3 Oil Pipeline MLP Stocks Shining Despite Industry Headwinds

The midstream energy space is generally less vulnerable to fluctuations in oil and natural gas prices. Despite this, the outlook for the Zacks Oil and Gas – Pipeline MLP industry is gloomy. With the conservative spending of exploration and production companies, demand for transportation and storage assets is not going to be lucrative.Despite these developments, players like Enterprise Products Partners LP EPD, Energy Transfer LP ET and Plains All American Pipeline LP PAA are well-positioned to sail through the prevailing uncertainties.

About the Industry

The Zacks Oil and Gas – Pipeline MLP industry comprises master limited partnerships (or MLPs) that primarily transport oil, natural gas, refined petroleum products and natural gas liquids (NGL) to consumers in North America. Apart from transporting the commodities, the partnerships have huge capacities to store oil, natural gas and petrochemical products. The partnerships thus provide midstream services to producers and consumers of the commodities. The firms generate stable fee-based revenues from all these transportation and storage assets. The services provided by the MLPs entail the gathering and processing of commodities. The integrated midstream energy players also generate cashflows from ownership interests in fractionators and condensate distillation facilities.

What’s Shaping the Future of Oil & Gas – Production & Pipelines Industry?

High Debt Load: The industry is inherently capital-intensive, as evident in the debt-to-capitalization ratio of 56.6%, where borrowing is a common practice to finance large infrastructure projects. However, elevated leverage can constrain financial flexibility, hindering midstream energy companies’ capacity to invest in new developments, navigate economic downturns, or address unforeseen costs.

Shift to Renewables: Energy majors will increasingly face challenges in providing sustainable energy to the world while reducing greenhouse gas emissions. Thus, to address the issues of climate change, there will be a gradual shift from fossil fuels to renewable energy. This will lower the demand for the partnerships’ pipeline and storage networks for oil and natural gas.

Explorers’ Conservative Capital Spending: Oil and gas exploration and production companies are facing heightened pressure from investors to focus on stockholders’ returns rather than production. This is hindering the production growth of commodities, thereby denting the demand for pipeline and storage assets.

Zacks Industry Rank Indicates Weak Prospects

The Zacks Oil and Gas – Pipeline MLP industry is a six-stock group within the broader Zacks Oil – Energy sector. The industry currently carries a Zacks Industry Rank #214, which places it in the bottom 12% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates dull near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries forms an unfavorable earnings outlook for the constituent stocks in aggregate. Before we present a few stocks that you may want to consider, let’s look at the industry’s recent stock market performance and its valuation picture.

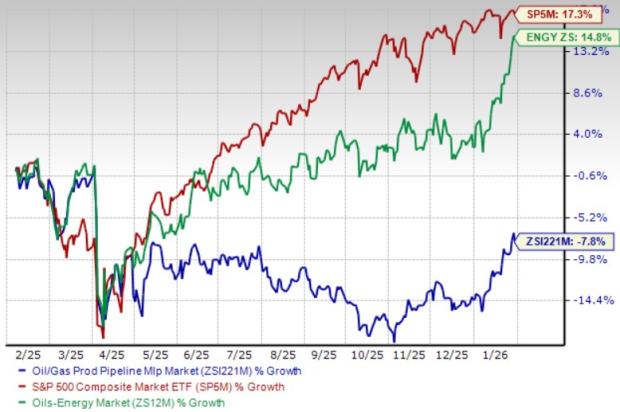

Industry Underperforms Sector, S&P 500

The Zacks Oil and Gas – Pipeline MLP industry has underperformed the broader Zacks Oil – Energy sector and the Zacks S&P 500 Composite over the past year. The industry has declined 7.8% in the past year against the broader sector’s 14.8% gain and the S&P 500’s 17.3% rise.

One-Year Price Performance

Industry’s Current Valuation

Since midstream-focused oil and gas partnerships use fixed-rate debt for the majority of their borrowings, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest, Tax, Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt.

On the basis of the trailing 12-month enterprise value-to-EBITDA (EV/EBITDA), the industry is currently trading at 11.01X, lower than the S&P 500’s 19.05X. It is, however, significantly above the sector’s trailing 12-month EV/EBITDA of 5.95X.

Over the past five years, the industry has traded as high as 12.58X and as low as 8.23X, with a median of 10.51X.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio

3 Oil & Gas Pipeline MLPs to Gain

Enterprise Products Partners is a leading midstream player and therefore has a resilient business model. EPD has a pipeline network that spans more than 50,000 miles, transporting oil, natural gas, refined products and other commodities. Thus, the partnership generates stable fee-based revenues from the midstream assets as the assets are booked by shippers for a long term.

Due to the resilience of its business model, the partnership, currently carrying a Zacks Rank #3 (Hold), has been able to return capital to unitholders on an ongoing basis. Since its IPO, Enterprise Products has returned billions of dollars to unitholders through both repurchases and distributions. EPD has increased distributions for 27 consecutive years. Thus, the partnership has successfully kept cash flow steady at all business cycles.

Price and Consensus: EPD

Energy Transfer has a stable business model with its huge pipeline network of natural gas, oil and refined petroleum products across 125,000 miles. The partnership has midstream assets in all the key basins in the United States, generating stable fee-based revenues.

Energy Transfer, with a Zacks Rank of 3, has offered a higher dividend yield than the composite stocks belonging to the industry over the past three consecutive years. For this year, the partnership is likely to see earnings growth of 17%.

Price and Consensus: ET

Plains All American Pipeline also enjoys stable fee-based revenues, banking on its oil and natural gas pipeline network and storage assets. Over the past seven days, the #3 Ranked stock has witnessed upward earnings estimate revisions for 2026.

Price and Consensus: PAA

Radical New Technology Could Hand Investors Huge Gains

Quantum Computing is the next technological revolution, and it could be even more advanced than AI.

While some believed the technology was years away, it is already present and moving fast. Large hyperscalers, such as Microsoft, Google, Amazon, Oracle, and even Meta and Tesla, are scrambling to integrate quantum computing into their infrastructure.

Senior Stock Strategist Kevin Cook reveals 7 carefully selected stocks poised to dominate the quantum computing landscape in his report, Beyond AI: The Quantum Leap in Computing Power.

Kevin was among the early experts who recognized NVIDIA’s enormous potential back in 2016. Now, he has keyed in on what could be “the next big thing” in quantum computing supremacy. Today, you have a rare chance to position your portfolio at the forefront of this opportunity.

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Plains All American Pipeline, L.P. (PAA) : Free Stock Analysis Report

Energy Transfer LP (ET) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.