Weekly Chartstopper: January 30, 2026

This Week

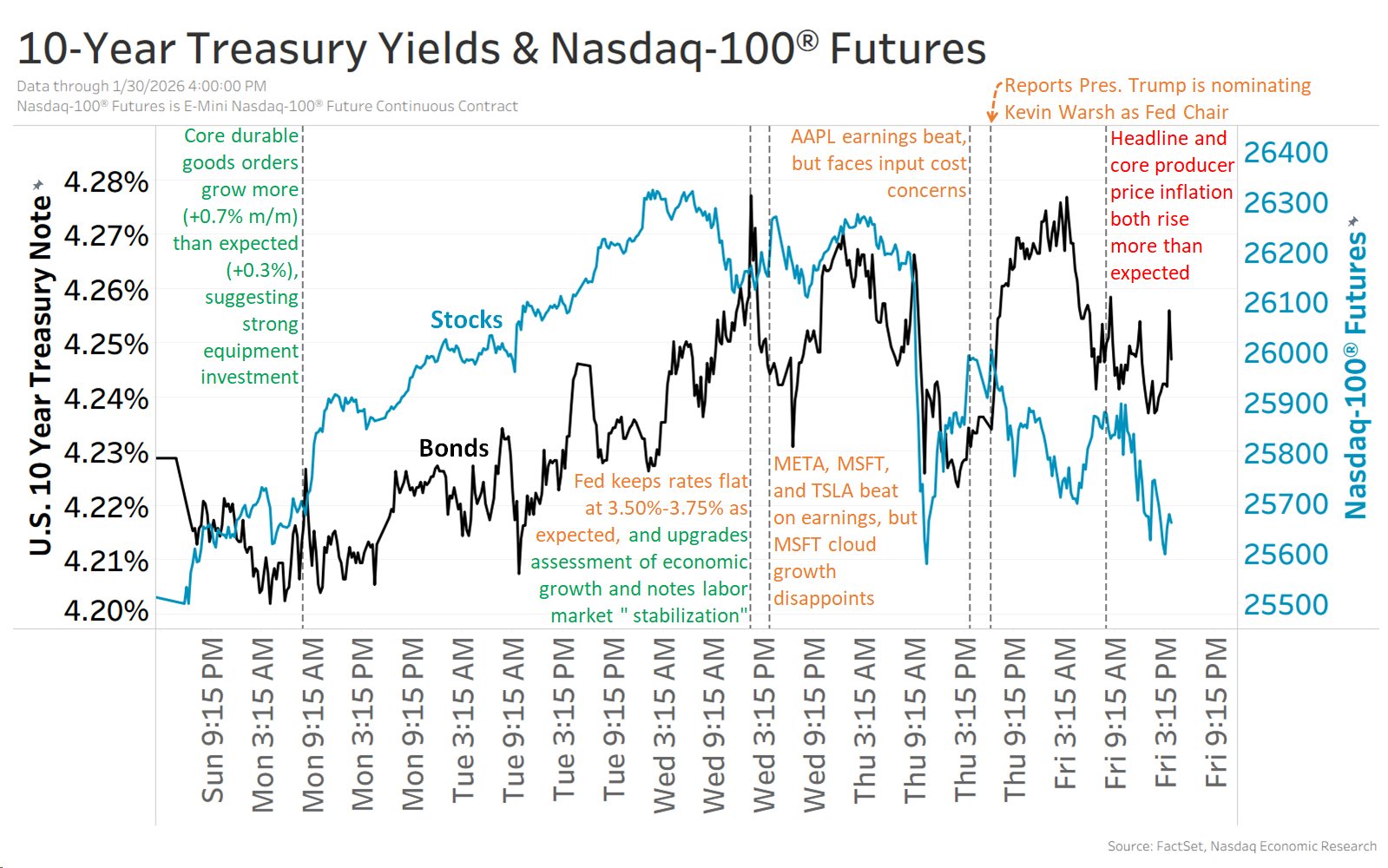

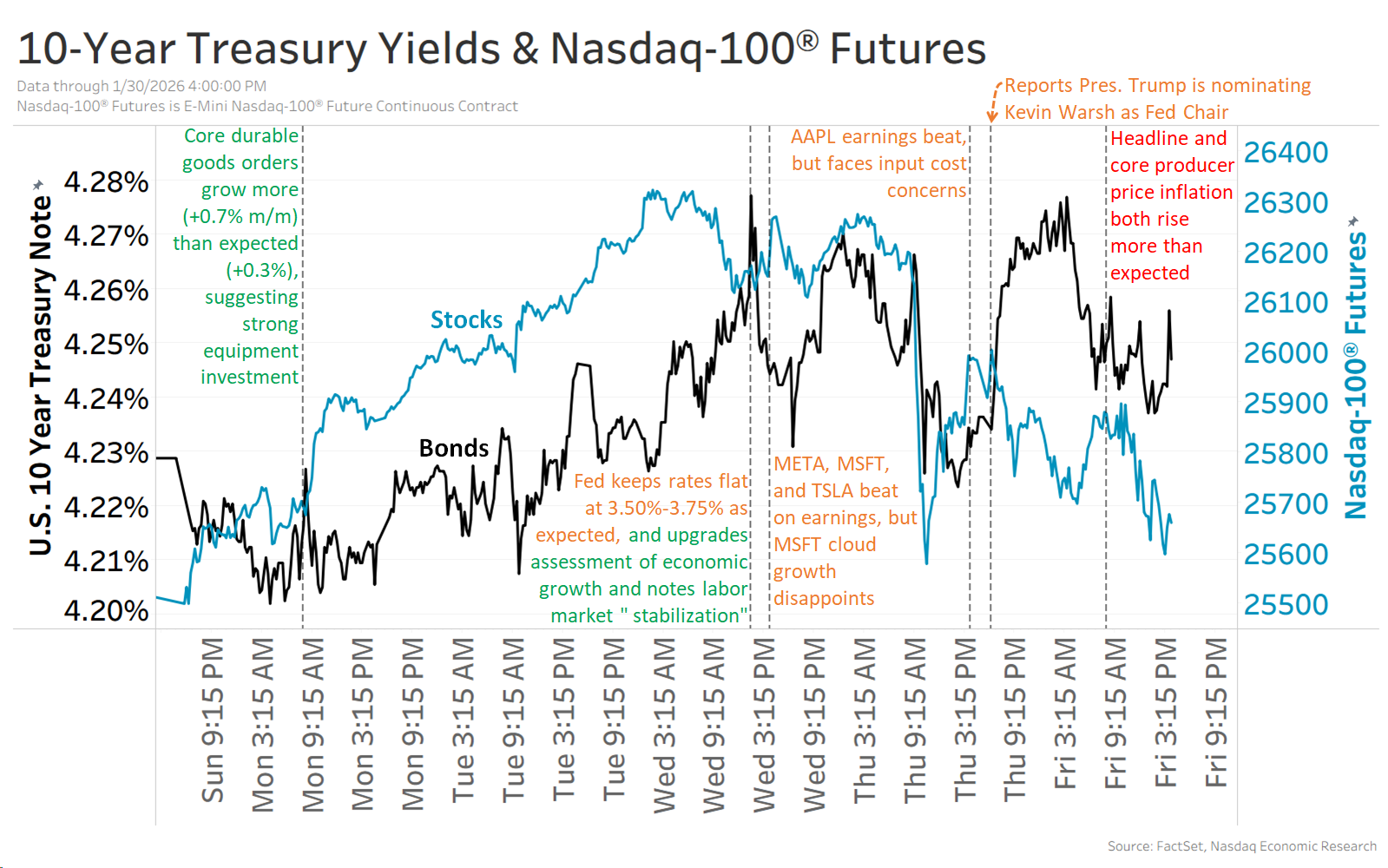

It was a big week for fourth-quarter earnings, but also for the Federal Reserve – even in a week where it kept rates unchanged (as expected).

First, the Fed upgraded its assessment of the economy, seeing economic growth as “solid,” instead of “moderate,” and recognized “some signs of stabilization” in the labor market.

Second, President Trump announced he’ll nominate former Fed governor Kevin Warsh for Fed Chair. While he was seen as a “hawk” (concerned about inflation) as a Fed governor, he’s argued recently that AI-driven productivity and deregulation are a path to lower inflation and rates.

We also had mega-cap earnings, with META (beat), MSFT (beat), and TSLA (beat) all reporting. Despite the beats across the board, META gained +10% on stronger revenue projections, while MSFT lost 10% on slower revenue projections, even as both boosted AI spending.

And after all that, the Nasdaq-100® (blue line) and 10-year Treasury yield (black line) both ended the week roughly flat.

(Also, I have to note that there’s a chance of a partial government shutdown tomorrow, but it may be .)

Next Week

Here are the major events I’m watching next week:

1. January nonfarm payrolls on Friday

2a. GOOG Q4 earnings on Wednesday

2b. AMZN Q4 earnings on Thursday

3. December JOLTS on Tuesday

4. ISM Manufacturing PMI (Monday) & ISM Services PMI (Wednesday)

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.