NVIDIA vs. Palantir: One AI Stock is a Clear Buy Right Now

The rise of artificial intelligence (AI) has fueled explosive gains for both NVIDIA Corporation NVDA and Palantir Technologies Inc. PLTR, making them some of the most sought-after stocks on Wall Street.

Over the past year, Palantir’s shares have even outperformed NVIDIA’s (+54.6% vs +44%). But does this make Palantir the better investment now, or is there more beneath the surface? Let’s take a closer look.

The Bullish Case for NVDA Stock

U.S.-China trade tensions appear to have eased somewhat. China has allowed leading tech companies, including Alibaba Group Holding Limited BABA and ByteDance, to purchase NVIDIA’s H200 AI chips. The U.S. government has cleared the shipment of these chips to China, which could bolster NVIDIA’s sales.

Soaring data center spending, projected by NVIDIA to reach between $3 trillion and $4 trillion annually by 2030, provides the Jensen Huang-led company with ample opportunities to sell its computing hardware and drive revenue growth. Additionally, strong demand for its cloud graphics processing units (GPUs) and cutting-edge Blackwell chips is likely to boost sales.

NVIDIA now expects fiscal fourth-quarter 2026 revenues to hit almost $65 billion, with a plus or minus 2%, according to investor.nvidia.com. The company’s third-quarter fiscal 2026 revenues jumped 62% year over year and 22% sequentially to $57 billion.

The Bullish Case for PLTR Stock

Palantir delivered strong quarterly results, largely fueled by rising demand for its Artificial Intelligence Platform (AIP), which has seen growing adoption among both U.S. commercial clients and government, as it helps customers effortlessly deploy AI and large language models across highly complex data systems.

For the fourth quarter of 2025, Palantir’s revenues from the U.S. commercial client segment soared 137% year over year and 28% sequentially to $507 million, according to investors.palantir.com. The government revenues of $570 million were up 66% year over year and 17% quarter over quarter.

Palantir’s future looks particularly bright, backed by a scalable business model, as reflected in its Rule of 40 score of 127%, well above the 40% threshold. The company now forecasts total full-year 2026 revenues of $7.182-$7.198 billion, more than double its 2025 revenue of $3.320 billion.

At the heart of such optimism is Palantir’s strong competitive advantage. Neither of its premiere platforms, Gotham or Foundry, faces significant competition, supporting predictable operating cash flows over the long term.

NVDA Has the Edge: Why It’s a Better AI Buy Than PLTR Now

No doubt, both NVIDIA and Palantir are well-positioned for strong growth, fueled by rising AI demand, robust product adoption, scalable business models and their competitive advantages in the market. However, NVIDIA is still a better stock, hands down, than Palantir.

This is because if companies cut back on AI investments due to unprofitable projects, Palantir may face headwinds. Its heavy reliance on government contracts also exposes it to potential risks from defense budget cuts. On the other hand, NVIDIA’s leading position in the AI market provides stronger pricing power and greater revenue generation opportunities.

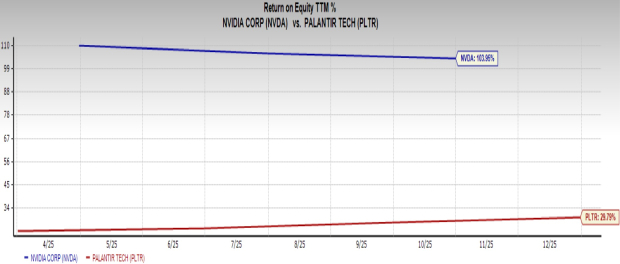

NVIDIA, anyhow, consistently delivered stronger profits than Palantir, reflected in its return on equity (ROE) of 103.9% compared with Palantir’s 29.8%.

Image Source: Zacks Investment Research

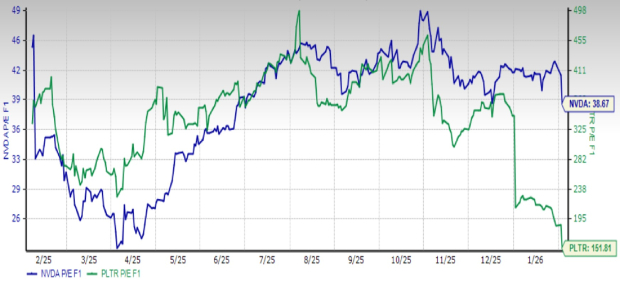

At the same time, buying NVIDIA’s shares is relatively more affordable than Palantir’s, giving investors a potential advantage. Per the price/earnings ratio, NVDA trades at 38.67 forward earnings. In comparison, the PLTR’s forward earnings multiple is 151.81.

Image Source: Zacks Investment Research

NVIDIA, currently, has a Zacks Rank #2 (Buy), while Palantir has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the “first wave” of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks’ AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.