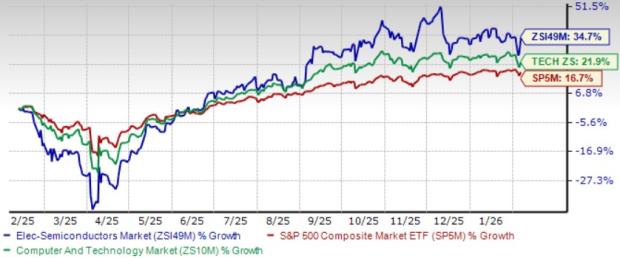

Crypto Market Update: Tether Doubles Down With US$150 Million Gold.com Stake

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrencymarket news

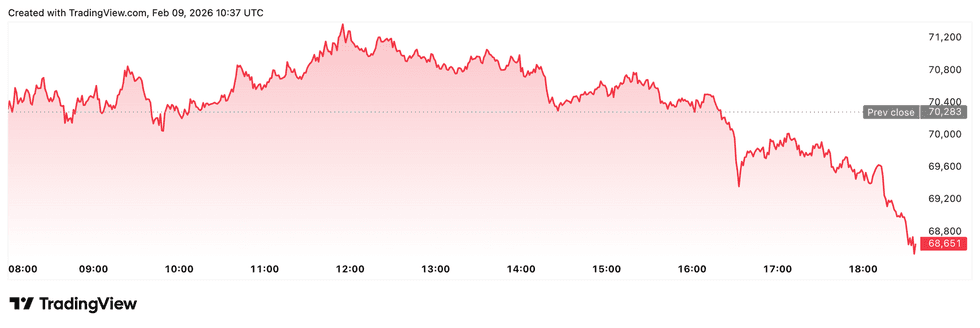

Bitcoin (BTC) was priced at US$69,837.08, down by 1.1 percent over 24 hours.

Chart via TradingView

Chart via TradingView

Bitcoin price performance, February 9, 2026.

Ether (ETH) was priced at US$2,049.31, down by 3.5 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.41, down by 3.5 over 24 hours.

- Solana (SOL) was trading at US$84.50, down by 3.9 percent over 24 hours.

Today’s crypto news to know

Tether deepens gold push with US$150 million stake in Gold.com

Tether has made a US$150 million investment in Gold.com, acquiring roughly a 12 pecent minority stake as it moves to broaden access to both tokenized and physical gold.

The deal sets up a long-term partnership that will integrate Tether’s gold-backed token, XAU₮, into Gold.com’s platform and explore ways for customers to buy physical gold using digital currencies such as USDT and the newly launched, federally regulated USA₮.

The move comes as gold prices push above US$5,000 an ounce, reinforcing demand for hard-asset exposure amid geopolitical and macroeconomic uncertainty. Tether said the gold-backed stablecoin market has nearly tripled over the past year to more than US$5.5 billion, with XAU₮ accounting for over 60 percent of total market value.

The company says XAU₮ is backed 1:1 by allocated physical gold, with about 140 tons in total held in secure vaults and each token linked to a specific London Good Delivery bar.

Bitcoin breaks below US$70,000 as liquidations accelerate

Bitcoin fell sharply this week, breaking below the closely watched US$70,000 level and trading as low as roughly US$60,300 before stabilizing near US$65,000

The US$70,000 mark had become a crowded positioning zone, and once it failed, mechanically driven selling took over.

In addition, the Crypto Fear & Greed Index dropped to 9, its lowest reading in nearly four years, while futures open interest slid toward multi-month lows, signaling defensive positioning rather than dip-buying. “

South Korea tightens scrutiny after Bithumb’s distribution error

South Korea’s Financial Supervisory Service has moved to strengthen oversight of crypto exchanges following a major error at Bithumb that briefly flooded user accounts with billions of dollars’ worth of bitcoin.

The incident occurred when customers were mistakenly credited with roughly 2,000 BTC each instead of small promotional rewards, triggering panic selling and a sharp price dislocation on the exchange.

Bitcoin prices on Bithumb fell as much as 30 percent below global levels before trading and withdrawals were halted.

Authorities said the episode exposed “vulnerabilities and risks” in virtual asset systems and raised concerns about internal controls and reserve backing. “It is a case that shows the structural problems of electronic systems for virtual assets,” said Lee Chan-jin, governor of South Korea’s Financial Supervisory Service.

Regulators plan to introduce tougher penalties for IT failures and expand monitoring tools that flag suspicious trading patterns in real time.

Of the more than 620,000 bitcoins mistakenly distributed, authorities said nearly all have since been recovered.

FDIC settles FOIA fight over crypto “pause letters”

The Federal Deposit Insurance Corporation (FDIC) has agreed to pay US$188,440 in legal fees and drop its effort to withhold crypto-related “pause letters,” settling a Freedom of Information Act lawsuit tied to alleged debanking practices.

The case stemmed from a records request filed by History Associates on behalf of Coinbase, seeking documents that showed how banks were allegedly pressured to halt or limit crypto activities.

A federal court ruled last year that the FDIC violated FOIA by categorically withholding the letters rather than reviewing them individually.

“We successfully uncovered dozens of crypto ‘pause letters’—indisputable proof of OCP2.0,” Coinbase chief legal officer Paul Grewal wrote on X after the settlement.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.