Why Have Tech Stocks Lost Their Mojo?

The Tech sector’s 2025 Q4 earnings results have been very good. But what accounts for the group’s stock market underperformance in recent days can broadly be connected to two factors. At one level is the resumption of the market’s unease with the ever-rising capex budgets from the Mag 7 group.

This isn’t a new issue and has been with us for some time, but this reemerged as a headwind for the group after bigger-than-expected capex announcements from Amazon AMZN, Meta META, and Alphabet GOOGL on their respective Q4 earnings calls.

The other issue is tied uncertainty around the legacy software business in the coming AI world, with many investors fearing that these software operators may not be as profitable going forward as they have been in the past.

With respect to actual earnings, both results for 2025 Q4 and outlook for the current and coming quarters, the Tech sector remains well positioned. The group has been a key growth driver over the last few years and it continues to play that role in the 2025 Q4 earnings season and is expected to remain a leader in the coming periods as well.

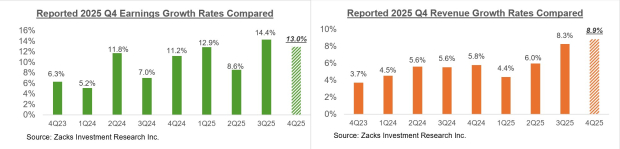

In terms of the Q4 earnings season scorecard, we now have results from 358 S&P 500 members or 71.6% of the index’s total membership. Total earnings for these companies are up +13% from the same period last year on +8.9% higher revenues, with 75.7% beating EPS estimates and 72.1% beating revenue estimates.

The comparison charts below put the Q4 earnings and revenue growth rates in a historical context

The comparison charts below put the Q4 EPS and revenue beats percentages in a historical context

To learn more about the Q4 earnings season and evolving expectations for the coming periods, please check out our weekly Earnings Trends report >>>Analyzing the Evolving Earnings Picture: What Should Investors Know?

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

See Our Newest 5 Stocks Set to Double Picks >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.