A Once-in-a-Decade Investment Opportunity: The Best Artificial Intelligence (AI) Stock to Buy in February 2026

Key Points

Spending on artificial intelligence (AI) infrastructure is poised to remain robust in the coming years, with McKinsey estimating a whopping $7 trillion will be spent on data centers by 2030 to build enough computing power to support workloads in the cloud.

There are several ways you can take advantage of the massive AI infrastructure opportunity during this decade. From Nvidia to Broadcom to Micron Technology, investors are spoilt for choice to capitalize on booming AI spending on data centers. However, now is a good time to take a closer look at Advanced Micro Devices (NASDAQ: AMD), an emerging force in the AI chip market that seems like a terrific buy this month.

Will AI create the world’s first trillionaire? Our team just released a report on the one little-known company, called an “Indispensable Monopoly” providing the critical technology Nvidia and Intel both need. Continue »

Image source: AMD

AMD’s latest pullback is a buying opportunity

AMD released its fourth-quarter 2025 results on Feb. 3. Surprisingly, AMD stock fell a whopping 17% the following day despite the company’s better-than-expected results and guidance.

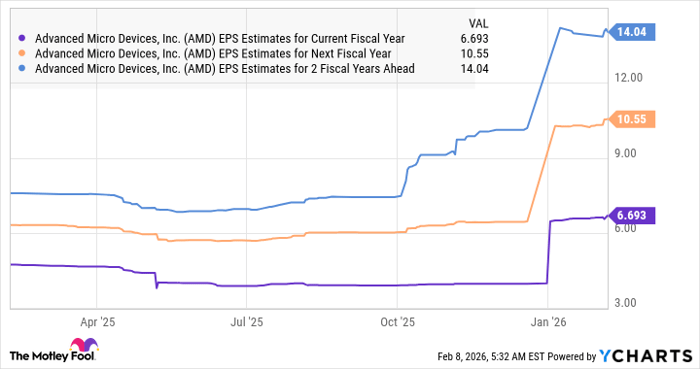

The chip designer’s adjusted earnings increased by 26% in 2025 to $4.17 per share. So, the Q1 guidance indicates that it is on track to clock a bigger earnings jump in 2026, driven by healthy growth in revenue and an uptick in the margin. Not surprisingly, analysts are bullish regarding AMD’s earnings growth for the next three years.

AMD EPS Estimates for Current Fiscal Year data by YCharts

Importantly, the company can sustain this terrific momentum beyond 2028. That’s because it stands to gain from AI adoption on multiple fronts — data centers, personal computers (PCs), and embedded processors deployed in networking, storage, industrial, automotive, and other applications. What’s more, AMD designs not just graphics cards but also central processing units (CPUs) that go into these applications.

AMD sees its data center addressable opportunity growing from $200 billion last year to a whopping $1 trillion in 2030. As a result, the company anticipates its revenue to grow at an annual rate of more than 35% through 2030, while earnings per share could jump to more than $20 during this time frame.

The stock could be a multibagger by the end of the decade

AMD is trading at just over $200 per share following its latest slide. It trades at a price/earnings-to-growth ratio (PEG ratio) of 0.65, according to Yahoo! Finance, which means it’s undervalued with respect to the annual earnings growth it can deliver over the next five years.

We have already seen that analysts are expecting impressive growth in AMD’s bottom line through 2028. Even if it clocks a slower earnings growth rate of 20% in 2029 and 2030, its bottom line could indeed hit $20 per share by the end of the decade (in line with the company’s expectations).

Multiplying the projected earnings in 2030 by the tech-laden Nasdaq-100 index’s forward earnings multiple of 26 suggests this semiconductor stock could jump past $500. So, AMD stock can become a multibagger, which is why investors should consider buying it following its steep decline.

Should you buy stock in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $429,385!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,165,045!*

Now, it’s worth noting Stock Advisor’s total average return is 913% — a market-crushing outperformance compared to 196% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 12, 2026.

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Micron Technology, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.