Notable Friday Option Activity: ABNB, TOL, OXM

Looking at options trading activity among components of the Russell 3000 index, there is noteworthy activity today in Airbnb Inc (Symbol: ABNB), where a total volume of 18,790 contracts has been traded thus far today, a contract volume which is representative of approximately 1.9 million underlying shares (given that every 1 contract represents 100 underlying shares). That number works out to 45.6% of ABNB’s average daily trading volume over the past month, of 4.1 million shares. Particularly high volume was seen for the $140 strike call option expiring January 23, 2026, with 2,040 contracts trading so far today, representing approximately 204,000 underlying shares of ABNB. Below is a chart showing ABNB’s trailing twelve month trading history, with the $140 strike highlighted in orange:

Toll Brothers Inc. (Symbol: TOL) saw options trading volume of 5,126 contracts, representing approximately 512,600 underlying shares or approximately 44% of TOL’s average daily trading volume over the past month, of 1.2 million shares.

Especially high volume was seen for the $135 strike put option expiring January 16, 2026, with 687 contracts trading so far today, representing approximately 68,700 underlying shares of TOL. Below is a chart showing TOL’s trailing twelve month trading history, with the $135 strike highlighted in orange:

And Oxford Industries, Inc. (Symbol: OXM) saw options trading volume of 2,851 contracts, representing approximately 285,100 underlying shares or approximately 43% of OXM’s average daily trading volume over the past month, of 663,240 shares.

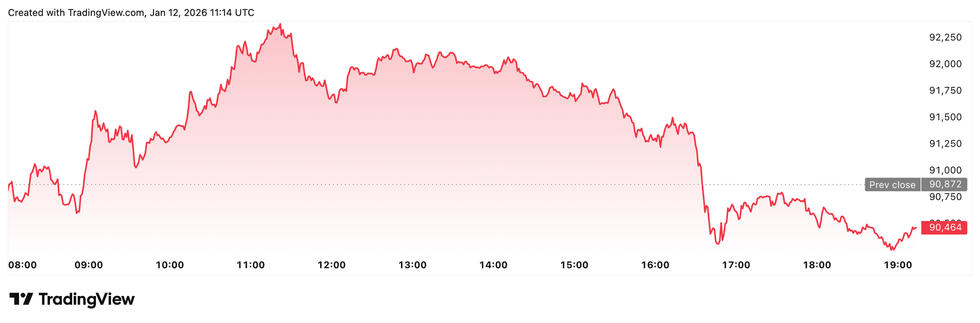

Especially high volume was seen for the $40 strike put option expiring January 16, 2026, with 1,501 contracts trading so far today, representing approximately 150,100 underlying shares of OXM. Below is a chart showing OXM’s trailing twelve month trading history, with the $40 strike highlighted in orange:

For the various different available expirations for ABNB options, TOL options, or OXM options, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Also see:

GO shares outstanding history

KAHC YTD Return

CFP Split History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.