Netflix Has Released 28 Seasons of Its Sales Growth Series. What Will Season 29 Look Like?

Key Points

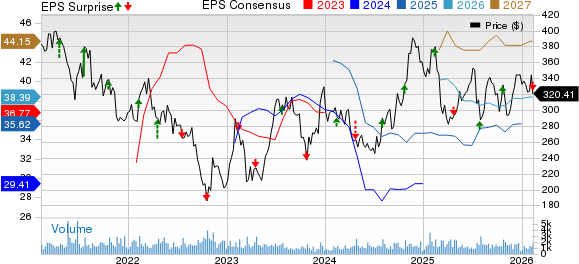

- Netflix stock has been on the downswing in recent months.

- Netflix’s key metrics, however, remain attractive.

-

Sometimes, share-price pullbacks that don’t make sense from a fundamental business perspective create smart investment opportunities.

- 10 stocks we like better than Netflix ›

Few stocks have seen the long-term growth that streaming video pioneer Netflix (NASDAQ: NFLX) has enjoyed throughout its history. For more than a quarter-century, Netflix has produced consistent annual revenue growth, and the company has become immensely profitable even as it has continued to innovate in many ways. Yet recently, Netflix stock has hit the skids as some investors fear that just as with all of its popular content, the streaming giant’s growth story is eventually not going to get renewed for another season.

In this second article in this series for the Voyager Portfolio on Netflix, you’ll have the chance to put the information you learned from yesterday’s article on Netflix’s origin story within the context of financial performance. As you’ll see, it didn’t take long for Netflix to figure out how to make its business profitable, but the company’s most impressive growth has come in recent years as its expansion initiatives have really started to pick in.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

How Netflix set the stage for video streaming

Netflix spent its first 10 years executing its DVD-by-mail business model. The company did an exemplary job of ramping up the scale of that business, going from $1.3 million in sales in 1998 to over $1.2 billion by 2007.

Perhaps more impressive, though, was the fact that Netflix became profitable as quickly as it did. Many subscription-based companies choose to concentrate solely on building an audience, paying less attention to customer acquisition costs and instead focusing on market share. Netflix, on the other hand, imposed cost discipline earlier on. After topping out with losses of $57 million in 2000, Netflix’s bottom line starting moving in the other direction, and by 2007, the company enjoyed a profit of nearly $67 million.

Another decade of building

When video streaming came, it changed the dynamics of the industry. It also changed the financial model that Netflix followed, requiring considerable investment in infrastructure necessary to get content out to viewers via the internet rather than through physical media.

It’s therefore not all that surprising to see the disparity in how revenue and profits performed during the first decade of the streaming era. Netflix saw its revenue jump seven times between 2007 and 2016, rising to $8.83 billion. However, growth in net income was relatively muted. Earnings of $187 million in 2016 came in not quite three times higher than they’d been nine years earlier. That was in large part due to a more than tenfold rise in research and development spending, along with considerable increases in marketing expenses and general overhead.

The big bottom-line boom

The past decade has been the most important for Netflix from a financial perspective. Sales have roughly quintupled between 2016 and 2025. But net income is about 60 times higher, as an increased emphasis on maintaining higher profit margins has largely borne fruit.

Indeed, much of those gains have come in just the past two years. Profits have doubled to nearly $11 billion as Netflix has made moves to tighten up multi-user policies in ways that have brought in more high-margin revenue. The company has continued to spend on R&D efforts, but not in such a profligate way that it has counteracted margin expansion efforts.

What will the next episode bring?

When share prices drop, it signals concerns among investors about whether a company can continue to achieve the results it has in the past. For Netflix, the bar is especially high, and so the recent unease among shareholders suggests that the streaming video specialist’s strategy for future growth is raising some red flags. In the third and final article of this series for the Voyager Portfolio, you’ll get a better sense of exactly what that growth plan looks like and whether there’s reason to think that Netflix won’t keep its financials on the upward track they’ve been on for decades now.

Should you buy stock in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $429,385!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,165,045!*

Now, it’s worth noting Stock Advisor’s total average return is 913% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 12, 2026.

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.