA)

- Alphabet

- Apple

- Microsoft (NASDAQ: MSFT)

- Amazon

- Meta Platforms (NASDAQ: META)

- Tesla

These seven stocks have been great investments over the years, but rarely are they called cheap. However, I think we’re nearing that point, and some of these stocks could be scooped up at a fairly attractive valuation compared to just a few months back.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Which ones are now cheap? Let’s take a look.

Image source: Getty Images.

All trade at a premium to the market

First, we must select a validation tool. Because several of these stocks are rapidly growing, valuing them on forward earnings is the best tool, in my opinion. While trailing earnings is a more concrete way to value a company, the AI boom is causing many of these companies’ earnings to soar, so valuing them based on the past 12 months isn’t a fair representation of the current state of the business. As a result, using forward earnings gives investors the best picture of what’s going on right now with each of these stocks.

From this standpoint, all of their valuations have converged on a fairly typical range, except for Tesla. Tesla trades at nearly 200 times forward earnings, so I have excluded it from the chart.

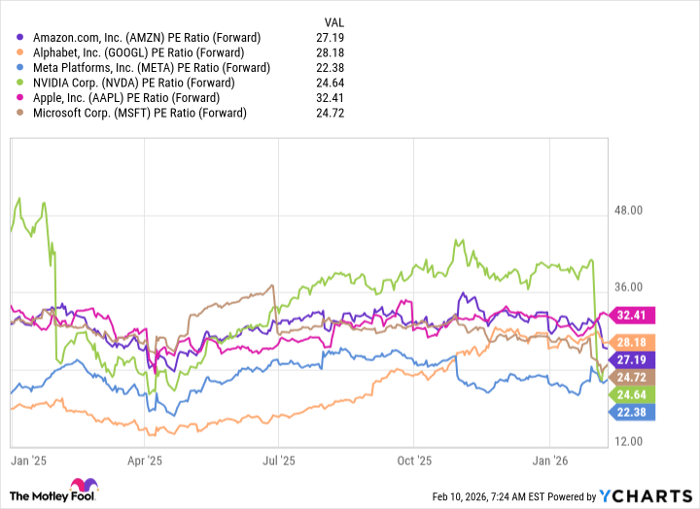

AMZN PE Ratio (Forward) data by YCharts.

All of the stocks are trading from about 30 times forward earnings all the way down to about 22. The ones in the 22 to 24 times forward earnings range are the ones that I’m focused on, with Nvidia, Microsoft, and Meta Platforms all looking like pretty good bargains.

These low prices are compounded by the fact that the S&P 500 (SNPINDEX: ^GSPC) trades for 21.8 times forward earnings. Essentially, these stocks are basically valued at the market average, but their results are far from average.

This trio doesn’t have a great reason to be valued at a discount

Starting with Nvidia, there have been a few times when you can buy the stock as cheaply as it is right now during its major run since 2023. There’s really no good reason for it to be down. While some investors may fear an artificial intelligence (AI) bubble is forming, Amazon, Alphabet, and Meta Platforms, over the past few weeks, said they plan to spend over $500 billion in capital expenditures, mostly going toward data centers, combined in 2026. That money will flow to several different areas, but Nvidia will receive a solid slice of the pie for its computing units. This will result in another massive year of growth for Nvidia. Wall Street analysts back up this sentiment and project that Nvidia’s revenue will rise 52% during the fiscal year (FY) of 2027 (ending January 2027). There isn’t a bigger no-brainer buy in the market than Nvidia, and right now is an excellent time to load up on the stock if you haven’t done so already.

Next is Microsoft. Microsoft got slammed following its second-quarter FY 2026 (ending Dec. 31) earnings announcement. There really wasn’t a lot to dislike about the quarter — management outperformed internal expectations, and Azure, Microsoft’s cloud computing platform, delivered strong 39% year-over-year growth. Microsoft is a key part of the AI investment trend, and this sale price should be taken as a gift for investors.

Last is Meta Platforms. At 22.2 times forward earnings, it’s the cheapest stock on this list and trades for the same valuation as the broader market. With only that piece of information, you’d expect Meta to maybe grow at about a 10% per-year pace, but you’d be wrong. Meta is growing far faster, with revenue rising 22% during Q4 2025. Wall Street expects it to grow at a 25% pace this year and 17% next year. Those are excellent growth figures and do not reflect a stock that should be trading at the same level as the broader market. But because it is, you can utilize this cheap price tag to scoop up shares of a company that will rise faster than the market’s usual 10% per-year growth rate.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 15, 2026.

Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.