Crypto Market Update: Trump Signals Imminent Signing of US Crypto Market Structure Bill

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrencymarket news

Bitcoin and Ether price update

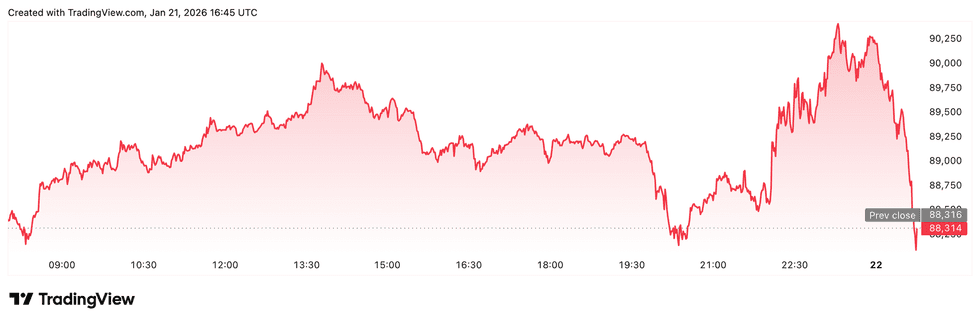

Bitcoin (BTC) was priced at US$88,716.44, down by 1.8 percent over 24 hours.

Chart via TradingView

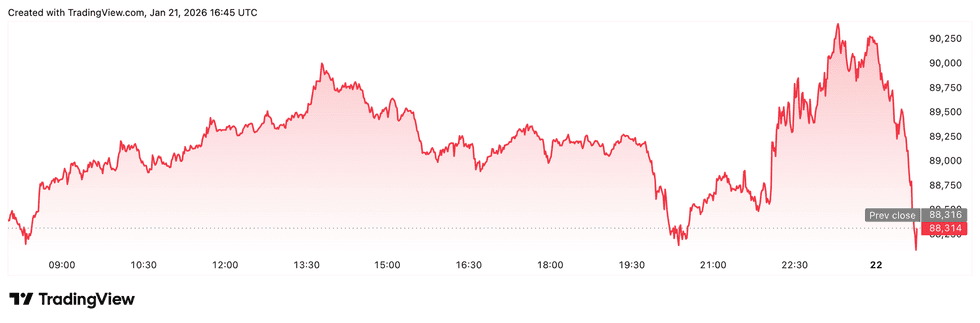

Chart via TradingView

Bitcoin price performance, January 21, 2025.

Ether (ETH) was priced at US$2,939.32, down by 3.7 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.89, down by 0.2 percent over 24 hours.

- Solana (SOL) was trading at US$127.11, up by 0.2 percent over 24 hours.

Today’s crypto news to know

Bitget: Macro reset reframes Bitcoin’s role as risk appetite cools

Crypto markets are entering 2026 under a markedly different macro backdrop, as geopolitical tensions, trade disputes, and shifting rate expectations force investors to reassess risk.

According to Bitget CMO Ignacio Aguirre, capital is rotating back toward traditional safe havens, with gold reclaiming its defensive role while Bitcoin trades more like a risk asset amid tighter liquidity.

The roughly US$1.3 trillion erased from US equities underscores a broader repricing rather than a market anomaly, reflecting how policy uncertainty typically drives investors to pull back first before selectively re-entering.

Aguirre notes that similar patterns played out during the 2008 financial crisis and the 2022 crypto downturn, where sharp contractions ultimately set the stage for renewed growth.

In the near term, Bitcoin could face additional pressure and test lower support levels before finding stability.

Longer term, however, structural factors such as improving infrastructure and institutional participation continue to support a bullish thesis. The adjustment, Aguirre argues, is part of crypto’s maturation rather than a rejection of its long-term value.

DeFi groups push Back on FTC’s approach to non-custodial systems

Major crypto policy groups are urging the US Federal Trade Commission to rethink how it applies consumer protection rules to decentralized finance.

In a joint letter, industry organizations including the Crypto Council for Innovation and the Blockchain Association warned that enforcement models designed for custodial finance do not translate cleanly to non-custodial systems.

They argue that imposing centralized safeguards such as kill switches or circuit breakers could weaken, rather than enhance, security by undermining decentralization.

The groups further emphasized that developers who do not control user funds should not be treated as financial intermediaries. Overly prescriptive standards, they said, risk stifling innovation and driving responsible development outside the United States.

The appeal comes as Congress debates broader crypto legislation, raising concerns that regulatory overlap could create confusion.

Trump signals imminent signing of Crypto market structure bill

President Donald Trump said he expects to sign a long-awaited crypto market structure bill “very soon,” injecting fresh momentum into legislation that has faced recent turbulence in Congress.

Speaking at the World Economic Forum in Davos, Trump framed the bill as a step toward expanding financial access, explicitly referencing Bitcoin and digital assets more broadly.

His remarks followed a contentious week on Capitol Hill after a planned Senate Banking Committee vote was abruptly pulled. That setback was triggered when Coinbase withdrew its support over concerns about provisions affecting stablecoin yield products.

White House officials have since signaled impatience with industry infighting that could derail passage.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.