Lithia Motors Q4 Earnings Miss Expectations, Revenues Remain Flat Y/Y

Lithia Motors LAD reported fourth-quarter 2025 adjusted earnings per share of $6.74, down from the prior-year quarter’s figure of $7.79. The figure missed the Zacks Consensus Estimate of $8.09. Revenues of $9.2 billion remained flat year over year and missed the Zacks Consensus Estimate of $9.53 billion.

Segmental Performance

New vehicle revenues fell 5.7% year over year to $4.63 billion and missed our estimate of $4.71 billion due to lower-than-expected average selling price (ASP). New vehicle units sold declined 8.1% from the prior-year quarter’s level to 97,424 units but beat our estimate of 95,435 units.

The ASP of new vehicle increased to $48,239 from $47,478 in the prior-year quarter but missed our estimate of $49,401. The gross margin in this segment contracted 70 basis points (bps) to 5.9% while the cost of sales fell 5% year over year to $4.36 billion.

Used vehicle revenues rose 6.7% year over year to $3.2 billion and surpassed our estimate of $2.68 billion due to higher-than-anticipated unit sales and ASP. The used-vehicle retail units sold increased 4.8% from the year-ago quarter’s figure to 99,905 units and beat our expectation of 94,261 units. The ASP of used vehicle was $28,533, up 3.1% year over year. Our estimate was $28,413. The gross margin in the segment decreased 60 bps to 4.7%.

The company’s finance and insurance revenues rose 0.3% to $356.9 million and beat our estimate of $347 million. Revenues from aftersales totaled $1.04 billion, which rose 11.4% year over year and beat our estimate of $972.1 million. Same-store new vehicle revenues fell 6.6% year over year, while same-store used vehicle sales rose 6.1%. Same-store revenues from finance and insurance fell 0.9%, while those from the aftersales unit rose 10.9%.

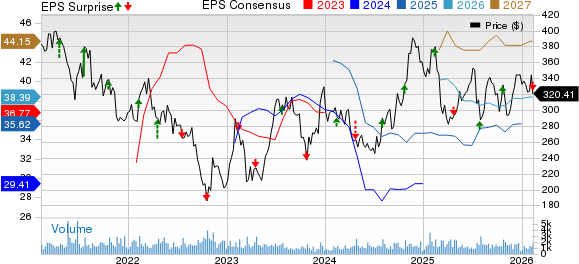

Lithia Motors, Inc. Price, Consensus and EPS Surprise

Lithia Motors, Inc. price-consensus-eps-surprise-chart | Lithia Motors, Inc. Quote

Financial Tidbits

Cost of sales was up 0.3% year over year. SG&A expenses amounted to $979.3 million, up 8.6% year over year. Adjusted SG&A, as a percentage of gross profit, was 71.4%, up from the prior-year quarter’s 66.3%. Pretax and net profit margins declined from the year-ago levels.

The company announced a dividend of 55 cents to be paid out on March 20, 2026, to its shareholders of record as of March 6, 2026. In fourth-quarter 2025, LAD repurchased nearly 917,427 shares at an average price of $314. Currently, Lithia has approximately $621.6 million shares remaining under its buyback authorization.

Lithia had cash/cash equivalents/restricted cash of $341.8 million as of Dec. 31, 2025, down from $402.2 million as of Dec. 31, 2024. Long-term debt was $7.27 billion as of Dec. 31, 2025, up from $6.12 billion as of Dec. 31, 2024.

Lithia’s Zacks Rank & Key Picks

LAD carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the auto space are Ford Motor F, Modine Manufacturing MOD and PHINIA Inc. PHIN, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for F’s 2026 earnings implies year-over-year growth of 40.4%. EPS estimate for 2026 and 2027 has improved 10 cents and 15 cents, respectively, in the past 30 days.

The Zacks Consensus Estimate for MOD’s fiscal 2026 sales and earnings implies year-over-year growth of 21.2% and 18.8%, respectively. The EPS estimate for fiscal 2026 and 2027 has improved 18 cents and 72 cents, respectively, in the past seven days.

The Zacks Consensus Estimate for PHIN’s 2025 sales and earnings implies year-over-year growth of 1.1% and 33.4%, respectively. The EPS estimate for 2025 and 2026 has improved 45 cents and 81 cents, respectively, in the past 60 days.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

See Our Newest 5 Stocks Set to Double Picks >>

Ford Motor Company (F) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

PHINIA Inc. (PHIN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.