Hyperscaler Earnings Preview: MSFT & META

A major week of earnings results is upon us, with several hyperscalers – Meta Platforms META and Microsoft MSFT – on the docket. Both stocks have underperformed the S&P 500 by a notable margin over the last three months, as shown below.

Image Source: Zacks Investment Research

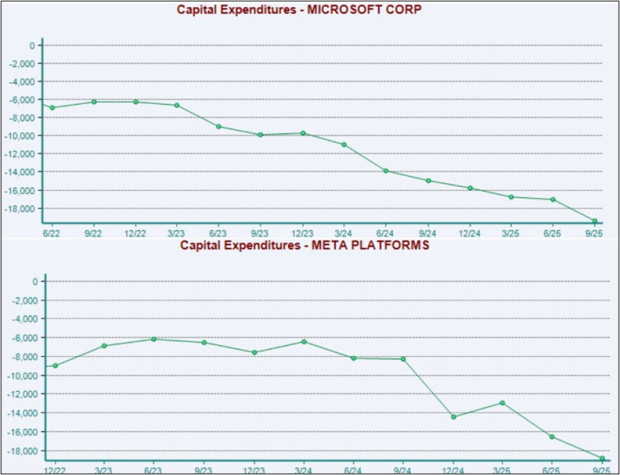

While the performance has been visibly weak, some of the downside can likely be attributed to scrutiny of all the AI spend, which has exploded for both over the past year.

Below is a chart illustrating the capital expenditures of both over the past several years, with a clear acceleration seen throughout 2024 and 2025. Please note that the chart below treats CapEx as an expense, explaining the negative values.

Image Source: Zacks Investment Research

Expect both companies to spend the majority of their calls discussing the AI outlook, a theme we won’t be getting away from anytime soon.

Are Analysts Bullish?

Both EPS and sales revisions for META and MSFT haven’t budged much over the last few months, largely reflecting stability. Both are still forecasted to see growth, with META’s earnings expected to be up 1.6% and MSFT expected to see a much stronger 20% growth rate. Concerning sales, MSFT is expected to see 15% higher revenues, whereas META’s revenues are expected to grow 20.7% year-over-year.

While analysts haven’t raised their expectations in a clear bullish way, the stability of both EPS and sales revisions for the duo remains a positive takeaway. Negative revisions heading into the release would warrant some caution, which we just haven’t seen over recent months. Keep in mind that MSFT is also currently a Zacks Rank #2 (Buy), with positive revisions for other periods keeping its overall earnings outlook strong.

Watch These Metrics

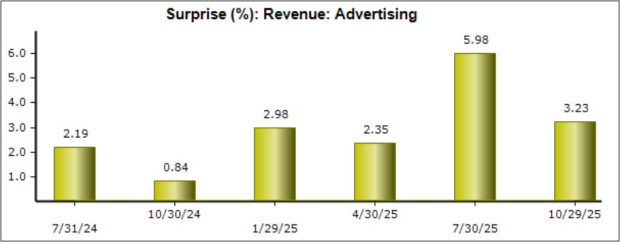

Advertising results are generally the major metric investors watch heavily for META, accounting for the bulk of the tech titan’s revenue. AI implementations have enabled the company to deliver more relevant ads to consumers, boosting performance significantly over recent periods.

We expect Meta Platforms to post $56.8 billion in ad revenue, reflecting a sizable 21% jump year-over-year. The company has regularly blown away our consensus expectations on the metric, with the beats growing in size. The YoY growth rate here is also largely in line with recent periods, a key hurdle that investors will be watching.

Below is a chart illustrating META’s ad revenue results relative to our consensus expectations, expressed as a percentage.

Image Source: Zacks Investment Research

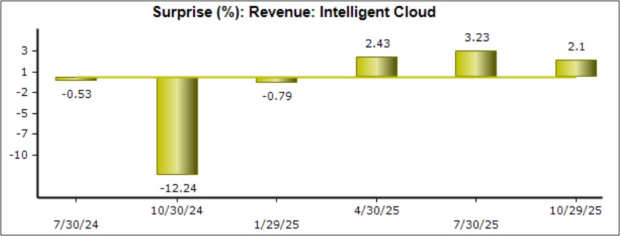

Concerning MSFT, cloud revenue will be a major focus. Its Intelligent Cloud results include Azure, the cloud platform that provides the computing power and infrastructure that AI needs. The buildout and expansion of the platform are the primary drivers behind its large CapEx increases, which are expected to pay off in a big way.

Our consensus estimate for MSFT’s Intelligent Cloud revenue stands at $32.4 billion, reflecting a strong 27% YoY improvement. The company has seen an acceleration in the metric, with any further improvement likely to impress investors in a big way.

MSFT has strung together three consecutive beats on the metric relative to our expectations, as shown below.

Image Source: Zacks Investment Research

Putting Everything Together

Stability in sales and EPS revisions for both companies positions them well heading into their releases, though investors will certainly be laser-focused on capital expenditures and everything else related to the broader AI frenzy.

It’s also worth noting that Microsoft MSFT shares have been big-time laggards over the past two years relative to both Meta Platforms META and the S&P 500. The performance disparity could easily begin to change post-earnings if MSFT continues its favorable cloud results, with its current Zacks Rank #2 (Buy) also a big tailwind.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don’t build. It’s uniquely positioned to take advantage of the next growth stage of this market. And it’s just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.