Can Strong Search and Cloud Growth Aid Alphabet’s Q4 Earnings?

Alphabet’s GOOGL fourth-quarter 2025 results, scheduled to be released on Feb. 4, are expected to have benefited from solid momentum in Search and Cloud businesses. The momentum in Search is expected to have been driven by AI-enhanced experiences and expanding commercial query growth in the to-be-reported quarter. The Cloud business is riding on accelerating demand for AI infrastructure and an expanding enterprise customer base.

The Zacks Consensus Estimate for Google Search revenues is currently pegged at $61.27 billion, suggesting 15.2% growth from the figure reported in the year-ago quarter. The consensus mark for Google Cloud revenues is currently pegged at $16.25 billion, indicating 33.9% growth from the figure reported in the year-ago quarter. Both these segments are expected to have driven top-line expansion. The Zacks Consensus Estimate for total revenues is currently pegged at $94.7 billion, indicating 16.02% growth from the figure reported in the year-ago quarter.

Alphabet has an impressive earnings surprise history. GOOGL’s earnings outpaced the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 18.74%.

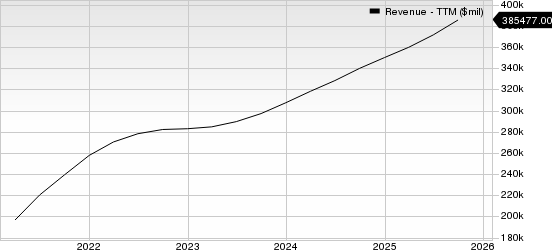

Alphabet Inc. Revenue (TTM)

Alphabet Inc. revenue-ttm | Alphabet Inc. Quote

Alphabet Inc. revenue-ttm | Alphabet Inc. Quote

Click here to know how Alphabet’s overall fourth-quarter 2025 results are likely to be.

GOOGL’s AI-Powered Innovations Drive Search & Cloud Momentum

GOOGL’s Search business benefits from accelerating generative AI adoption. AI Mode demonstrates strong traction with query volumes doubling sequentially in the previously reported quarter while attracting over 75 million daily active users across 40 languages. This rapid adoption is contributing incremental query growth, with commercial query expansion creating additional advertising inventory and monetization opportunities. The Zacks Consensus Estimate for Google’s advertising revenues is currently pegged at $80.97 billion, indicating 13% growth year over year.

Alphabet has been capitalizing on advanced Gen AI integrations across Search. Innovations like Nano Banana image generation in AI Mode and Gemini models processing 7 billion tokens per minute are enhancing user experiences. The ongoing expansion of AI Overviews and Chrome’s AI-powered transformation through Gemini integrations is anticipated to capture additional search queries and advertising revenues as agentic capabilities continue scaling. The Zacks Consensus Estimate for Search and other revenues is currently pegged at $61.27 billion, suggesting 15.2% year-over-year growth.

Meanwhile, Alphabet has been gaining traction through the expanding cloud infrastructure market. Google Cloud holds the third position, competing with Amazon‘s AMZN Amazon Web Services and Microsoft‘s MSFT Azure. Per Synergy Research Group, enterprise spending on cloud infrastructure services grew 28% year-over-year in the third quarter of 2025, reaching $106.9 billion, benefiting Amazon, Microsoft and Google Cloud.

In the Cloud segment, Alphabet has been leveraging its partnerships to accelerate growth. The company’s ongoing collaboration with NVIDIA NVDA includes deploying advanced GPU infrastructure alongside proprietary Tensor Processing Units. Google Cloud’s early access to NVIDIA’s latest generation chips is expected to have attracted AI-focused enterprise customers. The segment crossed 2 million Gemini Enterprise subscribers across 700 companies in the third quarter, with enterprise AI solutions likely to have contributed substantially in the fourth quarter. The segment is expected to be maintaining improving profitability as it competes with Amazon Web Services, Microsoft Azure and leverages NVIDIA infrastructure.

The Zacks Consensus Estimate for Cloud revenues is currently pegged at $16.25 billion, suggesting 33.9% growth over the figure reported in the year-ago quarter.

Alphabet currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA’s enormous potential back in 2016. Now, he has keyed in on what could be “the next big thing” in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.