4 Consumer Discretionary Stocks Set to Win This Earnings Season

The Consumer Discretionary sector has entered the earnings season with momentum that is stronger than many expected. While the consumer discretionary sector spans a broad mix of industries from autos to travel and home improvement, our focus here is on lifestyle-driven businesses, including apparel brands, footwear manufacturers, fragrance companies and accessories players. These categories sit at the intersection of fashion, identity and aspiration, making them especially sensitive to shifts in consumer sentiment, disposable income and trend cycles.

This corner of the sector is showing renewed strength. Consumers are prioritizing brands that deliver authenticity, innovation, compelling price points and emotional connection, rather than simply chasing discounts. Shoppers are willing to pay for differentiated design, comfort technology, statement accessories and signature scents. At the same time, companies have become more disciplined, tightening inventory, refining assortments and leveraging data analytics to better match supply with demand.

Digital engagement continues to be a powerful growth lever. Robust direct-to-consumer platforms, loyalty ecosystems and influencer-led marketing are enabling lifestyle brands to deepen customer relationships while capturing higher margins. Accessories, in particular, are benefiting from trend-driven purchases and higher repeat buying behavior, supporting both top-line momentum and profitability. Meanwhile, easing input and freight costs are providing incremental relief, setting the stage for potential margin expansion.

However, the Consumer Discretionary sector is not without its challenges. Lifestyle-focused Consumer Discretionary companies remain exposed to macro volatility, including uneven global demand, cautious consumer spending and currency fluctuations in key international markets. Even as inflation moderates, shoppers are still value-conscious, which can pressure pricing power and elevate promotional activity. Fast-changing fashion trends and shorter product cycles increase execution risks, particularly for apparel, footwear and accessories brands that must balance inventory carefully to avoid markdowns.

As earnings season unfolds, apparel makers, footwear brands, fragrance houses and accessories companies that combine brand heat with operational discipline are especially well positioned. Those demonstrating pricing power, efficient inventory management and compelling product pipelines could deliver upside surprises. In a sector where perception and momentum matter, lifestyle-focused consumer discretionary stocks may emerge as standout performers this reporting cycle.

Earnings Expectations This Season

The Zacks Consumer Discretionary sector looks poised for growth in this earnings season, owing to the aforementioned trends and initiatives of players. Overall, the Consumer Discretionary sector’s earnings are projected to witness year-over-year growth of 4.8% on 5.9% higher revenues, per the latest Earnings Trends report.

A strategy to arrive at the potential winners is by picking stocks that have the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP is our proprietary methodology for identifying stocks that have high chances of surprising in their upcoming earnings announcement. It shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. Our research shows that for stocks with this combination, the chances of a positive earnings surprise are as high as 70%.

You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Our Picks

Based on the above-mentioned factors, we have identified four lifestyle-focused Consumer Discretionary stocks, which are lined up to report earnings in the coming weeks — Carter’s Inc. CRI, Interparfums, Inc. IPAR, Savers Value Village, Inc. SVV and Cintas Corporation CTAS.

Carter’s is the largest marketer of branded apparel and related products for babies and young children in North America. Carter’s demonstrates momentum across both its U.S. Retail and International segments, underscoring steady consumer engagement and expanding global relevance. Carter’s continues to leverage strategic pricing actions to mitigate rising costs and sustain profitability amid tariff pressures. Despite inflationary conditions, Carter’s compelling value proposition, anchored by affordable core products, continues to resonate with budget-conscious families, particularly younger Gen Z parents.

Carter’s delivered a negative earnings surprise of 0.5% in the trailing four quarters, on average. The Zacks Consensus Estimate for the company’s fourth-quarter 2025 earnings is pegged at $1.66 per share, suggesting a decline of 30.5% from the year-ago reported quarter. This Atlanta, GA-based company has an Earnings ESP of +3.93% and flaunts a Zacks Rank #1 at present.

Carter’s, Inc. Price, Consensus and EPS Surprise

Carter’s, Inc. price-consensus-eps-surprise-chart | Carter’s, Inc. Quote

Interparfums is engaged in the manufacturing, distribution and marketing of a wide range of fragrances and related products. Core franchises, such as Jimmy Choo, Coach and Lacoste, continue to anchor the company’s performance, while targeted product launches across multiple brands help sustain brand relevance and long-term growth. Interparfums is also investing in portfolio expansion, including its first fully owned ultra-luxury brand and newer licenses, which enhance brand control and support growth opportunities.

This New York-based company is scheduled to report results on Feb. 24. The company has an Earnings ESP of +2.56% and a Zacks Rank #2 at present. IPAR delivered an earnings surprise of 5.03% in the trailing four quarters, on average. The Zacks Consensus Estimate for the company’s fourth-quarter 2025 earnings is pegged at 78 cents per share, suggesting a decline of 4.9% from the year-ago reported quarter.

Interparfums, Inc. Price, Consensus and EPS Surprise

Interparfums, Inc. price-consensus-eps-surprise-chart | Interparfums, Inc. Quote

Savers Value Village sells second-hand merchandise in retail stores in the United States, Canada and Australia. The company is benefiting from steady traffic, healthy comparable sales growth and disciplined execution across markets. Continued store expansion supports long-term revenue visibility, while operational efficiency and margin stability highlight improving underlying profitability. With management signaling a return to year-over-year profit growth, SVV appears well-positioned to capitalize on value-seeking consumer trends and deliver sustainable earnings momentum.

This Bellevue, WA-based company is scheduled to report results on Feb. 19. The company has an Earnings ESP of +1.08% and a Zacks Rank #3 at present. SVV delivered an earnings surprise of 25% in the trailing four quarters, on average. The Zacks Consensus Estimate for the company’s fourth-quarter 2025 earnings is pegged at 16 cents per share, suggesting growth of 60% from the year-ago quarter’s actual.

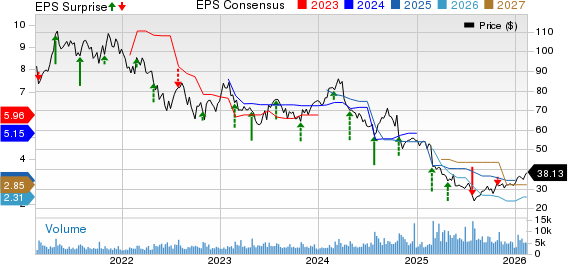

Savers Value Village, Inc. Price, Consensus and EPS Surprise

Savers Value Village, Inc. price-consensus-eps-surprise-chart | Savers Value Village, Inc. Quote

Cintas delivers corporate uniforms and business services across North America and Latin America, anchored by its resilient Uniform Rental and Facility Services segment, supported by strong retention and cross-selling. Expanding demand for safety solutions, alongside ongoing investments in technology, automation and product innovation, positions Cintas for sustained operational strength and long-term earnings growth.

This Cincinnati, OH-based company has an Earnings ESP of +0.89% and a Zacks Rank #3 at present. CTAS delivered an earnings surprise of 3% in the trailing four quarters, on average. The Zacks Consensus Estimate for the company’s third-quarter fiscal 2026 earnings is pegged at $1.23 per share, suggesting growth of 8.9% from the year-ago reported quarter.

Cintas Corporation Price, Consensus and EPS Surprise

Cintas Corporation price-consensus-eps-surprise-chart | Cintas Corporation Quote

Free Report: Profiting from the 2nd Wave of AI Explosion

The next phase of the AI explosion is poised to create significant wealth for investors, especially those who get in early. It will add literally trillion of dollars to the economy and revolutionize nearly every part of our lives.

Investors who bought shares like Nvidia at the right time have had a shot at huge gains.

But the rocket ride in the “first wave” of AI stocks may soon come to an end. The sharp upward trajectory of these stocks will begin to level off, leaving exponential growth to a new wave of cutting-edge companies.

Zacks’ AI Boom 2.0: The Second Wave report reveals 4 under-the-radar companies that may soon be shining stars of AI’s next leap forward.

Access AI Boom 2.0 now, absolutely free >>

Cintas Corporation (CTAS) : Free Stock Analysis Report

Interparfums, Inc. (IPAR) : Free Stock Analysis Report

Carter’s, Inc. (CRI) : Free Stock Analysis Report

Savers Value Village, Inc. (SVV) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Discover more from stock updates now

Subscribe to get the latest posts sent to your email.